I am changing up the format a bit on The Oxen Report starting today. Let me know what you think. Yesterday, our buy pick of the day was very successful, giving us a solid 3% return. At 8:15 AM, I chose E*Trade Financial Corp. (ETFC) as my buy pick of the day. In my Oxen Report Morning Levels alert for members, I suggested entering E*Trade at 1.72 for an entry point with an exit at 1.79. After five minutes of the open, E*Trade pulled back to 1.72, where we opened the position. By 9:45 AM, the stock had reached 1.79 for a 3% gain. Yingli Green Energy (YGE) was our Short Sale of the Day. Unfortunately, this stock did not work as well due to the rally in the market. A First Solar downgrade, as well as, a heavily overweighted YGE was the thinking behind the pick, but the stock got too far down in price in the morning, and we entered at too low of a price with 12.55. We got stopped out for a 3% stop loss at 12.80. Went 1/2 yesterday, but made that great 3% on ETFC.

I am changing up the format a bit on The Oxen Report starting today. Let me know what you think. Yesterday, our buy pick of the day was very successful, giving us a solid 3% return. At 8:15 AM, I chose E*Trade Financial Corp. (ETFC) as my buy pick of the day. In my Oxen Report Morning Levels alert for members, I suggested entering E*Trade at 1.72 for an entry point with an exit at 1.79. After five minutes of the open, E*Trade pulled back to 1.72, where we opened the position. By 9:45 AM, the stock had reached 1.79 for a 3% gain. Yingli Green Energy (YGE) was our Short Sale of the Day. Unfortunately, this stock did not work as well due to the rally in the market. A First Solar downgrade, as well as, a heavily overweighted YGE was the thinking behind the pick, but the stock got too far down in price in the morning, and we entered at too low of a price with 12.55. We got stopped out for a 3% stop loss at 12.80. Went 1/2 yesterday, but made that great 3% on ETFC.

On to today…

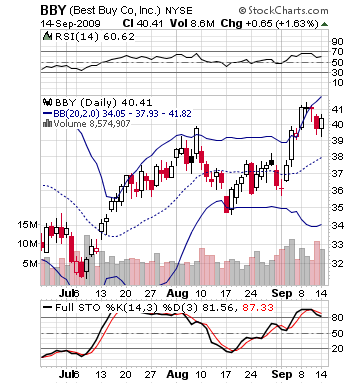

Buy Pick of the Day: Best Buy Inc.

Typically, one does not select a company that missed its EPS and profit estimates for its second quarter results as its buy of the day, but I like the prospects for BBY. The company did miss estimates and is only down 1% in pre-market trading as of 8:30 AM. Why is that? The company made $158 million in profit in its Q2 results, which was down 22% from one quarter ago. The company hit an EPS of 0.37, while analysts had been expecting the company to hit an EPS of 0.42. On the other hand, the company grew revenue 12% beating expectations and raised its full year outlook from 2.50 – 2.70 EPS to 2.70 – 3.00 EPS, with analysts expecting 2.87 on average.

the day, but I like the prospects for BBY. The company did miss estimates and is only down 1% in pre-market trading as of 8:30 AM. Why is that? The company made $158 million in profit in its Q2 results, which was down 22% from one quarter ago. The company hit an EPS of 0.37, while analysts had been expecting the company to hit an EPS of 0.42. On the other hand, the company grew revenue 12% beating expectations and raised its full year outlook from 2.50 – 2.70 EPS to 2.70 – 3.00 EPS, with analysts expecting 2.87 on average.

A lot of numbers but what it really means is that the company grew its revenue from one year ago and was able to raise its full year outlook while missing profit estimates in the short term. So, in the long term, the stock’s book value is higher for the full year based on its raise in expectations. This makes the long term prospects of the company better, but in the very short term, it is not as strong.

