Assessing the Odds of a Double Dip Recession

Courtesy of Mish

Courtesy of Mish

If you have a job and it is not in jeopardy, pull out the party hats and toot your horns. The OECD calls an end to the global recession.

The global downturn was effectively declared over yesterday, with the Organisation for Economic Co-operation and Development (OECD) revealing that "clear signs of recovery are now visible" in all seven of the leading Western economies, as well as in each of the key "Bric" nations.

The OECD’s composite leading indicators suggest that activity is now improving in all of the world’s most significant 11 economies – the leading seven, consisting of the US, UK, Germany, Italy, France, Canada and Japan, and the Bric nations of Brazil, Russia, India and China – and in almost every case at a faster pace than previously.

Each of the 11 economies saw an improvement in July, the OECD said, with only France improving at a slower rate than in June. The July figures are the most encouraging since the indices began ticking downwards during the first quarter of last year.

The OECD’s leading indicators are considered a key economic yardstick because they measure the sectors of countries’ economies that tend to react first to upswings and downturns. As such they provide early evidence of the way in which the overall economy is progressing.

Unemployment Likely To Rise For A Year

If you don’t have a job or your job is in jeopardy you may not feel like partying much. Unemployment is likely to rise for another year.

Moreover, there are strong reasons to expect Structurally High Unemployment For A Decade.

In the Incredible Shrinking Boomer Economy I noted a harsh reality quote of Bernanke:

"It takes GDP growth of about 2.5 percent to keep the jobless rate constant. But the Fed expects growth of only about 1 percent in the last six months of the year. So that’s not enough to bring down the unemployment rate."

Pray tell what happens if GDP can’t exceed 2.5% for a couple of years? What about a decade (or on and off for a decade)?

If you have come to the conclusion that we are going to have structurally high unemployment for a decade, you have come to the right conclusion. Ask yourself: Is that what the stock market is priced for?

False Threat of a Double Dip

Inquiring minds are reading Econbrowser’s Guest contribution from Michael Dueker on the economic recovery.

Michael Dueker is Head Economist for North America at Russell Investments and a member of the Blue Chip forecasting panel. In February of 2008 he warned Econbrowser readers that it appeared unlikely that the economy was going to escape the slowdown without a recession. In December of 2008, he predicted in this forum that the recession would last until July or August of 2009, but that employment growth would not resume until March of 2010.

With that track record, we were very interested to learn the latest macroeconomic predictions stemming from Russell’s Business Cycle Index, subject to the disclaimer that the content does not constitute investment advice or projections of the stock market or any specific investment.

Model Predictions

It’s difficult to praise a model that predicts a recession 3 months after it has already started.

The key is what the model suggested in January of 2007, not February of 2008. It would be useful to know what odds his model had on a recession one year in advance, not three months late. Perhaps his model merits praise, perhaps not.

Note that it took the NBER until November 2008 to figure out the recession started a year earlier. See the NBER report Determination of the December 2007 Peak in Economic Activity for details.

Projections On Payroll Employment

Looking ahead here are Dueker’s payroll projections from the article.

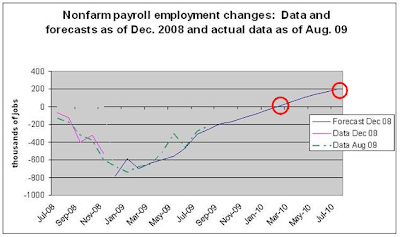

click on chart for sharper image

The chart above shows the projected forecast as of 2008. A chart below has current projections. The 2008 projection shows the economy will be steadily adding jobs early in 2010 and by mid-summer adding 200,000 jobs a month. The new projections are not as rosy.

Modeling the Double Dip

From the article:

One key point of discussion at present is whether the economy faces a danger of sliding back into recession for the second part of a double-dip recession. The business cycle index and its accompanying payroll employment forecasts can help assess the risk of a double-dip recession. The chart of the business cycle index below illustrates that some backsliding in business cycle conditions is projected early in 2010.

Business Cycle Index Shows Recession Is Over

click on chart for sharper image

One possible reason for backsliding early in the year is that various stimulus programs may be running out of steam. Indeed cash-for-clunkers is already out of steam.

This is where projections get dicey.

I believe without continued stimulus the economy will slide back into recession, and would do so later even with additional stimulus, even if the Fed does not step on the brakes. Dueker sees things like this.

Model-Based Recession Probabilities

To see if the projected backsliding in business cycle conditions in early 2010 represents a serious threat of a double-dip recession, we can look at the forecasted recession probabilities for future months. The chart below shows that the recession probabilities do not reach the threshold between 40 and 50 percent where we would call a double-dip recession.

click on chart for sharper

Inquiring minds would like to see what those probabilities looked like in July 2006 and again January and July 2007.

