Happy Monday, my fellow investors. A quick recap for you. On Friday, the buy pick of the day was Ultrashort Proshares Financials (SKF). Even with the market being down we were still able to manage to make this trade work, entering the stock at 24.20 at 3:30 PM and getting out at 24.46 at the end of the day for a solid gain of just over 1%. In the morning the stock retraced back to 24.22, but I had set the range ar 24.20 so could not buy into it. If you got in around that low, you could have ridden SKF up for more than 2% into the 24.70s. On the short sale side, we liked BP PLC (BP). We got in at the open at 54.66. The stock trailed down to the 54.40s before moving back up with an oil rally to end the day at 54.75 for a minimal loss. We picked 1/2 winners on Friday and are looking for 2/2 today as we get set for the start of the week. Later today, we will have an updated virtual portfolio report for you so you can see how I have taken $3000 and turned it into close to $5000 in just six months of day trading.

down to the 54.40s before moving back up with an oil rally to end the day at 54.75 for a minimal loss. We picked 1/2 winners on Friday and are looking for 2/2 today as we get set for the start of the week. Later today, we will have an updated virtual portfolio report for you so you can see how I have taken $3000 and turned it into close to $5000 in just six months of day trading.

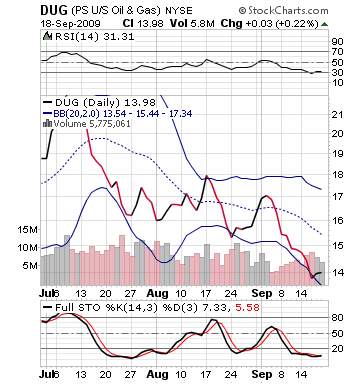

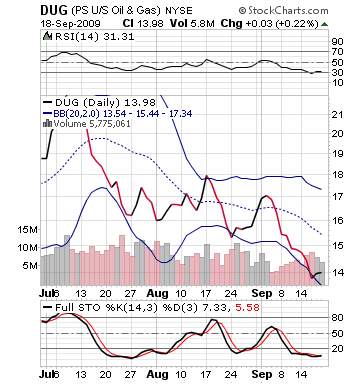

Buy Pick of the Day: Ultrashort Proshares Oil and Gas ETF (DUG)

The market is looking definitely very toppy right now as it has hit its highest levels of 2009. With the world markets pulling back on Monday, it may set up the American markets for a similar fate that could transcend into a long term downward trend for the market. The problem, therefore, is most of the things we want to buy are really overweighted and its hard to say whether the market will really sell off or just stay pretty neutral in the red or even rally. All the world markets have trended lower throughout the day, and if profit taking begins in the morning, it may spark a lot of short interest. Oil seems to be dropping like a rock, and it may move back upwards a bit after a 10:00 AM announcement of the CB Leading Indicators. This piece of data measures overall economic health by combining 10 indicators such as building permits, new orders, money supply, average workweek. It is predictable, but it still continues to show the health of the economy.

I want to, therefore, play the oil shorting market with the inverse ETF with Ultrashort Proshares Oil and Gas (DUG). The ETF is trading up 3.36% in pre-market trading, which is too overvalued of a price for our entry  point. We will want to wait for a pullback before buying into the ETF. While I do think that this ETF is a solid play, I think we are going to see a small rally off the 10:00 AM news and general market intraday up and down movement.

point. We will want to wait for a pullback before buying into the ETF. While I do think that this ETF is a solid play, I think we are going to see a small rally off the 10:00 AM news and general market intraday up and down movement.

So, what is pumping this pullback of such levels, like a 2.7% pullback in the NYMEX Crude Oil price this morning. One is that the International Energy agency reported that they believe electricity output is going to drop for the first time since 1945 in 2009. At the same time, Sinopec, which is China’s leading oil refinery, commented that they believe demand is still very depressed in China, sending oil to $70.81 per barrel in Asia. The NYMEX, therefore, may be exaggerating its pullback at its current $70.12 level. Why not play DIG then?

DIG will see some movement up if DUG will move backwards, but there is no potential in DIG. The movement could be as little as 1% upwards or even less. DIG is looking extremely toppy. It is at the top of its bollinger bands, overvalued on RSI, and overbought. With downward pressure, this volatile ETF is going to see a ton of profit taking.