With the way the market is going to perform today, Best Buy is in an even better situation. Core retail sales, which extrapilates auto sales that were much higher due to Cash for Clunkers, were much higher than expected, rising 1.10% from one year ago and beating expectations of 0.40%. Other economic indicators, such as the NY State Manufacturing Index and the PPI Index, which is a measure of prices, both beat expectations, as well. These are heathly signs of the economy and are boosting futures across the board. If the market rallies, it will help Best Buy mask the short term misses and give growth investors even more reason to buy into the stock.

Technically, Best Buy is a bit toppy and should begin to see resistance at $42 per share, while trading currently at $40.41. The stock is a overbought and overvalued, as well. However, the stock sold off into the earnings over the past couple days, dropping almost 3%. However, with the bullish market and the ability to get this stock at a discounted price, it makes Best Buy a very attractive play.

Technically, Best Buy is a bit toppy and should begin to see resistance at $42 per share, while trading currently at $40.41. The stock is a overbought and overvalued, as well. However, the stock sold off into the earnings over the past couple days, dropping almost 3%. However, with the bullish market and the ability to get this stock at a discounted price, it makes Best Buy a very attractive play.

Entry: We would like to be able to enter the stock at 40.10 – 40.20 with hopefully a slight pullback in the morning as some investors unload their shares on the EPS miss, but the fundamentals long term are there for a value trade. I will be adjusting this entry price in my Morning Levels alert for Oxen Group alert member as need be, so stay tuned.

Exit: Looking for an exit around 40.90 – 41.30 for 2-3% increase from entry point.

Stop Loss: Set at 39.00.

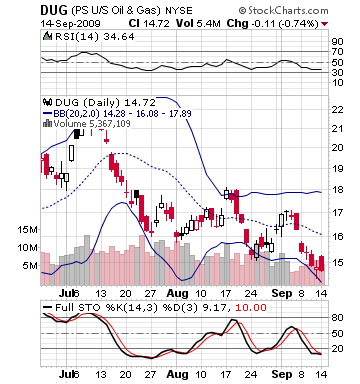

Short Sale of the Day: Ultrashort Proshares Oil and Gas (DUG)

The price of oil is increasing once again on the NYMEX. After dropping some over the past week, the price of oil fell to below $68 a barrel, but is up over $69 per barrel today with an 80 cents increase so far in morning trading. The price of oil did fall in Asia, but the economic data that Americans got today from retail, PPI, and manufacturing indices is propelling the markets. These signs of a healthy economy are going to propel, as well, oil prices to match the momentum of the market. In retaliation, oil production and gasoline refining companies should be boosted, as well. This is bad news for the oil and gas inverse ETFs, such as DUG.

The price of oil is increasing once again on the NYMEX. After dropping some over the past week, the price of oil fell to below $68 a barrel, but is up over $69 per barrel today with an 80 cents increase so far in morning trading. The price of oil did fall in Asia, but the economic data that Americans got today from retail, PPI, and manufacturing indices is propelling the markets. These signs of a healthy economy are going to propel, as well, oil prices to match the momentum of the market. In retaliation, oil production and gasoline refining companies should be boosted, as well. This is bad news for the oil and gas inverse ETFs, such as DUG.

DUG has done poorly as of late with the market’s sustained small rallies that have driven the price down around 10% in the past week or so. The ETF is getting into a momentum pull back that is going to be hard to reverse. Yesterday, the stock lost all of its 4% gap up and finished in the red and more losses appear on the way as oil prices increase. The sort of momentum that we are seeing with these inverse ETFs is a great reason to short a short.

What is even more attractive about the ETF is that it is only down a bit over 1%, but the market is looking for a big day and oil is shooting up. That should mean an inverse ETF with as much volatility as DUG has could be looking at something much more severe in its drop. While the stock is undervalued and oversold, it has no catalyst to reverse this trend.

Watch out below on this one.

Entry: A solid entry would be between 14.50 – 14.60 to short sale the ETF. Check back in my morning levels alert to oxen group members for updates on those prices.

Exit: Looking for an exit around 14.25 – 14.15 for a 2-3% gain from the entry price.

Stop Loss: Set at 15.00