In the end, it appears, panic buying, like panic selling, is all too human. Joshua M. Brown explains. And, welcome Joshua, thanks for contributing to our Favorites! – Ilene

The Five Stages of Panic Buying

Courtesy of Joshua M Brown, The Reformed Broker

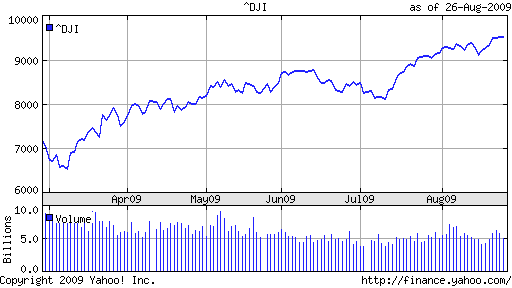

I talk to a ton of traders, portfolio managers, brokers and high net worth investors, both on and off Wall Street. Most of them have engaged in a bit of panic buying at some point this summer as the 50% rally in US stocks surprised many smart players.

Panic buying is what happens when you run money for a living and you feel like you’re missing a huge upside move. To make up for lost performance, your purchases get more aggressive than usual.

For all I know, the rally could end today and it will still be one for the record books. Lots of people weren’t ready for it.

This post is dedicated to the guys and gals who were able to adjust, despite what their quant models, economic indicators or magic Roubini email blasts were telling them. The quotes below are real, if paraphrased, and came from a variety of my contacts and friends (love you guys, don’t hate me!).

The Reformed Broker presents:

The Five Stages of Panic Buying!

1. Denial (Late March/ Early April)

“Ha, another Bear Market rally…wait til the foreclosure/ new home sales/ confidence data comes in! Right back to 6500, maybe lower…bagholders”

“Dude, the stress tests are coming out next month. B of A may be done-ski. Sell the May 10 calls, you’ll never have to cover.”

2. Anger (Mid-April)

“What the f@&% do you mean the goddamn banks are cheap based on normalized earnings? They will never ever earn anything again, ever! Idiot!”

“You gotta be kidding me with these retailers running now. RETAILERS? Are you nuts? They’re FINISHED!”

“If one more consumer discretionary name rallies on a less-than-expected loss, I’m gonna kick this Bloomberg down a flight of stairs.”

3. Bargaining (May-June)

“Okay, I can stomach picking up some large cap tech and I’ll nibble – NIBBLE! – at discount retailers, but I will absolutely NOT buy Goldman Sachs at 130.”

If China would just pull back 5 to 7% I’d get in, but I can’t chase it here…except Sohu, and I guess a little Baidu and I’ll just take a quarter position in China Mobile just in case. But I’m not chasing here.”

“(whispered) Dear market god, please stop the tape. Just give me one crack at the Nazz and some banks and I will never doubt the solvency of the US balance sheet or the wisdom of the Troubled Asset Relief Program ever again.”

4. Depression (July)

“I can’t believe I missed it. Those D-bags next to me are high-fiving after every earnings report. Hate those f@&%ing guys.”

“How could Las Vegas Sands do this to me? I’ve been watching this stock go up for 900% now. Couldn’t just give me one chance to get in. I suck.”

5. Acceptance (Early August)

5. Acceptance (Early August)

“That’s it! I don’t give a damn anymore, GET ME IN NOW! Forget the big ones, they’re already up too much, are there any $5 stocks left that haven’t done anything yet?

“I gotta blow out this stupid GLD, it does nothing, sick of it and sick of hearing about inflation. Even Paulson blew it out. Get me some $2 biotechs and some midwest regional bank stocks, I gotta get poppin’ over here! We’re going to 10,000 baby!”

If hearing these words and phrases from somewhere outside of your own inner monologue was at all cathartic or helpful, then you’re welcome. I don’t care how smart you think you are, at some point this spring/ summer, we’ve all had to chase something.

To panic buy is to be human, just make sure you weren’t the last one in and keep your eyes on the exits.

Full Disclosure: Nothing on this site should ever be construed as investment advice, research or an invitation to buy or sell any securities. Please see my Terms & Conditions page for a full disclaimer.