And away we go!

We have finally broken through all of our breakout levels and no one is more surprised than I am to see this coming without a pullback (perhaps David Fry – see chart on right). We will, of course, remain cautious through the weekend but we're already preparing to throw caution to the wind (sort of) as I've posted a primer for our Buy/Write Strategy, so we can start picking up the stocks we want at roughly 15-20% discounts. This is why we can afford to be patient as we wait for our breakout levels – WE DON'T MISS ANYTHING! At PSW, we can STILL buy BAC for $14.41 (16% off) and C for $3.43 (27% off) and PARD for $3.79 (51% off) and now that we have made our tops, we feel a lot more comfortable working in at those prices than we would have when the market was 20% lower in early July.

Hopefully that floor holds (Dow 8,000). We're looking good so far as our breakout levels have been Dow 9,600, S&P 1,030, Nasdaq 2,038, NYSE 6,700 and Russell 577 and now they form a floor we will be able to watch so we’ll know when to be worried that the rally is running out of steam.

We are also well-protected with our disaster hedges from the Aug 24th post and, if you don't have any – it's still a good idea to get some (and cheaper now too!). Only 2 33% (off the top) levels remain and that’s 1,056 on the S&P and 6,959 on the NYSE and we will be officially raising our mid-point from Dow 8,650 to 9,500 if we can take those out and hold them for a day or two, which will make 9,000 our new expected floor on the Dow and that means we should be buying here! There’s no point in having watch levels if we don’t act on them.

The dollar continues to fall and that's supporting oil and gold but not the Nikkei, who fell 100 points off their open and finished down .666% for the day as the dollar failed to hold 91 Yen against the world's mightiest currency. Even a 50-point "stick save" into the Nikkei close couldn't paint a positive close for the day. A 100-point boost into the close was enough to give the Hang Seng a 91 point gain on the day, capping off a 700-point week (3.5%) and exactly 10% off the September 2nd low at 19,500, matching the Aug 4th high for the year. The Nikkei hasn't matched their high for the year yet (10,639) and we'll need to see confirming moves up next week to keep this global party going. The Shanghai Composite rose 2.2%, erasing their losses for the week as China reported a 12.3% rise in Industrial Production.

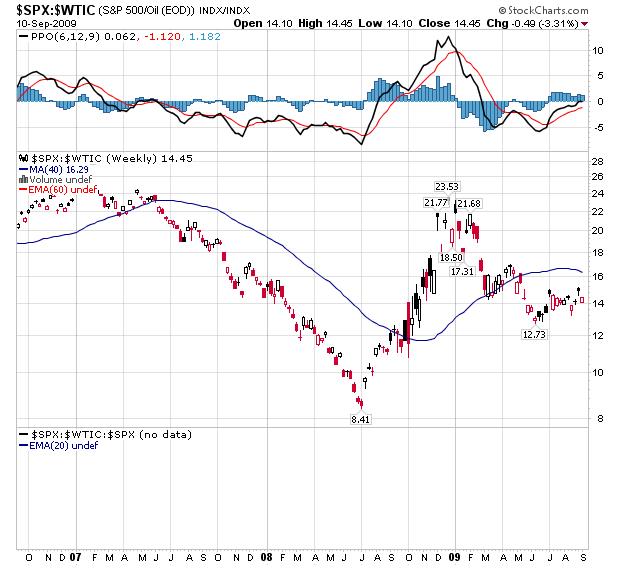

Europe is also having a nice morning, led by commodity pushers TOT and BHP as China's production report and the weak dollar boosted commodity prices. This is interesting because, just yesterday, I pointed out to members that, if you look at a chart of the S&P 500 adjusted against the price of a barrel of oil over the same period – we aren't really looking all that hot:

That paints a slightly different picture of our recovery doesn't it? This is a fine illustration of how rising oil prices destroy our economy and it's a pretty reasonable indicator that we will NOT be able to sustain a recovery if oil prices keep climbing above $70. In fact, you can mark the beginning of the great decline in our markets right around July of 2007, when oil first crossed $70. At that time, that spring, the S&P 500 had crossed 1,500 for the first time as well but that party ended in October of 2007, as oil broke $80 and began to bankrupt the global consumer at the rate of $25Bn per month per $10 per barrel increase. The rise in oil prices to $147 a year later cost the global economy $2.5Tn of discretionary income, half went for crude itself and the other half went to pay for mark-ups refined products and, of course, trading fees for GS et al.

That party had the XLE up 70% from where it is now and the OIH up 100% from where it is now and XLF (who were trading all the commodities) was up 200% from where it is now and XHB was up 200% from where it is now as people who thought they were rich (based on stocks in their virtual portfolios) ran out and bought multiple homes as "investments." It wasn't just oil and the fee-mongers who were doing so well – Agriculture (DBA) was up 75% and Materials (XLB) were up 50%. Will we be rallying back on the same house of cards that took us to the last collapse or are we going to build a better base this time. That's something I intend to examine in the conclusion of our ongoing "Stock Market Crash – Year One Review" series.

We'll get a much better picture with next week's data beginning with PPI, Retail Sales, NY Manufacturing and Business Inventories on Tuesday. Wednesday we'll get CPI, TIC Flows, Industrial Production and Utilization plus Crude Inventories. Thursday is Building Permits, Housing Starts and another 550,000 jobs lost in September along with the Philly Fed Report so lots of fun data to chew on and we will be taking a bearish stance into the weekend – just in case not everything is as great as it seems but we'll also be enjoying the rally while we can as there's still plenty of good things to BUYBUYBUY – especially with our discount program.

Have a great weekend,

– Phil