Is China Going to Go “Nuclear”?

Courtesy of Graham Summer’s Gains, Pains and Capital

In case you have not heard the news, China has announced that it will be instructing its state-owned enterprises to potentially default on their derivatives contracts. As I have written extensively in the past, the derivatives market is a massive time bomb just waiting to go off. China’s latest move may be the match that lights the fuse.

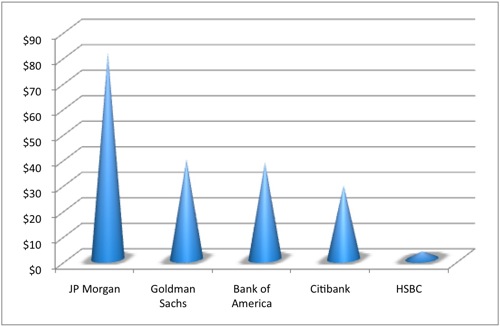

All told, US Commercial banks own $202 trillion in derivatives in notional value. To put that number into perspective, it’s roughly four times the global GDP. And 96% of this exposure sits on five banks’ balance sheets. I’ve shown the below chart before, but it’s worth re-visiting (chart is denominated in TRILLIONS).

Of course, not ALL of the $202 trillion these guys own is “at risk.” As their name implies, derivatives are “derived” from underlying assets (homes, debt, etc). The actual “at risk” money can be far FAR smaller than the “notional” value of derivatives outstanding.

However, when you’re talking about $200+ trillion, even a marginal amount of “at risk” money can mean ENORMOUS losses. Consider, if 1% of that $200 trillion were at risk, that’s $2 trillion in capital. Now, if even 10% of those bets go bad, you’re talking about $200 billion in losses.

Now consider that, combined, the top five banks (JP Morgan, Goldman, BofA, Citi, and HSBC) have roughly $700 billion in equity.

Given the over-leveraged, stupid plays Wall Street made on mortgage-backed securities and credit default swaps (both investments that had SOME degree of oversight, even if it were paltry), as well as the fact that derivatives are COMPLETELY unregulated, I would argue it’s quite possible that as much as 5% or even 10% of the derivatives outstanding could be “at risk.” In that case, we’re talking about $10-$20 trillion in “at risk” capital. If even 10% of these bets go wrong, ALL the equity at all five banks AND THEN SOME could be wiped out.

As I mentioned just now (and before many times), the primary problem with derivatives is that they are completely unregulated. No one has any idea what’s “at risk” or who owns what or who’s betting against who.

But we may be about to find out.

I’ve detailed the ongoing conflict between China and the US regarding monetary policies on these pages before. The brief overview is that China owns $800+ billion (by some accounts $1.3 trillion or more) of our Treasuries (debt) and is not too happy about Ben Bernanke and other US monetary figures throwing trillions around in bailouts and emergency measures to counteract the financial crisis.

China has fired a couple of “warning” shots already, mainly in the form of various Chinese diplomats expressing concern and frustration with the US’s monetary policies. They even flew China’s Vice Premiere to an unscheduled talk with US monetary officials back in July.

No one knows what was said during the talks, but given that Ben Bernanke is extended Quantitative Easing to October and has shown little signs of reversing his current “anti-dollar” policies, it’s pretty clear China didn’t get what they wanted. I’ve often wondered what China would do if push came to shove. Its decision to have state-owned enterprises default or renege on their derivatives contracts may be the answer.

As I’ve stated on these pages before, I view the “bailouts” as nothing more than an attempt to funnel taxpayer money to the large US banks so they can raise capital to avoid insolvency. It was essentially a “re-capitalization” effort using public funds. And it came at the expense of the dollar and Treasuries.

As I’ve stated on these pages before, I view the “bailouts” as nothing more than an attempt to funnel taxpayer money to the large US banks so they can raise capital to avoid insolvency. It was essentially a “re-capitalization” effort using public funds. And it came at the expense of the dollar and Treasuries.

China, who owns more Treasuries and dollar-denominated assets than anyone, was not too pleased about this. Geithner, Bernanke, et al, simply plowed ahead ignoring China’s requests. (Geithner actually told a group of students in China that the math behind the US’s policies were solid which resulted in the students laughing at him).

China’s threat to default on its commodity derivatives is a very clever means of slapping the US Federal Reserve in the face without “going nuclear” by selling Treasuries outright.

