It has been a crazy few weeks!

I went back over our Long Shots list from August 9th, thinking all our picks must be doing great but really only C, with a 67% gain, is really outperforming. Long spreads on UYG and BHI are on target for nice gains but haven't moved much. Looking at our original picks in Pharmboys Phavorites from the same week, GSK is on track and up nicely already, our AZN cover is up 45% and MRK flew up 19% already. On the riskier Biotech side, ARIA's stock is up 16% and our spreads are all performing well, ONTY has been flat, OGXI is up 33% and the Jan $17.50s are up a rockin' 63% with that "cautious" spread up a surprising 75% already.

SPPI had a wild ride (as we predicted with TSCM's failed assassination attempt) and the buy/write is already up 24%, the Feb vertical is up 50% and the naked Jan put sale is up 27% and our Feb hedge play is right on track so all good there and a fine example of how following Cramer and his lackeys and and doing the opposite of what they say can be very profitable! Congrats to Pharmboy for a very fine set of picks, proving once again that there is room for research and fundamentals – not a single loser in the bunch in a choppy market! It was very timely as I had mentioned just that week in my interview with AOL Finance that XLV was my favorite sector and our IHI pick of 8/10 is up 28% on the naked Feb $45 put sale while the Feb $45 calls have already jumped 16%. It was a great call as IHI outperformed XLV and all our major indexes.

So our energy service pick (BHI) and overall financial pick (UYG) have not done much in 3 weeks and those were our leading sectors into my call to cash out our exposed long calls on Aug 13th, ahead of expirations. The Dow was at 9,400 on that day and now, a bit more than 2 weeks later, we've gained another 144 points but to listen to the MSM, you would think you are missing the rally of the century the past couple of weeks. This is one of the reasons I've gotten a bit more cynical about the rally – there is so much hype and so little actual progress, something must be wrong.

Back on Thursday, Aug 6th, I noted the pump action that took us to just under 9,500 in the pre-markets was nonsense as GS upgraded their economic outlook while China and the ECB all announced the continuation of easy money policies would not be enough to give us a breakout and, of course, it didn't. I said at the time: ""THEY" are pulling out all the stops today because if we can’t make our breakouts by tomorrow, the weekly charts start looking questionable again and the one thing "they" can’t control is volume selling. We are in a very dangerous area here where sensible investors would cash out their gains and wait for the next dip." I made a call to take bullish profits off the table on the 13th, just ahead of the 400-point dip and we caught the dip on the nose but by Tuesday, the 18th I noted that the spin was back in and, once again, all the stops were being pulled out to jam the markets back up.

Back on Thursday, Aug 6th, I noted the pump action that took us to just under 9,500 in the pre-markets was nonsense as GS upgraded their economic outlook while China and the ECB all announced the continuation of easy money policies would not be enough to give us a breakout and, of course, it didn't. I said at the time: ""THEY" are pulling out all the stops today because if we can’t make our breakouts by tomorrow, the weekly charts start looking questionable again and the one thing "they" can’t control is volume selling. We are in a very dangerous area here where sensible investors would cash out their gains and wait for the next dip." I made a call to take bullish profits off the table on the 13th, just ahead of the 400-point dip and we caught the dip on the nose but by Tuesday, the 18th I noted that the spin was back in and, once again, all the stops were being pulled out to jam the markets back up.

The pump job was so ridiculous that even Warren Buffett had to say we were getting ahead of ourselves but Cramer rightly said that: "The bears must be stunned and confused, flummoxed even" and that pretty much describes the week of the 17th, as the Dow made up 500 points in 5 days into options expiration capped off on Friday by Goldman's Global Goose, when they chief equity strategist Kathy Matsui made the ridiculous prediction that Japan's corporate profits would rise 73% next year. That allowed us to close our our generally bullish $100,000 Virtual Portfolio with huge profits so thanks, I guess, to Kathy for being such a good company girl and saying whatever it takes to move the markets, no matter how many people follow your bad advice to their detriment. The Nikkei did indeed gap up 150 points on Monday and finished that day up 350 points higher than Friday's close but made no progress since – not what you'd expect with GS predicting next year's earnings will top 2007's when the Nikkei was 70% higher.

That brings us to last weekend, where we initiated a new $100,000 Virtual Portfolio (to be reviewed later this weekend) and Pharmboy made another round of picks with NVS quickly taking off, BMY up and down a bit but on target for the $22.50 buy/write, the SNY naked $32.50 puts are already up 44% and the JNJ spread was rightly conservative and is on target. On the Biotech side, GENZ popped right up on Tuesday and Pharm's call was right on the money saying: "buying the $50 Oct09C @ 4.2 ($1.5 premium), letting it run for the next few days, and then selling $55 Sept09 for 1.25 or better (all premium)." The Oct $50s jumped up to $6.50 (up 54%) and the $55 puts came in as a $2 cover, looking very good overall. Congrats to Pharm on another nice set of picks!

