Spending Collapses In All Generation Groups

Courtesy of Mish

It’s no secret that boomers fearing an underfunded retirement have sharply cut spending. However, it’s not just boomers cutting back. Consumer attitudes toward debt have changed across all age groups.

A recent Gallup Poll shows just how dramatic a spending shift has taken place. Please consider Boomers’ Spending, Like Other Generations’, Down Sharply.

Baby boomers’ self-reported average daily spending of $64 in 2009 is down sharply from an average of $98 in 2008. But baby boomers — the largest generational group of Americans — are not alone in pulling back on their consumption, as all generations show significant declines from last year. Generation X has reported the greatest spending on average in both years, and is averaging $71 per day so far in 2009, down from $110 in 2008.

Self-Reported Spending

Population Share By Age Group

The chart shows Boomers and Generation X are the two demographic largest groups. Spending is down by 34.7% among boomers and 35.4% in Generation X. Spending is down by 33.7% in generation Y, the third largest demographic group. That is a remarkably consistent decline in spending.

Spending by the "Greatest Generation" is down a whopping 44% but that group only constitutes 5% of the population.

Here are some more interesting charts from the article.

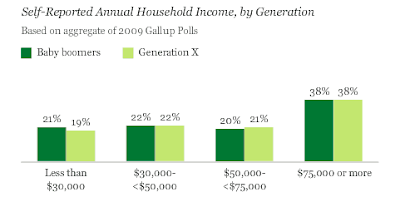

Annual Incomes – Boomers vs. Generation X

Surprisingly, annual incomes are nearly identical for boomers and generation X. However, Generation Y income is dramatically less as the following chart shows.

Annual Incomes – Boomers vs. Generation Y

Bottom Line

Baby boomers have pulled back considerably on their spending this year, but they are not alone in doing so. Gallup finds significant declines among all generations in average reported daily spending in 2009 compared to 2008. Given that consumer spending is the primary engine of the U.S. economy, it’s not clear how much the economy can grow unless spending increases from its current low levels. But spending may not necessarily be the best course of action for baby boomers as they approach retirement age and prepare to rely on Social Security and their retirement savings as primary sources of income. Indeed, the two generations consisting largely of retirement-age Americans consistently show the lowest levels of reported spending.

I can add to those thoughts. Boomers and Generation X are loaded to the gills with debt. Boomers in particular are downsizing and income growth is stagnating across the board.

Moreover, boomers headed into retirement are scared half to death about insufficient funds. Those boomers are not about to go on a spending spree.

Please consider the Incredible Shrinking Boomer Economy.

Boomer Statistics

- $400 Billion: Amount that will come out of annual U.S. consumption as thrifty boomers push savings rate from 1% to nearly 5%.

- 47%: Boomers share of national disposable income in 2005 before the bubble burst. Boomers contributed only 7% to national savings.

- 2.4%: Forecasted GDP growth over the next three decades as boomers ratchet back. GDP has grown 3.2% a year since 1965.

- 69%: Portion of boomers aged 54 to 63 who are financially unprepared for retirement.

- 78%: Boomers’ share of GDP growth during the bubble years of 1995 to 2005

Those stats are from a McKinsey study, and there is nothing remotely inflationary about boomer demographics.

Nor is there anything inflationary about Generation X demographics. Generation X’s have seen boomers blow it. By sharply curtailing spending, generation X at least has chance to right the ship before retirement. It’s too late for most boomers. Time ran out.

Now consider generation Y with 19% of the population. Think the income levels of generation Y are going to catch boomers or generation X?

When?

Finally, think about tightening lending standards and attitudes about debt in general. Because of lower incomes and tighter lending standards, it is unlikely that Generation Y will be either able or willing to carry debt burdens to sustain a strong recovery.

Distortionary vs. Inflationary

Bernanke can flood the world with "reserves" and indeed he has. However, he cannot force banks to lend or consumers to borrow.

Here is a simple analogy that everyone should be able to understand: You can lead a horse to water but you cannot make it drink. And if the horse does not want to drink, it was a waste of time and energy to lead the horse to the water.

Yet every day someone comes up with another convoluted theory about how inflationary this all is. It is certainly "distortionary" in that it creates problems down the road and prolongs a real recovery by keeping zombie banks alive (as happened in Japan). However, it is not (in aggregate) going to cause massive inflation because it is not spurring the creation of new debt.

Consumers and banks both are suffering from a massive hangover. Their willingness and ability to drink is gone. No matter how many pints of whiskey Bernanke sets in front of someone passed out on the floor, liquor sales will not rise.

In a debt-based economy, it is extremely difficult to produce inflation if consumers will not participate. And as noted above, demographics and attitudes strongly suggest consumers have had enough of debt and spending sprees.

Those pointing to flawed measures of money supply as proof of inflation just don’t get it, and likely never will.