Investing With a Time Machine

Courtesy of Tim at The Psy-Fi Blog

An Obvious Approach?

An Obvious Approach?

Always and everywhere the market timing argument resurfaces in multifarious forms. The idea is simple: sell high and buy low: what could be more obvious? Well, there’s a problem. It’s not necessarily insurmountable but it’s definitely a bit tricky.

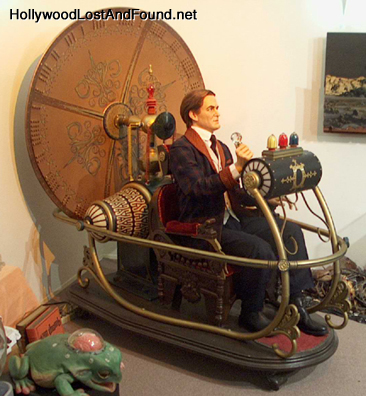

You may need a time machine to implement the concept successfully.

Market Timing

The idea behind market timing is easy to state. Sell stocks when they’re high and buy them when they’re low. It’s the basic idea the lies behind all investment in stocks so it’s hard to see why anyone should object. The difficulty lies in the impossibility of implementing the technique accurately in the timescales generally envisaged. Which, to be precise, tends to mean any timescale you can envisage at all. Mostly we have no idea ahead of time whether any given stock has peaked or troughed. Most guesses – let’s not dignify these with the term “forecast” – turn out to be wrong.

Unfortunately the idea is seductive and apparently easy to implement, in hindsight. Looking back everything seems so obvious that the untrained human brain finds it almost impossible to believe that the future isn’t equally predictable.

Buy and Hold

A recent study from the CFA shows that markets go up twice as much as they go down. Their recommendation, if you have cash to invest, is to invest everything now: the research shows that this will maximise your returns over an investment lifetime.

However, this is a pretty unnerving suggestion: had you thrown your money into the market back in the middle of 2006 you’d be sitting on a very nasty loss. Of course, you’d have been appallingly unlucky to get your timing that wrong, but inevitably some people did and the fact that the odds were against them doing so will be no consolation. The alternative suggested by the authors is to feed your money into the markets gradually – averaging your costs. This is a form of insurance, ensuring that you don’t put all your cash in at the market top or, of course, the market bottom.

However, the research also shows that there’s a limit to the value of averaging. After eighteen months there’s no discernable benefit to spreading the timescale of your investments. The vast majority of the benefit comes over the first six months.

Long Term Buy and Hold

The idea here is that you invest and you stay invested. There are a range of investors – in fact virtually all commentators in any form of media both professional and amateur – who regard this as anathema. Outperforming the markets by timing your way in and your way out is the true test of the hairy chested, red blooded investor.

On the other hand long term passivity vastly reduces the tax levied on investments by the money management industry’s fees. It also prevents investors getting their timing disastrously wrong. The majority of studies of active investment show that the behavioural biases stimulating investor trading results in significant selling at market lows and buying at market tops. Mutual fund flows are our best guide to this, but there is lots of other research looking at direct investment which consistently show the same pattern: people who time the market do so with remarkably poor judgement.

We can state, with a great deal of certainty, that if the only basis an investor has for timing their investments is their gut feel then they’d generally be much better off not trading at all. Personal certainty triggered by all the standard psychological quirks – overconfidence, over-optimism, hindsight bias, loss aversion, regret, availability effects and so on – will inevitably lead to over-trading, poor timing and significant underperformance.

Unfortunately long term buy and hold for equities hasn’t been a very successful strategy over the past few decades either. So if passivity doesn’t work and active investing doesn’t work, what can the average person in the street do to invest for their future?

Outperforming the Passive Investor

There is at least one method of predicting future market movements which works – or at least, it’s worked up until now. Cyclically adjusted price-earnings (CAP/E) forecasts have been remarkably successful at predicting market highs and lows. The idea was first introduced by Ben Graham and has more recently been popularised by Robert Shiller: the premise is that by looking a stock or market price-earnings ratios adjusted for a ten year cycle you get a better idea of whether an investment is currently over or underpriced.

When CAP/E is plotted against the return on the S&P500 it can be seen to beautifully track the wider market – when CAP/E is at cyclical highs then the market is overvalued and when it’s at cyclical lows then the market is undervalued. So if CAP/E is so wonderful why doesn’t everyone use it?

The Problems of CAP/E

Well, if it works this well then there’s not much value in employing an investment professional to manage your portfolio. The last thing the securities industry wants is to publicise a reliable method of predicting when its troops are making fools of themselves.

Secondly, though, CAP/E doesn’t actually give trading indicators. On a historic basis CAP/E was horribly high in 1998 but the markets went on rising for another two years. This year CAP/E finally fell through its long term average value but its greatest modern exponent, Shiller, didn’t use this as a buying signal – arguing that history shows that it falls much lower at cyclical lows. Instead, it’s risen again. Of course, he may yet be right as earnings recover faster than share prices over the next few years.

Thirdly, there’s the ever-present concern that if CAP/E becomes really popular it’ll stop working. This has happened to virtually every mechanical method of timing investments over the years. It’s a facet of human psychology – once we find a fireproof method we all want to use it. Inevitably some people will then start to try to get ahead of the game, by buying or selling a little bit earlier and the indicator’s value dissolves in noise until everyone goes off to play with the next interesting idea.

Finally, there are concerns over the measurement of earnings. In Ben Graham’s time most corporations were asset rich, making their money by leveraging those assets. These days such companies are rare, earnings streams are based increasingly on selling services and valuations on long-term cashflow predictions. Accounting conventions have changed to accommodate these changes. It’s questionable whether the historic CAP/E figures are really comparable to those of today.

Investment Nest Egg Timing

Market timing is a risky strategy when based on nothing other than gut feeling. If we can’t do better than intestinal rumblings then monies invested in stockmarkets should probably be invested quickly and left for a long time. They should only be invested in reasonably safe things like index trackers, spread across developed and undeveloped markets and across equities and bonds with occasional rebalancing to sell down successful investments and buy unsuccessful ones, aiming to capitalise gently on mean reversion effects.

Trading strategies based on anything – even an indicator apparently as solid as CAP/E – should generally be avoided by the majority of investors because they open them up to the temptation to move money in and out of the market. While value effects do occur and can be capitalised on, the mental discipline to do this when markets are exhibiting screaming volatility is not given to many people. Still, where CAP/E may be a help is in avoiding investing when markets are massively overvalued and in encouraging investment when they’re clearly undervalued.

Leave Trading To The Experts

There are good judges out there who have developed trading strategies based around CAP/E and, if they’re correct, they’ll outperform more passive investors quite significantly over an investing lifetime. Sadly without a time machine we can’t look ahead to check and without being able to check we’re reliant on our intuitions rather than on hard evidence. The past is not, unfortunately, predictive of the future when it comes to market timing strategies.

As bad market timing based on greed and fear appears to be the norm, this probably does matter, so we’d better try and develop some mental strategies for avoiding the worst we can do to ourselves. The alternative is likely to be a long, miserable and non-existent retirement.

Other Reading

By chance David Stevenson of the FT has just written a characteristically excellent article on a similar topic >>> Strategies for time and time again

Also it’s well worth listening to David’s interviews with a number of the investment industry’s more thoughtful participants >>> David Stevenson FT Interviews

Related articles: Caplitalism Evolving, Be a Cockroach not a Dinosaur, Momentum Trading Madness, Technical Analysis, Killed By Popularity