On Monday morning I noted that the market momentum was still up but slowing and we went over some long-term protective puts on SKF, with Jan vertical spread that is holding even so far; DXD held our $36 target but triggered our roll to the Jan $35 calls for net $4.95 and also even for the week and the SDS Dec vertical is slightly ahead. That's not bad for a group of bearish hedges after what Cramer calls a huge bullish victory for the week! My fourth bearish call of the morning was grabbing the FXP $10 calls, which made a quick 37% as we hit our target on Thursday morning and made a very well-timed exit.

You can't be a greedy bear in this market as the feeding is scarce indeed but it's there if you know where to look. I laid out our trigger list of buys for the $100KP at 10:28 on Monday, expecting we were topping out for the day but we never got a dip low enough to trigger half our targets and we wisely decided to go light on the covers as it just didn't look like this market wanted to go down. As I said, I'll reveiw that in detail later. GOOG $450 puts made a quick buck but we wisely went bullish into the close, playing for the stick at 3:25, when I sent out a Member Alert saying: "We can sell those DIA $95 puts for $1.98 as a full cover against long Dec puts, taking 1/2 off if we fail 9,500 on the Dow and going to 1/2 cover overnight regardless." Sadly, we stopped out half of it with a nickel loss on a down spike as the next morning we took off like a rocket but we did pick up .50 (25%) on the 1/2 covers at least.

Tuesday Moning's market booster was the pre-announcement of Bernanke's second term. Something that was sure to be celebrated by Wall Street as Mr. Bernanke's solution to everything is to give Wall Street more money and for the government to pick up their losses. That popped the Dow 120 points the 9,620 but I didn't like it and pointed out the this news seemed to made to counteract some not so good news about bank problems and commercial real estate – two major industries that would much rather know that "Helicopter Ben" is on the job than worry about figuring out how to scam money from a new guy in January.

Tuesday Moning's market booster was the pre-announcement of Bernanke's second term. Something that was sure to be celebrated by Wall Street as Mr. Bernanke's solution to everything is to give Wall Street more money and for the government to pick up their losses. That popped the Dow 120 points the 9,620 but I didn't like it and pointed out the this news seemed to made to counteract some not so good news about bank problems and commercial real estate – two major industries that would much rather know that "Helicopter Ben" is on the job than worry about figuring out how to scam money from a new guy in January.

I called the buy-back of the DIA $95 puts in my 10:09 Alert to Members and that caught the top of the Dow "rally" pretty much right on the nose as we gave back all the gains and then some by the end of the day. OIH $105 puts at $2.30 were a huge winner, giving us a quick $1 (up 43%) by the afternoon. By 10:36, I sent out another Alert with another bearish play, this time the DIA $94 puts, which also made a quick 10% at the day's end. The ERY buy/write is going well as is the Jan vertical despite oil's comeback at the end of the week. I was still bearish when the Dow made a move back to 9,600 at noon and I said to Members: "Still a very good time to look at some of those long put plays we discussed in yesterday’s morning post." That was it for picks that day, the rest was just waiting to see if 9,500 would hold (it did, so we re-covered our long DIA puts).

Wednesday morning I was out of the box early with a 7:33 am pick on PARD in member chat although it turns out we could have been more aggressive with our buy/write position and we'll have to settle for 122% at $5, rather than the 300% at $7.50 had we gone with the riskier spread. Of course dropping our break/even by 1/3 let us commit more cash at the outset so a good lesson in trade-offs! Wednesday we had our quote of the week from Chantale, who said of the markets: "It s hard to predict when somebody on coke will stop dancing." That pretty much sums up August to a tee and I said in the morning post: "The markets have indeed been out on a bender and, like our coke dancer, we know there’s going to be a crash, we just can’t say exactly when it’s going to happen." As long as the Government keeps handing our hits of free money, we can keep this party going for quite some time, despite the damage it's doing to the long-term health of the economy.