Entry: Let’s wait for a pullback to 14.25 – 14.32. Check back in my Oxen Alerts for adjusted entry/exit, because if we don’t get a pull back, we are going to need to readjust where we get involved.

Exit: We will want 2-3% on top of our entry.

Stop loss: Set at 13.95

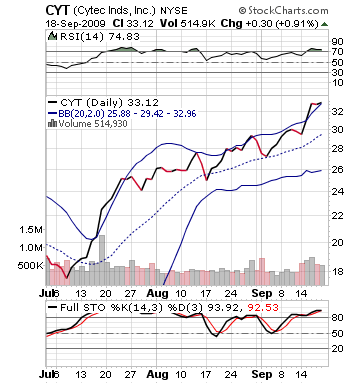

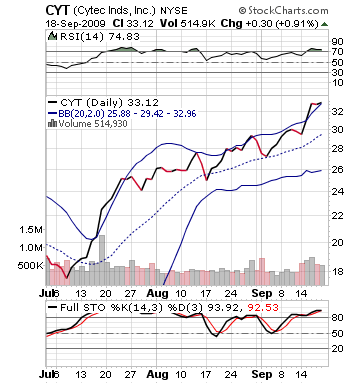

Short Sale of the Day: Cytec Inc.

Normally, when a company gets an upgrade from Hold to Buy by a brokerage firm, the company’s stock i s something most of us may be more interested in buying. However, today, Cytec Inc. may be presenting a short sale opportunity for investors. The stock received an upgrade from KeyBanc Capital Markets with a new price target set ar $42 per share. The stock is currently trading at $33 per share. That is a significant increase of 33% on the stock.

s something most of us may be more interested in buying. However, today, Cytec Inc. may be presenting a short sale opportunity for investors. The stock received an upgrade from KeyBanc Capital Markets with a new price target set ar $42 per share. The stock is currently trading at $33 per share. That is a significant increase of 33% on the stock.

However, the stock is currently extremely overvalued and outside of its upper bollinger band. That signals for any day trader a red alert when a stock jumps outside of its upper bollinger band. It means that selling pressure is on its way. With the upgrade, it has moved the stock up even higher for its opening, which should give investors a great premium to start the day. Yet, as investors take profits, that will compound with other investors doing the same.

The company is definitely something to look at buying before the next quarter’s earnings because it is going to price in this upgrade eventually…with the markets facing futures that are looking at a 60 point decline for the Dow, nearly everything is going to be under selling pressure. We are going to wait to pull the trigger for Cytec to bounce up slightly to start the day before short selling.

Entry Price: Waiting for the bounce, we are looking for an entry at 33.70 – 33.80.

Exit: 2-3% cover on our short sale price.

Stop Loss: Set at 34.50.

Good luck today and good investing,

David Ristau

Good luck

down to the 54.40s before moving back up with an oil rally to end the day at 54.75 for a minimal loss. We picked 1/2 winners on Friday and are looking for 2/2 today as we get set for the start of the week. Later today, we will have an updated virtual portfolio report for you so you can see how I have taken $3000 and turned it into close to $5000 in just six months of day trading.

down to the 54.40s before moving back up with an oil rally to end the day at 54.75 for a minimal loss. We picked 1/2 winners on Friday and are looking for 2/2 today as we get set for the start of the week. Later today, we will have an updated virtual portfolio report for you so you can see how I have taken $3000 and turned it into close to $5000 in just six months of day trading. point. We will want to wait for a pullback before buying into the ETF. While I do think that this ETF is a solid play, I think we are going to see a small rally off the 10:00 AM news and general market intraday up and down movement.

point. We will want to wait for a pullback before buying into the ETF. While I do think that this ETF is a solid play, I think we are going to see a small rally off the 10:00 AM news and general market intraday up and down movement.  s something most of us may be more interested in buying. However, today, Cytec Inc. may be presenting a short sale opportunity for investors. The stock received an upgrade from KeyBanc Capital Markets with a new price target set ar $42 per share. The stock is currently trading at $33 per share. That is a significant increase of 33% on the stock.

s something most of us may be more interested in buying. However, today, Cytec Inc. may be presenting a short sale opportunity for investors. The stock received an upgrade from KeyBanc Capital Markets with a new price target set ar $42 per share. The stock is currently trading at $33 per share. That is a significant increase of 33% on the stock.