Current Jobs Forecast

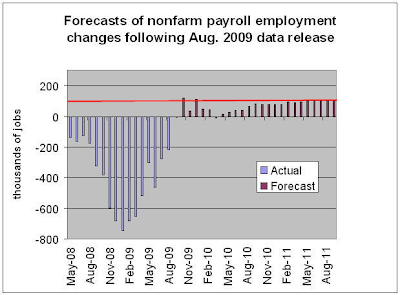

The current employment forecast shows some promising job gains between October and December 2009 and then some backsliding, with a small negative forecast for March 2010. If this occurs, there will be discussion about the possibility of a double-dip recession, although that is not the scenario projected here. Instead of a double-dip recession, the forecast presented here is one where it takes a long time for the economy to achieve consistent triple-digit job gains, which are not expected until 2011.

click on chart for sharper image

Note that it takes somewhere between 120K and 150K jobs before unemployment starts heading down. So Dueker’s chart, if accurate, portrays a bleak economic forecast.

However, let’s be optimistic and assume that unemployment starts falling at 100K jobs added per month. Even then, unemployment will not drop until August 2011 at a minimum, and it will still be above 10% at that time!

Jobs are somewhat of a tough guess simply because it’s hard to believe any of the jobs numbers by the BLS, especially the atrocious Birth-Death adjustments that have had more business creations than failures all through the entire recession.

It’s also important to point out there are many unknowns such as a second stimulus, more cash for clunker programs, and perhaps more housing incentives.

Thus it’s easy for a model or a projection to miss Congressional incentives and thus be right or wrong because of them.

Finally, a massive back-revision in January 2010 is one tactic by which the numbers in the second half of 2010 could be met. Because January is a BLS revision month, the odds of a huge backslide in January are far greater than a huge backslide in March.

Assuming his job forecasts are reasonably accurate, and given there is no driver for jobs, the odds of a double dip would seem to be far greater than implied by the Model-Based Recession Probabilities.

However, Michael Dueker is not the only respected economist who sees the odds of a double-dip recession as unlikely.

Paul Kasriel On The Double-Dip Theory

Economist Paul Kasriel points out various headwinds in The Shoals of Depression Have Been Avoided, but the Economy Still Faces Strong Headwinds. Nonetheless, Kasriel concludes a double dip is unlikely. Here are a select 9 of his 48 slides.

Click on any slide to see a sharper image. Better yet, you may want to click on the link instead as there is much more to see including his inflation forecast.

In spite of what appears to be formidable set of headwinds, Kasriel concludes "Over 50 years of history suggests that the economy does not enter a recession unless the Fed pushes it into one."

I highly respect Kasriel, but I have my doubts as to the wisdom of comparing post WWII recessions to the one we are currently (in/coming out of). Note that based on the last 50 years, deflation was not supposed to happen, but it did anyway.

Inquiring minds might be interested in my Interview With Paul Kasriel in December of 2006, in which he laid out the case of a Japanese style deflation in the US, regardless of what Bernanke might do.

Krugman vs. Kasriel

I seldom agree with Krugman (even more so on solutions to problems), but I happen to think Krugman has it right when he says U.S. unemployment not to peak until 2011.

Unemployment in the United States will peak only in early 2011 because of a slow and painful recovery from the global economic crisis, Nobel Prize-winning economist Paul Krugman said on Wednesday.

He said the global economy seems to be stabilizing at a level that is "unacceptably poor" and added it is possible that the recession will be a double-dip one.

Krugman, who received a Nobel Prize for economics in 2008, said the acute phase of the global crisis had passed but the recovery is likely to feel like a "continuing recession."

He said recoveries have been weak from past crises in the United States and other regions as job sectors continued to get worse long after the crises have bottomed out, adding the global job market will continue to get worse "well into 2011."

"We might have a double dip, that’s a real possibility now for the world as a whole," said Krugman, saying the effects of stimulus programs will start to fade early next year and recovery will be slow due to the global nature of the crisis.

The recovery will be slow, not only because of the global nature of the problem, but more importantly because the debt overhang on consumers and banks is enormous.

Moreover, unemployment statistics are particularly grim. Here is one of the charts from Dismal Unemployment Situation In Chart Form

Job Loss Recovery

The last three recessions are unlike the eight preceding recessions. For numerous reasons described below we are heading for another job loss recovery. …

As the above chart shows, in 8 consecutive recessions unemployment peaked right as the recession ended. In the 1990 and 2001 recessions, unemployment peaked later.

In this recession, assuming one believes it has ended now, unemployment is likely to keep rising for another 18 months. Yes I know that unemployment is supposed to be a "lagging indicator" but "lag" does not do justice to what happened in 2001 or what I think is likely for 2007-2011.

One key difference between the last two recessions is consumers barely stopped spending in 2001 but in 2009, consumers are tapped out, unemployment is a whopping 4 points higher, and credit is shut off.

More importantly, consumers attitudes towards debt have changed. Greenspan had the wind of consumption at his back. Bernanke is on the backside of Peak Credit with a breeze of frugality blowing briskly in his face.

Given we are following the path of Japan, the economy is likely to slip in and out of recession or at least flirt with it a number of times over a period of several years as described in Case for an "L" Shaped Recession.

No matter what one calls the recovery (or lack thereof), Krugman has the right idea when he says the "recovery is likely to feel like a continuing recession." That to me is an "L".

Photo: Tylerrecessionspecial, by Shiori Kawaski, at wikimedia, © 2009 Shiori Kawasaki.