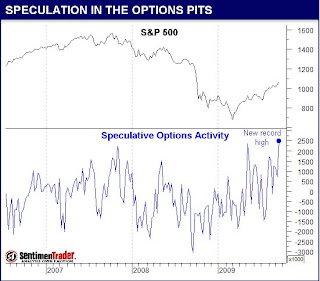

Amazing observation: "bullish speculative mania as measured by option activity is now at a decade, if not all time, high"…, if speculation as to whether our president is a crook was measured and plotted, what would that chart look like? – Ilene

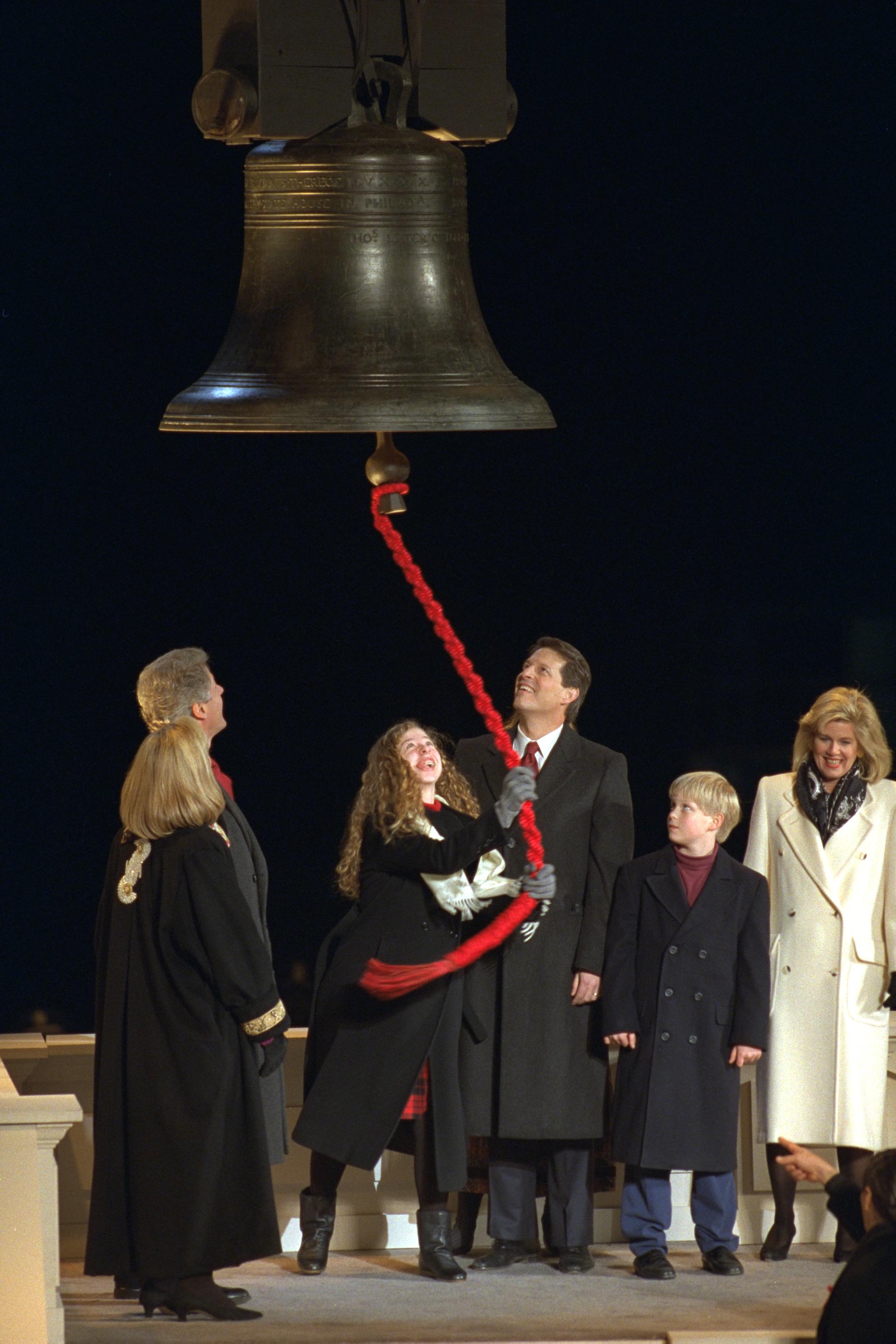

Ding, Ding, Ding, Ding…. For the Market and the Democrats

Courtesy of Jesse’s Café Américain

Courtesy of Jesse’s Café Américain

Sometimes they do ring a bell.

Hard to believe that after one of the greatest credit crises in history, Wall Street and the punters went back to their old ways of chasing beta with hot (taxpayer) money.

As ZeroHedge so insightfully observed:

"Sentiment Trader demonstrates how bullish speculative mania as measured by option activity is now at a decade, if not all time, high. With moral hazard having become the only game in town, everyone believes their investments are implicitly guaranteed by the government…"

Paul Krugman, stalwart Democratic liberal economist, took Obama to task recently for his lack of stomach to change and reform the financial system in his column Reform or Bust

"What’s wrong with financial-industry compensation? In a nutshell, bank executives are lavishly rewarded if they deliver big short-term profits — but aren’t correspondingly punished if they later suffer even bigger losses. This encourages excessive risk-taking: some of the men most responsible for the current crisis walked away immensely rich from the bonuses they earned in the good years, even though the high-risk strategies that led to those bonuses eventually decimated their companies, taking down a large part of the financial system in the process…

I was startled last week when Mr. Obama, in an interview with Bloomberg News, questioned the case for limiting financial-sector pay: “Why is it,” he asked, “that we’re going to cap executive compensation for Wall Street bankers but not Silicon Valley entrepreneurs or N.F.L. football players?”

That’s an astonishing remark — and not just because the National Football League does, in fact, have pay caps. Tech firms don’t crash the whole world’s operating system when they go bankrupt; quarterbacks who make too many risky passes don’t have to be rescued with hundred-billion-dollar bailouts. Banking is a special case — and the president is surely smart enough to know that."

Paul has not yet been able to express the growing concern that many of Obama’s top advisors and key staff managers are hopelessly conflicted, if not corrupted, in dealing with Wall Street. The question should be asked, "if Obama is that smart, why is he acting so slowly, clumsily, ineffectively?"

The answer gets to the heart of the proposition put forward by Richard Nixon, "People have got to know whether or not their president is a crook."

So which is it to be: ineffective blowhard or corrupt politician? History may not be kind to the first African-American president, as it may not be to the first president to lay a false claim to that title (Slick Willy), and that is a dreadful, regrettable shame.