Whee – we finally made it!

In an UNBELIEVABLE move off the bottom over the past 6 months and one week, we have gained 58% on the S&P and have finally crossed into our 33% levels (from the highs) that we first set as upside targets back in our July Big Chart Review. At the time I said "I just don't see that happening without a pullback" yet here we are, with barely a wiggle down since I wrote that on July 27th and up 20% from our July 13th S&P base at 880.

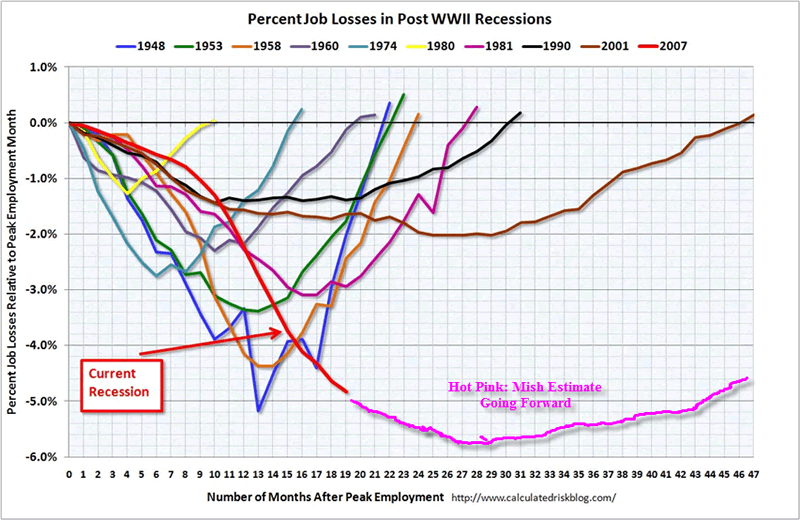

Have we been too bearish? Is it now natural for the market to rise 20% in 2 months without a pullback? Are we really 20% better off than we were 2 months ago? History tells us not to mess with the 5% rule so we SHOULD encounter powerful resistance here as we approach the zone of a roughly 60% move off the March lows as well as 30% off our highs – it's going to be a rough 2.5% from here. As you can see from the above chart, we have already exceeded all previous recoveries by almost 100% at this point in the cycle. And why not, our government spent $9 TRILLION dollars to do it so we damn sure better have a pretty chart as a souvenir! The other rally that had a spectacular recovery was the the great crash of 1929 (the grey line).

In the 1929 crash, the stock market fell first, not the banks, which didn't begin failing until 1932 as lack of electronic data and next-day mail meant it took a lot longer for the late payment and foreclosure cycle to start impacting bank balance sheets. Also, of course, they were nowhere near as maniacally levered as today's institutions. In 1929 the banks did not play the market, they simply lent money to people who invested in stocks, businesses and properties that went bust so there were two distinct waves to the market crash in the Great Depression: First the people went broke, then the banks.

In the 1929 crash, the stock market fell first, not the banks, which didn't begin failing until 1932 as lack of electronic data and next-day mail meant it took a lot longer for the late payment and foreclosure cycle to start impacting bank balance sheets. Also, of course, they were nowhere near as maniacally levered as today's institutions. In 1929 the banks did not play the market, they simply lent money to people who invested in stocks, businesses and properties that went bust so there were two distinct waves to the market crash in the Great Depression: First the people went broke, then the banks.

Unemployment in the US in 1930, a year after the crash, was only 8.7% – less than it is now. No one at that time thought it was important to help the average American get back on their feet after many of them lost their life savings and went deeply into debt as their homes dropped in value and jobs became scarce. It was only after the banks balance sheets began to dry up and business began to fail as consumers cut back on the lavish spending of the 20s that Wall Street decided it was a "crisis." From the crash of 1929 into the middle of 1930, the market bounced 50% off its lows and then the second wave hit.