Wednesday morning I was out of the box early with a 7:33 am pick on PARD in member chat although it turns out we could have been more aggressive with our buy/write position and we'll have to settle for 122% at $5, rather than the 300% at $7.50 had we gone with the riskier spread. Of course dropping our break/even by 1/3 let us commit more cash at the outset so a good lesson in trade-offs! Wednesday we had our quote of the week from Chantale, who said of the markets: "It s hard to predict when somebody on coke will stop dancing." That pretty much sums up August to a tee and I said in the morning post: "The markets have indeed been out on a bender and, like our coke dancer, we know there’s going to be a crash, we just can’t say exactly when it’s going to happen." As long as the Government keeps handing our hits of free money, we can keep this party going for quite some time, despite the damage it's doing to the long-term health of the economy.

Also in Wednesday morning's post we delved into the concentration of trading volume in just 4 stocks and we compared buying FRE, FNM and AIG to a game of hot potato. This weekend, in Member chat, we had a great quote from Trader Mark on a similar subject (LEHMQ), who said: "The shell known as bankrupt Lehman Brothers (LEHMQ.PK) which now trades on the pink sheets rallied a solid 200% Friday. And why not – fundamentals no longer matter; even having a functioning business is just an afterthought. As long as you have a shell that one high frequency trading firm can trade with another (or if you are real clever, I assume the same HFT firm can work in the dark pools and trade among themselves to create "demand" – not that this would ever happen because its illegal)."

We had a huge chart that showed a 42% dive in the Baltic Dry Index since June so we anticipated a poor Durable Goods number but the headline LOOKED good and the media ran with it and I said: "Just like you couldn’t have a .com bubble or a housing bubble without a complicit media, you can’t have an irrational market rally without the MSM waving their pom-poms to get the masses into the game" and my plan for the day was to take our short plays right off the table and reload later. Also, in the main post, I called for the FXP $9 calls at $1.50, expecting China to pull back into the weekend and they picked up .25 the next day but nothing more so far.

PARD was our first Alert of the day and I already mentioned that has taken off nicely and in that morning Alert I said: "We also get new home sales for July, we can assume they will beat so a great excuse to pop us up off the 9,480 line in 5 minutes." It actually took 10 minutes for the market to take off but it was plenty of time for us to make our exits on the short side as planned. In the morning we did a PALM back-spread that's holding up fine so far, an AAPL spread that was a home run for those who followed the plan and took out the caller and rolled down the next morning and, as usual, SRS was taken at $11.50 with the $10 calls at $1.75, which ran to $2.15 the next day (22%) and were reloaded yet again into the weekend at $1.50. Another trade idea on the same comment was selling the naked $12 puts at $1.20, which made their 20% the next morning as well and can now be sold for $1.40 on Friday's move down. The range we have been playing on SRS (as a stock) is buying at $11.50 and selling near $12 but Friday was a move back to the August lows at $11 and we are considering it an opportunity at the moment.

As the market jerked up and down all day, we were not motivated to make many trades. We did a complex spread on EP, targeting $9 for the Sept close which is right on track but that was it and we went 1/2 covered into the close (wishy-washy) as the GDP + Jobs the next morning was too much of a wild-card to deal with. By Thursday morning I had decided I didn't care what the GDP was as it was based on stimulus anyway and jobs were what mattered. We had no improvement on that front and TOL announced they had sold a grand total of 792 homes in Q2 – just 5 homes per state per month. While the company has done a great job of trimming operating expenses from $1.2Bn in Q2 '07 to $842M last year and all the way down to $580M announced on Thursday, sadly sales have plummeted from $1.1Bn in Q2 '07 (loss) to $739M last year (loss) to $461M last Q (huge loss).

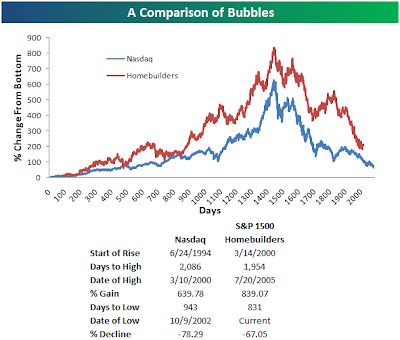

Nonetheless, after a sensible sell-off in the morning, TOL jumped back up 5% into Friday's opening rally. Major market madness for a company trading with a $3.7Bn market cap who have earned a total of $2.4Bn in 10 years with 80% of that money earned in the 3 bubble years of 2004-2006. Without repeating this bubble performance, it seems very unlikely TOL can return more than $1.5Bn over the next 10 years, which is just about 3% a year on your $3.7Bn investment.

Nonetheless, after a sensible sell-off in the morning, TOL jumped back up 5% into Friday's opening rally. Major market madness for a company trading with a $3.7Bn market cap who have earned a total of $2.4Bn in 10 years with 80% of that money earned in the 3 bubble years of 2004-2006. Without repeating this bubble performance, it seems very unlikely TOL can return more than $1.5Bn over the next 10 years, which is just about 3% a year on your $3.7Bn investment.

