Greater Than One in Four FDIC Insured Institutions are Unprofitable; Bank Problem List at 15 Year High

Courtesy of Mish

Courtesy of Mish

The second quarter 2009 Quarterly Banking Profile has some interesting charts and facts that inquiring minds will be interested in.

Insured Institution Performance

- Higher Loss Provisions Lead to a $3.7 Billion Net Loss

- More Than One in Four Institutions Are Unprofitable

- Charge-Offs and Noncurrent Loans Continue to Rise

- Net Interest Margins Show Modest Improvement

- Industry Assets Decline by $238 Billion

- The Industry Posts a Net Loss for the Quarter

The Industry Posts a Net Loss for the Quarter

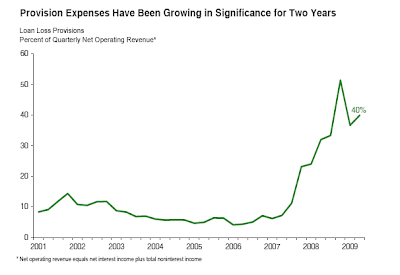

Burdened by costs associated with rising levels of troubled loans and falling asset values, FDIC-insured commercial banks and savings institutions reported an aggregate net loss of $3.7 billion in the second quarter of 2009. Increased expenses for bad loans were chiefly responsible for the industry’s loss. Insured institutions added $66.9 billion in loan-loss provisions to their reserves during the quarter, an increase of $16.5 billion (32.8 percent) compared to the second quarter of 2008. Quarterly earnings were also adversely affected by writedowns of asset-backed commercial paper, and by higher assessments for deposit insurance.

Almost two out of every three institutions (64.4 percent) reported lower quarterly earnings than a year ago, and more than one in four (28.3 percent) reported a net loss for the quarter. A year ago, the industry reported a quarterly profit of $4.7 billion, and fewer than one in five institutions (18 percent) were unprofitable. The average return on assets (ROA) was -0.11 percent, compared to 0.14 percent in the second quarter of 2008.

Net Charge-Off Rate Sets a Quarterly Record

Net charge-offs continued to rise, propelling the quarterly net charge-off rate to a record high. Insured institutions charged-off $48.9 billion in the second quarter, compared to $26.4 billion a year earlier. The annualized net charge-off rate in the second quarter was 2.55 percent, eclipsing the previous quarterly record of 1.95 percent reached in the fourth quarter of 2008.

The $22.5 billion (85.3 percent) year-over-year increase in net charge-offs was led by loans to commercial and industrial (C&I) borrowers, which increased by $5.3 billion (165.0 percent). Net charge-offs of credit card loans were $4.6 billion (84.5 percent) higher than a year earlier, and the annualized net charge-off rate on credit card loans reached a record 9.95 percent in the second quarter. Net charge-offs of real estate construction and development loans were up by $4.2 billion (117.0 percent), and charge-offs of loans secured by 1-4 family residential properties were $4.0 billion (41.1 percent) higher than a year ago.

Noncurrent Loan Rate Rises to Record Level

The amount of loans and leases that were noncurrent (90 days or more past due or in nonaccrual status)increased for a 13th consecutive quarter, and the percentage of total loans and leases that were noncurrent reached a new record.

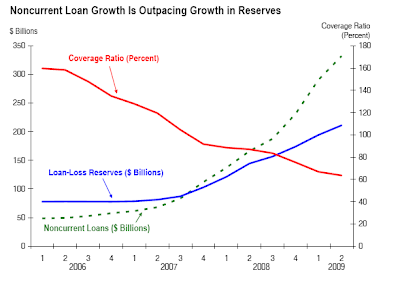

Institutions Continue to Add to Reserves

The industry’s reserves for loan losses increased by $16.8 billion (8.6 percent) during the second quarter, as loss provisions of $66.9 billion exceeded net charge-offs of $48.9 billion. The ratio of reserves to total loans and leases set another new record, rising from 2.51 percent to 2.77 percent. However, the pace of reserve building fell short of the rise in noncurrent loans, and the industry’s ratio of reserves to noncurrent loans fell from 66.8 percent to 63.5 percent, the lowest level since the third quarter of 1991.

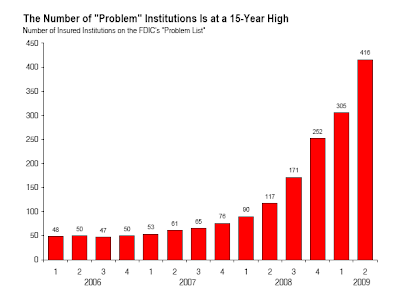

“Problem List” Expands to 15-Year High

The number of insured commercial banks and savings institutions reporting financial results fell to 8,195 in the quarter, down from 8,247 reporters in the first quarter. Thirty-nine institutions were merged into other institutions during the quarter, twenty-four institutions failed, and there were twelve new charters added.

During the quarter, the number of institutions on the FDIC’s “Problem List” increased from 305 to 416, and the combined assets of “problem” institutions rose from $220.0 billion to $299.8 billion. This is the largest number of “problem” institutions since June 30, 1994, and the largest amount of assets on the list since December 31, 1993.

FDIC Problem Institutions At 15 Year High

click on any chart for sharper image

Troubled Loans Still Growing But At Slower Pace

Provision Expenses As Percent Of Operating Revenue

Noncurrent Loan Growth Outpaces Reserve Growth

Fed Fails To Recapitalize Banks

In spite of mammoth injections of cash by the Fed, huge efforts by banks to raise capital, a Fed swap-o-rama of biblical proportions, monetary printing by the Fed, and capital injections from the Treasury, and a massive 50% stock market rally, noncurrent loan growth still outpaces reserve growth.

In spite of mammoth injections of cash by the Fed, huge efforts by banks to raise capital, a Fed swap-o-rama of biblical proportions, monetary printing by the Fed, and capital injections from the Treasury, and a massive 50% stock market rally, noncurrent loan growth still outpaces reserve growth.

Excess Reserves Revisited

Let’s review Creative Destruction

Reluctance to lend can easily be seen in a chart of bank reserves.

Excess Reserves of Depository Institutions

Conventional wisdom regarding money supply suggests there is massive pent up inflation in the works as a result of the buildup of excess reserves. The rationale is that 10 times those excess reserves (via fractional reserve lending) will soon be working its way into the economy causing huge price spikes, a collapse in the US dollar, and possibly even hyperinflation.

The reality is excessive debt and falling asset prices have rendered the best efforts of the Fed impotent.

Banks are not well capitalized, they are insolvent, unwilling and unable to lend.