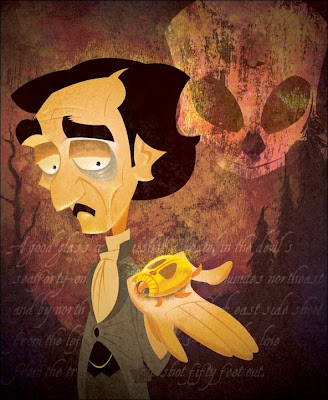

Who is going to buy gold?

Courtesy of Vitaliy Katsenelson at Contrarian Edge

Courtesy of Vitaliy Katsenelson at Contrarian Edge

This is the first in a series of what some may consider as “gold bashing” articles. I am not short gold in any shape or form. I have no axe to grind against gold bugs. I am simply presenting the other side of the argument in response to what I deem to be dishonest, gold-pimping commercials (e.g., “If gold prices went up to $5,000 this pile of gold would be worth $300,000”) that we are subjected to all day long on TV. I may be wrong, but I am honest.

Here is a trivia question for you: what country is the seventh largest holder of gold, ahead of China, Japan, and Switzerland? Well, it was a trick question: the seventh largest holder of gold is not a country, it is an exchange-traded fund, GLD. Yes, a fund that is not even five years old is the seventh largest holder of physical gold in the whole world, even ahead of mighty China.

When investors buy GLD, GLD in turn has to go out and buy gold, driving up the price. This raises a little question: who will be buying this gold from GLD when investors decide to sell it? Gold is one of those weird assets where nobody knows what it is really worth. You cannot run discounted cash-flow analysis to value it – it has no cash flows. It is an asset where perception and reality are deeply intertwined.

Investors buying the gold ETF (GLD) are influencing the price of gold, which is fair for the most part, as otherwise they’d be buying the real thing. The ease of buying GLD creates a higher, artificial demand – but GLD is still fair game.

The violent selloff in GLD will be caused by factors that are hard to predict today (e.g., hedge-fund liquidations) but that will drive the price of gold down dramatically unless a real buyer steps in (like another government sick of owning the US debt, for instance), and the gold price could get cut in half overnight. Suddenly, perception of not being a store of value will create the reality of gold not being a store of value. The gold game will be over.

Vitaliy N. Katsenelson, CFA, is a portfolio manager/director of research at Investment Management Associates in Denver, Colo. He is the author of "Active Value Investing: Making Money in Range-Bound Markets" (Wiley 2007). To receive Vitaliy’s future articles by email, click here.