Once upon a time, this was how you would value a stock investment. You would look at the long-term prospects, compare the risk and returns to other asset classes and allocate your capital accordingly. Somehow, all of that has gone completely out the window in today's market and TOL is typical of what's going on in the property space, commanding huge premiums to potential growth while ignoring all risks as if they don't exist. Only then can you justify putting your money into TOL vs a 10-year bond that is guaranteed to pay you 4%.

My concluding outlook in the morning post on Thursday was: "If the market doesn’t finish the week at or above the mid-week highs, I think we may have finally found a top. Meanwhile, we have continued to be wishy-washy with our covers but that will end this weekend, where we are more likely to go more bearish… I see nothing in the actual figures that indicates a strong enough economy to justify the p/e ratios we are being asked to pay for so many stocks (91%) that are above their 200-day moving averages." Still we remained cautious to the bear side and watching our levels kept us safe. In my 10:02 Alert to Members I said: "Dow 9,400, S&P 1,010, Nasdaq 2,000, NYSE 6,600 and Russell 575 – anything over those and we are still in a bullish trend but below those and we should get our move down to 9,100 et al."

In that same alert I wisely called for a stop out on our FXPs and just 25 minutes later I had to send out a follow-up alert saying: "Notice we are holding that 9,480 line like it’s life or death. Oil is holding $70 and gold is holding $945 so Mr. Stick is hard at work. Now watch the upside breaks of 575 on the RUT and 300 on SOX and 2,000 on Nas and I still like selling the DIA $95 puts for $2 as a day trade using those points (and Dow 9,480) as the on/off switch, looking for a quick .25+ to the upside. SRS calls are, of course stopped out here as $12 was the best we expected but happy to reload yet again at $11.50 if they let us." You can tell from the above chart on that DIA put how well that went. People often want to know if our plays are easy to follow – this seems simple enough: Get an Alert at 10:27, sell the put for $2, and by 2:30 you can buy it back for $1.50. You just can't make 25% a day trading stocks that often and that's what I love about options – this kind of stuff happens almost daily!

We took an October bull vertical on SKF at 11:30 as I felt we were topping out on the financial run but I called for taking the money and running on ERY longs at $17.50 in that same note, which was a very nice top call. Non-greedy exits are CRITICAL in this market – whether you are a bull or a bear the tide is very likely to change if you wade too far out into the water. Keeping that in mind, we took a quickie short on AIG, selling $50 calls for $7 at 11:57 and we made our 20% goal by 2. An AIG spread was taken in our $100KP as well and we made some adjustments for more aggressive players. We were too early re-entering the SRS $9s at $2.60 though as they fell to $2.25 on Friday (down 14%). At 2:23 I announced to members: "I’m calling shenanigans on this rally as the dollar was smacked 1% in on hour (and into the NYMEX close) and that has provided this market boost since 1:30. Between that and a 5% turnaround in CRE since the open on no news at all, I have to think this is pure and utter BS. At $1.15, I like the DIA $94 puts for the weekend. It’s going to be a gut check if we break 9,600 but, right now, I feel it’s worth a shot as a short play." The DIA $94 puts are still $1.17 so we'll have to see what Monday brings us.

Another afternoon short I called was long on ERY (ultra-short oil) with the Oct $17.50s at $1.80 which are down a dime so far but even for those who took the cover on the play (Sept $18s). DELL had a beat after hours and the dollar was under attack on Friday morning but we focused on the 3% drop in the Shanghai Composite index and drastically low volume that was driving the US markets to the upside.

Another afternoon short I called was long on ERY (ultra-short oil) with the Oct $17.50s at $1.80 which are down a dime so far but even for those who took the cover on the play (Sept $18s). DELL had a beat after hours and the dollar was under attack on Friday morning but we focused on the 3% drop in the Shanghai Composite index and drastically low volume that was driving the US markets to the upside.

I did the math and it seems GS and their 11 pals who control the world are trading AT LEAST 60%, probably 70% of all transactions in the market leaving just 30% for you retail investors and all the other hedge funds and mutual funds that dare to swim in Goldman's pool. I am firmly convinced that real market volume is 50% lower than it appears which means anything you see in a chart is total nonsense as it's based statistically invalid levels of trading. Sadly, most technical analysts take all their numbers at face value and this is leading to more nonsense being spouted by "experts" than I have heard since 1999's dot com boom.

