The big news on the day is the Shanghai Composite out of China that fell over 6.7% on Monday, bringing down the rest of Asia with it. Even Japan’s Nikkei index closed in the red despite Japan’s announcement that they had seen growth of nearly 2% in factory production in July. The Chinese market is becoming a very powerful leading force in the markets, setting the tone of each day with its major swings up and down.

The big news on the day is the Shanghai Composite out of China that fell over 6.7% on Monday, bringing down the rest of Asia with it. Even Japan’s Nikkei index closed in the red despite Japan’s announcement that they had seen growth of nearly 2% in factory production in July. The Chinese market is becoming a very powerful leading force in the markets, setting the tone of each day with its major swings up and down.

In effect, the American markets are looking a bit red. Mondays are always slow for news and data, so investors look elsewhere, like China, for direction. One Chinese analyst noted that there was no direct piece of news or data that caused the drop, but investors are worried about the economy and are panic selling. The worries over the recovery in America have started to crop up as last week we saw a number of neutral to red days.

Futures are already down as of 7:30 AM. The Dow is down nearly 55 points, the Nasdaq has dropped almost 6 points, and the S&P 500 has skated down nearly 6 points. It is a broad range selloff that appears to be affecting each and every sector. The major sectors hit in China were the financials and energy service companies, so we should definitely watch those for extra volatility today.

Europe followed China down its bearish path, with almost all the major European indices dropping at least 0.5% to 1%. England’s FTSE 100 was actually trading up, however, around 1%.

There are very few stories today in the market, which really makes me worry about the market’s ability to stop any major selling off. I am afraid we are going to see this market move down in major swings today because there will not be anything for buyers to get in on for the day. The box office weekend was pretty lousy with The Final Destination taking home the top spot with under $30 million. In second was Inglorious Basterds and in third was The Weinstein Company’s Halloween II. The  movie made only $17 million, but that was greater than its only $15 million budget.

movie made only $17 million, but that was greater than its only $15 million budget.

In other news, BJ Services Inc. has announced that they will be bought out by Baker Hughes, another oil services company. The deal is worth $5.5 billion and it will help Baker Hughes as it looks to improve its shale oil and oil exploration and production.

Other than this, the market is pretty much moving on emotion and momentum, which points to more selling. I think we might be in for a very significantly downwards moving day. Oil should follow the market down as Asia dropped the price back down towards $71 per barrel on the weak day.

Good luck and let’s find some places to make money.

The inverse ETFs are all looking very overweight up 3-4% to start the day, so I am going to avoid these and look for two solid short sales for the day.

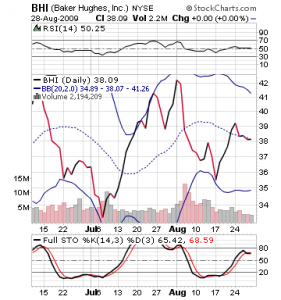

Short Sale of the Day #1 (Buy Pick of the Day): Baker Hughes Inc. (BHI)

When I started investing some years ago, I never understood the phenomenon behind mergers and acquisitions. Whenever a company would acquire another one, the one being bought would skyrocket while the buyer would plummet. To me, it seemed fundamentally good for the buyer and very bad for the seller. However, time and time again, every time I see a larger company buy a smaller company, the larger company tumbles.

Today, we should see history repeat itself with Baker Hughes Inc. The company has announced its purchase of BJ Services Inc. at $5.5 billion. Both companies have been struggling in the recession era, and the acquisition should help Baker Hughes become more competitive and profitable in the long term. The company will buy out shareholders at a nearly 17% premium, and they will become a 1/4 majority holder in the new company. This will dilute the value of the current share of BHI, which is why we see the downward trend.

Another issue with BHI is oil prices, which directly affect oil services and refining companies. As oil prices falter, companies want to supply less at lower prices. Therefore, there is less need for production, which negatively impacts BHI. The oil market is looking at a downwards moving day today, moving back towards $71 per barrel. This movement could be very bad for BHI coupled with the M&A news.

$71 per barrel. This movement could be very bad for BHI coupled with the M&A news.

Technically, BHI is in an interesting position. The stock had been rallying until the last couple of days as oil was rocketing upwards towards $75 per barrel, gaining around 10% in one week. The stock, however, has fallen right into its three-month moving average. The stock is right at that 50 mark on RSI, which means it is neither overvalued nor undervalued. The stock is basically in the balance, ready to tip down and gain momentum in that direction or continue back upwards. With today’s news it appears the prior is the verdict. The stock has a lower bollinger band in the high 35s, so we may see some resistance at that level.

Check back in my Oxen Alerts for entry/exit points.

Short Sale of the Day #2: American International Group Inc. (AIG)

This short sale is another market trend that has little to do with the news or market fundamentals. Since I am fairly certain the market is looking downwards for the day, I like the prospects of a major drop in AIG on the day. The stock already has fallen over 9% in pre-market trading. That should not really be a hindrance for a short sale because on numerous days we have seen this stock rise 40% or more. What I like about AIG is its beta.

Beta is basically the relationship between the returns of one security compared to the market as a whole. If the normal stock moves at a beta of 1, then anything higher than that has more  volatility and anything less than 1 has lower volatility. Typically, stocks have a beta in a range of 0.50 to 1.50. Anything higher signals a lot of volatility. AIG’s beta is at….3.5. The stock has unbelieveable momentum drives and volatile bounces. I like that for day trading.

volatility and anything less than 1 has lower volatility. Typically, stocks have a beta in a range of 0.50 to 1.50. Anything higher signals a lot of volatility. AIG’s beta is at….3.5. The stock has unbelieveable momentum drives and volatile bounces. I like that for day trading.

Getting into AIG on a day that is looking bleaker by the minute appears to be a risky but educated play. The stock can grow short interest in a jiffy and squeeze longs in no time. Since the stock is mostly played by day traders and machines, the switch to buy and sell are as fickle as a teenager in Abercrombie & Fitch. Therefore, I am not even concerned with how much this stock opens down because it can move down or up 2% in any given minute.

Buying in at the open and waiting for 3-4% is definitely risky and I caution you. On the other hand, AIG is a day trading delight.

Good Investing,

David Ristau