Job Creation Down 35%, Consumer Spending Down 33% From Year Ago

Courtesy of Mish

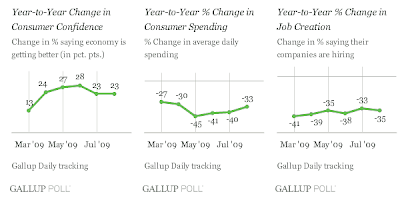

Gallup Daily economic data aggregated on a monthly basis show that job creation in August is just not taking place in the U.S. economy. While Gallup data for the month also show a slight moderation in job loss, this is not sufficient to take up the slack for a 35% decline in the rate of job creation compared to a year ago. And, while confidence in the future direction of the U.S. economy is at its highest level in 20 months, Gallup data also show a continued delinking of consumer spending — which is down 33% from a year ago.

What Happened?

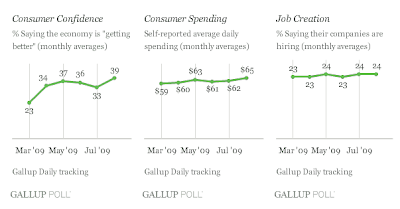

Job Creation was unchanged in August, with 24% of employees saying their companies were hiring, as was the case in July — and once again within the 23%-24% range that has held throughout 2009. However, the gap between job creation and job loss did close slightly, as 25% of Americans said their companies were letting people go — a slight improvement from the 26% of the previous three months. While Gallup data show fewer employees being laid off this summer than earlier in the year, the percentage of Americans reporting that their companies are hiring is down 35% from the same month a year ago.

Consumer Confidence hit a new high for the year in August and its highest level since Gallup Daily tracking began in January 2008, as the percentage of Americans saying the economy is "getting better" reached 39% for the month. Confidence is up from 33% during July and 16% a year ago. Still, even as confidence increases, 45% of consumers rate current economic conditions as "poor" — not much different from the 43% of a year ago. Consumers continue to believe the economy is improving, but — at least to this point — they don’t seem to see the improvement in their daily lives.

Consumer Spending improved slightly in August, as self-reported average daily spending in stores, restaurants, gas stations, and online increased by $3 per day. Still, spending over the first eight months of 2009 remains in a tight $6 range of $59 to $65, with August spending down 33% from the $97 daily average of a year ago. This lack of spending improvement even as confidence has improved dramatically since the beginning of the year seems to reflect a "new normal" in consumer spending.

It may be that the current inventory- and "clunker"-driven economic upturn will be a "jobless" recovery. It is possible that government and business spending alone can drive economic improvement for a short period of time. However, without significant job creation, it is hard to see how consumer spending will increase; how many retailers will survive after the Christmas holidays; and how the economic recovery will be maintained into early 2010.

Many think that consumer spending will return once job creation picks up. Actually, there is so much consumer debt, and for many, no reasonable way to service it, that consumer spending is likely to remain weak and defaults high even after unemployment starts inching back down.

Frugality The New Normal

Frugality is the "New Normal" as discussed on this blog for well over a year. Now, a Gallup Poll shows the effect in hard numbers. Please consider Consumers Adjust Attitudes Toward Spending.

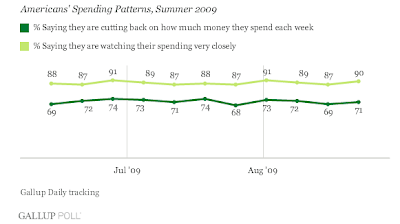

Most Americans have consistently viewed themselves as financially cautious this summer, with about 9 out of 10 since early June saying they are watching their spending closely, and 7 in 10 saying they are cutting back on how much they spend each week. There has been little variation in these reported behaviors.

Solid majorities of Americans across all income categories report that they are watching their spending closely and are cutting back. Eight in 10 of those making $90,000 or more a year say they are watching their spending, and nearly two in three say they are cutting back on their spending — nearly as high as the percentage of middle- and lower-income Americans doing the same.

Consumers are spending less because they have to. In many instances it is a forced attitude adjustment because debt levels are too high, and ability to service that debt increasing. Karl Denninger has some thoughts about that in 2009 Labor Day Ponderings….. It’s well worth a look.

Bear in mind I think unemployment is going to continue rising for another year, then come back down slowly and reluctantly as noted in Structurally High Unemployment For A Decade. Thus a jobless recovery is a given, assuming there even is a recovery worth mentioning.

Happy Labor Day