That is, of course, what residents of Macau are required to chant every morning in honor of Stanley Ho, who held the monopoly on casinos in China until 1992. This morning it turns out Macau's economy contracted by 13.7% in Q2, it's 3rd consecutive quarter of shrinkage. It's possible that the restrictions placed on civil servants in 2008 to stop them from gambling and to curb money laundering has caused much of the decline why is the decline accelerating if things are so good in China? One thing about Macau is that all the US businesses that are now there make it harder for the Chinese government to pad the statistics and, taken at face value, Maccau is underperfoming the rest of China by 22%.

This is worth noting today as China is leading the market bounce as the vice chairman of the China Securities Regulatory Commission, said the authorities will promote a “stable and healthy” market, tempering investor concern that the government wants to curb equity and property speculation. Ministers from the Group of 20 nations are likely to suggest the global economy is healing when they meet in London this weekend, while the European Central Bank probably will keep interest rates at a record low today. The Shangai composite index ran right up to the 5% rule today and has pulled a turnaround in global equities. As noted in David Fry's chart, we were oversold and due for a little bounce anyway.

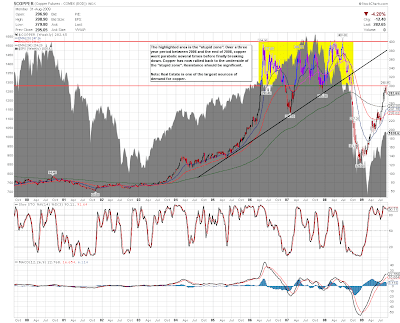

As noted by Ben over in our Chart School section, copper has climbed back into the "stupid zone" on that news but still has a ways to go before getting stupid enough to short again. We'll be keeping an eye on the copper miners like PCU, FCX and RTP as well as BHP, who got a nice pop on a UBS upgrade this morning but it's a little early to short until we see jobs reports today and tomorrow.

This is not surprising to us as we read the Fed minutes yesterday and the greenest shoot they could find was that things were picking up in other countries, a favorite ploy we discussed in Monday's post as the Shanghai was falling 6.7% that day. Fortunately, we were playing bullish into the close as we know how this game works and I had said to members just ahead of the Fed, at 1:58: "Beware bears – I was just noticing that last minutes were May 20th and July 15th – both ahead of major rallies!"

As I had mentioned in yesterday's morning post, our bearish bets were already on from last week and yesterday was a day for bottom fishing as we picked bullish (but hedged) plays on TTWO, RT, DIA, DIS, HMY, ABX, STX, BEAT along with a complex spread on UNG and a short call sale on GLD betting they won't break $1,000. So busy, busy yesterday as we liked the flatline even if we didn't like the Fed minutes that much and the sell-off into the close was very scary but, as we are well-hedged, we can afford to watch the nonsense and wait for clarity of direction.

After reading those Fed minutes we are far from bullish overall. The economy is NOT good at all and it's amazing to watch the MSM spin the Fed minutes as a positive this morning but here's an example of what I parsed out for members yesterday as I took the report and highlighted the facts and put the spin comments in red:

The information reviewed at the August 11-12 meeting suggested that overall economic activity was stabilizing after a contraction in real gross domestic product (GDP) during 2008 and early 2009 that the Bureau of Economic Analysis recently reported to have been greater than it had previously estimated. Employment continued to move lower through July, but the pace of job losses had slowed noticeably in recent months. A sizable pickup in motor vehicle production appeared to be under way. Housing activity apparently was beginning to turn up. Consumer spending dropped only a little further in the first half of this year, on balance, after falling sharply in the second half of last year. The decline in equipment and software (E&S) investment seemed to be moderating, although the incoming data did not point to an imminent recovery. The sharp cuts in production this year reduced inventory stocks significantly, though they remained high relative to the level of sales. A jump in gasoline prices pushed up overall consumer price inflation in June, but core consumer price inflation remained relatively stable in recent months.

Notice how the Fed minutes are crafted to allow the press to make fantastic quotes out of what they say even though the actual report is fairly dire. "Economic activity was stabilizing" (at the lowest level since the Great Depression), "The pace of job losses had slowed" (from catastrophic to horrifying) and "Consumer price inflation remained relatively stable" (at a pace where inflation is outpacing wages by almost 10% this year). Of course Uncle Rupert reads all this and orders a headline that reads: "Fed Expects Growth Amid Vulnerablility."

China also put their money where their interests lie and has agreed to buy $50Bn in IMF notes to bolster the funds lending capacity as the IMF seeks to keep weaker Asian economies afloat. BRIC partners Brazil, Russia and India have also expressed interest in helping and the G20 will likely announce funding this weekend as the second round of massive global bailouts becomes necessary. Also boosting the global markets before they break technical levels is an OECD report that sees a faster recovery than what they saw just 3 months ago. It's interesting when you drill down to WHY they see this and notice that they are saying: 1) Economic news has been mostly favorable the past few months 2) Changes in data modeling 3) Spare production capacity and "low" commodity prices 4) Substantial slack and a weak recover means more stimulus will be necessary and that will be good for the economy. Is that messed up logic or what?

We got some terrible Retail Sales numbers this morning (as we've been warning you all week) led by ANF down 29%, JCP down 8%, M down 8%, SKS down 20%, TGT down 3% and ZUMZ down 12%. Expectations were for much better performance and this was the 12th consecutive month of declines as back to school shopping disappointed and the holiday weekend came late this year. We'll get the ISM service numbers at 10am and they are expected to come in at 48.7, up from 46.4 in July but anything below 50 is still contraction. 570,000 people lost their jobs last week, 4,000 less than last week but 20,000 more than expected so keep digging for those green shoots and we'll keep being careful!