Have we escaped the second wave or are we just fooling ourselves and setting up for another huge correction? Unlike 1929, our crash started in the financial sector because the DATA showed us that the assets on their books were GOING TO fail. To some extent, perhaps this was a preemptive strike, sort of like when fire-fighters create a firewall by chopping down trees ahead of a fire to take away a possible source of fuel and contain the blaze. The pre-failure of our banking system took down the markets and the staggering government intervention of 2009 may be like the New Deal of 1932, which took the market from TOTAL collapse (90% off the top) back to 40% off the top by 1937.

OK, so that's not a very exciting sounding recovery compared to ours but the government didn't have $9,000,0000,0000,000 to spend back then (come to think about it, they don't have it now either). In fact, the GDP of the planet Earth in 1929 was just $500Bn, even adjusted for inflation that would be about $4Tn. So a US bailout, that is 225% of the GDP of the planet Earth in 1929, boosted the stock market 58% in 6 months – big friggin' deal! Globally, the bailout is roughly $20Tn – 50% of our current global GDP so a 50% boost in the market seems about right for that. But can we sustain it? Have we really turned the corner on the crisis or are we just fooling ourselves with all this stimulus and, is it even being applied to the right places?

OK, so that's not a very exciting sounding recovery compared to ours but the government didn't have $9,000,0000,0000,000 to spend back then (come to think about it, they don't have it now either). In fact, the GDP of the planet Earth in 1929 was just $500Bn, even adjusted for inflation that would be about $4Tn. So a US bailout, that is 225% of the GDP of the planet Earth in 1929, boosted the stock market 58% in 6 months – big friggin' deal! Globally, the bailout is roughly $20Tn – 50% of our current global GDP so a 50% boost in the market seems about right for that. But can we sustain it? Have we really turned the corner on the crisis or are we just fooling ourselves with all this stimulus and, is it even being applied to the right places?

I have long advocated that until the government does something to actually FIX the consumer – the average US homeowner – then everything else they do is the proverbial lipstick on a pig (and she did not end up getting elected did she?). It is beyond my understanding how a country in which 70% of the GDP is a result of consumer spending can have so little regard for the consumer. There is a cartoon I like to use that depicts Goldman Sachs' greed killing the goose (the American public) that laid the golden eggs yet that is what this recovery is all about so far. We have bailed out banks without helping the consumers and that makes no sense at all.

We gave Citigroup $50Bn to fix their balance sheets, which were under pressure because 5% of their mortgages were underperforming, causing them to have to write down hundreds of Billions in assets (and take a tax write-off that cost the government another $50Bn). Citigroup has a total of $667Bn in in mortgage loans and $122Bn in credit card debt outstanding. These loans are on 5M homes and about 12M individuals. $50Bn represents $10,000 per home that Citibank has loans out to.

We gave Citigroup $50Bn to fix their balance sheets, which were under pressure because 5% of their mortgages were underperforming, causing them to have to write down hundreds of Billions in assets (and take a tax write-off that cost the government another $50Bn). Citigroup has a total of $667Bn in in mortgage loans and $122Bn in credit card debt outstanding. These loans are on 5M homes and about 12M individuals. $50Bn represents $10,000 per home that Citibank has loans out to.

Had that money been given to the consumers, rather than the bank, it would have been enough for most to make a year's worth of payments on the average $100,000 home loan and had that money been distributed to the neediest 20%, it would have been $50,000 per troubled household. That simple act, by itself, would have turned Citigroup's balance sheets from sheet to pristine as all their loans would be up to date and a good portion of the troubled mortgages could be reduced with the remaining capital. That would have eliminated Citigroup's need for additional capital, deleted all counterparty risks to failure and, as a side benefit, would have markedly improved the lives of 1M homeowners and forestalled a Million foreclosures, and that would have helped the whole real estate industry, including the value of your home and mine.