Commodities account for the smallest portion of derivatives on US commercial bank balance sheets ($938 billion out of $200 trillion). A default here would trigger a chain reaction that could essentially wipe out the Fed’s attempts are re-capitalization (the US banks would suddenly be on the hook for billions in losses that they didn’t expect). It’s a very serious indirect way of China saying, “if you want to continue screwing around, we’ll simply walk away from the table.” But they’re doing it in a select asset class that no one but Wall Street engages in (derivatives).

The primary issues now are:

- Whether China WILL actually begin defaulting (remember, so far it’s just a threat).

- Whether or not China’s decision would trigger a larger chain reaction in the derivatives markets.

- How the US will respond to China’s threat.

I do not know the answer to these issues. No one does. I DO know, however, that a derivative chain reaction throughout the financial system could cause a full-blown implosion like September-November 2008.

Remember, computers account for 70% of the market’s volume. And they can simply walk away OR even worse, start driving the market lower as they adjust to trading in the new environment. These are not sensible, brain driven, investors who can make qualitative judgments. They are computers trading based on algorithms that track various metrics. If we get a black swan even (and China defaulting on derivatives would be one) these computers could go completely haywire and instigate a repeat of the ’87 Crash.

I am not saying that this WILL happen, but mention all of this to remind you of the investing environment we’re in. Pull the plug on the computers and we may see panic selling galore and a repeat of October 2008 if not 1987.

I’m preparing our portfolio for this eventuality this week (more on this in a minute) with a number of trades that should prove extremely profitable if the Crash I’ve been predicting for months comes to fruition.

However, we also need to consider the socio-economic implications of what could happen should China start defaulting on its derivative contracts with the US. If China chooses that route, the US could choose to default on its debt to China. At that point we would be in a full-scale economic war and potentially on our way to military conflict.

The fact that Japan’s new leadership has also expressed displeasure with the US’s monetary policy adds to the mix. This creates additional issues. Japan and China are our largest creditor nations.

I am not saying any of this to be “scary” or “doom and gloom.” But things are coming to a head in a very real way on the global stage. This financial crisis is nowhere near over. If anything we’re at the end of the beginning. Many, many more banks will go under. We can and will see a lot more volatility in the bond and currency markets (a bear market in bonds would be a nightmare we haven’t seen in 30 odd years). And stocks (already overbought and propped up via manipulation and accounting gimmicks) are primed to take a full-scale nosedive (more on this in a minute).

My Personal Message: BE PREPARED

In light of this, and on a more personal note, I am suggesting you prepare for the WORST if you are in the US. This means stockpiling food, and having enough cash on hand to survive an economic shutdown if it happens. We came close to such an event last fall (the story was not widely spread but banks in US and UK considered shutting down ATMs and having a holiday).

I can tell you that I personally have stockpiled food (3 months’ worth) and am telling my family and friends to do the same. After all, what’s the worst that could come from doing this? If I’m totally wrong and everything gets better, you simply eat the food just like you would anyway.

But if I am right, and things do get MESSY, then stockpiling now means you’ve got food on the table later. Again, we have the making of several black swan events that could push an already weak economy into SERIOUS trouble. Among them are:

- China defaulting on derivatives (triggering a chain reaction in the financial markets)

- China selling Treasuries (flight from the dollar and all paper money)

- Japan sell Treasuries (ditto)

- The $7 trillion commercial real estate market (as bad if not worse that the US residential market)

- Some other chain reaction event in the $1 QUADRILLION derivative market

- The H1N1 virus (a major flu pandemic would stop all economic growth in its tracks)

- A major bank failure (rumors of Wells Fargo or someone else are swirling)

- Some other item no one sees coming (e.g. Gmail shut down for an hour a few weeks ago, imagine if the NYSE’s servers did the same thing).

All of these could portend another crisis for the US economy and stock market. I put the likelihood that we are out of the Crisis and the Great Depression II (it is a DEPRESSION, not a RECESSION), at less than 5%. Even if we go the route Japan did in the ‘80s instead of a full-blown black swan induced meltdown, then we’re talking about weak economic growth for a two decades with high unemployment, lower quality of life, and the stock market slowly losing 80% of its value.

Again, NO ONE knows what exactly is to come for the market and US economy. But there is a LOT of RISK right now no matter how the media chooses to spin things. You should prepare personally and financially for the worst. I’ve put together a FREE Special Report detailing three investments that will explode when stocks start to collapse. I call it Financial Crisis “Round Two” Survival Kit. Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Good Investing!