Nonetheless, we do like AAPL and I made a bullish call on them for the morning post but we hedged that with a buy/write on EDZ aimed at giving us a 25% buffer if China turns out to be not all that in the fall or a 100% profit going out to the Jan vertical. My closing comment to the post was: "I hate to be a stick in the mud but I will remain bearish into this weekend and next weekend for that matter as it’s a holiday. After that, I guess I’ll have to start running with the bulls if they can hold it together that long but, keep in mind, those bulls are actually being herded into an arena where they will be slaughtered."

Nonetheless, we do like AAPL and I made a bullish call on them for the morning post but we hedged that with a buy/write on EDZ aimed at giving us a 25% buffer if China turns out to be not all that in the fall or a 100% profit going out to the Jan vertical. My closing comment to the post was: "I hate to be a stick in the mud but I will remain bearish into this weekend and next weekend for that matter as it’s a holiday. After that, I guess I’ll have to start running with the bulls if they can hold it together that long but, keep in mind, those bulls are actually being herded into an arena where they will be slaughtered."

Keep this in mind as you chase this market higher. The bulls think they have the men in red and white on the run and they merrily chase them along the path, scoring victory after victory along the way and they follow the obvious twists and turns in a full charge until they exhaust themselves at the end of a long run,and find they are in a huge stadium where the gates close behind them and there is no exit until the meat is stripped from their bones and they are carved up and sold at market prices.

We weren't buying the "rally" on Friday morning for one second and my 9:49 Alert to Members said about our short plays: "In general, this is the time to roll up if possible and be patient otherwise." The AIG $50s worked so well on Thursday that we jumped at the chance to sell the $55 calls for $7.50 in the morning and those made a quick 50% profit by lunch. We expected the sell-off to fizzle on such a low volume day and my 12:12 Alert to Members was: "Levels getting properly tested now. Noon volume just under 90M, which is dangerous for the bulls if it starts trending up but, more likely, this is a cash-out by the Hamptons crowd who are out of here by 1pm and then we’ll see what Mr. Stick has left in super thin trading this afternoon" and at 12:49, expecting the stick, I reminded Members: "If you were too bearish and freaking out this morning, this is a very good time to lighten up on some puts and/or take a few long plays for a possible stick save." We went back to the well on the DIA $95 puts, which returned a quick .20 this time and I suggested the DIA $96 calls at $1.35 as an additional cover with our watch levels at Dow 9,528 (finished at 9,544) and S&P 1,026 (finished at 1,028) – that's not bad targeting for a Friday afternoon!

We weren't buying the "rally" on Friday morning for one second and my 9:49 Alert to Members said about our short plays: "In general, this is the time to roll up if possible and be patient otherwise." The AIG $50s worked so well on Thursday that we jumped at the chance to sell the $55 calls for $7.50 in the morning and those made a quick 50% profit by lunch. We expected the sell-off to fizzle on such a low volume day and my 12:12 Alert to Members was: "Levels getting properly tested now. Noon volume just under 90M, which is dangerous for the bulls if it starts trending up but, more likely, this is a cash-out by the Hamptons crowd who are out of here by 1pm and then we’ll see what Mr. Stick has left in super thin trading this afternoon" and at 12:49, expecting the stick, I reminded Members: "If you were too bearish and freaking out this morning, this is a very good time to lighten up on some puts and/or take a few long plays for a possible stick save." We went back to the well on the DIA $95 puts, which returned a quick .20 this time and I suggested the DIA $96 calls at $1.35 as an additional cover with our watch levels at Dow 9,528 (finished at 9,544) and S&P 1,026 (finished at 1,028) – that's not bad targeting for a Friday afternoon!

Other than some fairly conservative buy/writes on ELN, DRYS and GNK, we weren't in much of a buying mood on Friday afternoon and we went into the weekend cautiously bearish. The last news of the day was Cerberus Capital Management, surprised to find its investors now want $5.5B back from its asset base of $7.7B – up from $4B just a few days ago so we'll see how that news plays out over the weekend. During chat this weekend (under this very post!), we've been discussing the state of retail malls in America as well as Hugh Hendry's latest fund letter, which makes some very bearish points and is a must read for all.

Dr. Brett says: "ARMS Index Indicates Market Is at Peak, Not Bottom" and David Fry says: "This Market's Running on Empty" but we have learned to fear the stick and, as this week's trades illustrate, it's very simple to make quick bets and take quick profits so why even bother with long, unhedged plays into this madness. There are bullish spots to pick and there are bearish ones – the one thing we have been able to count on is the volatility and we'll be keeping plenty of cash on the side to take advantage of that until we get a real breakout in one direction or another.