Multiply that very simple solution across the entire financial sector and we could eliminate the mortgage crisis tomorrow. Heck, we could have done it last November but instead we squandered the money in order to make sure Lloyd Blanfein and company would get their enourmous bonuses this year. Nothing was done last year to actually FIX the problems of the American people and nothing has been done this year either and THAT is why I am still not convinced this economy is really recovering. In 2007 a $168Bn stimulus package took the Dow up from 12,000 in March to 14,000 in September – that's 16% and we all know how that ended! So why is everyone so impressed that another $9Tn gave us a 58% gain this year. It's what happens when the music stops that really counts.

Meanwhile, it's the fundamentals that are failing us lately because we are back in a Meatballs Economy where bad news "just doesn't matter" and, if you want to hear me bitch about that, you can read my post from October of 2007, when everyone said I was being too bearish as well! So we'll skip all my usual warnings and just check out our levels. Asia had a great morning and Europe is doing well but I still think we're toppy and we haven't gone bullish yet but, as I said to members in yesterday's chat – we're going to have to if our levels hold:

| 8 Week | % Off | 40% | 33% | March | % From | ||

| Index | Current | Move | High | Down | Down | Low | Low |

| Dow | 9,791 | 698 | 30% | 8,413 | 9,394 | 6,469 | 51% |

| Transports | 2,013 | 237 | 35% | 1,868 | 2,086 | 1,233 | 63% |

| S&P | 1,068 | 89 | 32% | 946 | 1,056 | 666 | 60% |

| NYSE | 7,038 | 701 | 32% | 6,232 | 6,959 | 4,181 | 68% |

| Nasdaq | 2,133 | 168 | 25% | 1,717 | 1,917 | 1,265 | 69% |

| SOX | 326 | 26 | 41% | 329 | 368 | 188 | 73% |

| Russell | 617 | 69 | 28% | 514 | 574 | 342 | 80% |

| Hang Seng | 21,768 | 1,517 | 32% | 19,200 | 21,440 | 11,344 | 92% |

| Shanghai | 347 | -36 | 41% | 353 | 394 | 234 | 48% |

| Nikkei | 10,443 | 355 | 43% | 10,980 | 12,261 | 7,021 | 49% |

| BSE (India) | 16,711 | 1,333 | 21% | 12,720 | 14,204 | 8,054 | 107% |

| DAX | 5,706 | 440 | 30% | 4,891 | 5,461 | 3,588 | 59% |

| CAC 40 | 3,822 | 310 | 38% | 3,701 | 4,133 | 2,465 | 55% |

| FTSE | 5,140 | 558 | 24% | 4,052 | 4,525 | 3,460 | 49% |

Surprisingly, we're still waiting for the Shanghai to catch up, that index was higher but fell back below the 40% line and is struggling there. In the US Markets, the SOX and Transports still have something to prove and FDX wasn't much help with this morning's disappointing earnings after they led the rally in that sector for the past week. India is our global leader to date and I predicted yesterday that China will be shooting for a 100% gain off the bottom on the Hang Seng ahead of their celebration of the 60th anniversary of communism so we expect another 8% out of them in the next two weeks.

While the EU markets seem to be doing well, the CAC is holding things back and the FTSE, like the Dow, simply fell less than the others and so has less to make up. The S&P and NYSE are going to be the make or break for this rally and we need them to firm up here above 33% in order for us to set a new upside target in the Big Chart – an event we never take lightly at PSW as our Big Charts have successfully predicted major market moves for 3 consecutive years using our patented 5% rule.

When our fundamentals fail us, we switch off our brains and look at the dancing numbers and that's the mode we're in now. We're not looking to change our generally bearish stance until next week but we are looking for buying opportunities using those 33% lines as our stops. While I strongly suspect we're overbought here and overdue for a correction of at least 5%, we're getting a little bored waiting for it and maybe, like in 1999 – it will never come – at least not until the next year and then, OH BOY – does it come!

Stay careful – we haven't proven anything yet but we are ready to party like it's 1999.