Yesterday was another pretty solid day for The Oxen Report picks. Our short sale of the day, Cytec Inc. (CYT), was a gem. The stock opened way too high for its market value, and we got in at my suggested range in my Oxen Report Morning Levels Report for Oxen Alert members: "CYT has moved all the way up to 34.00 in pre-market trading. We are going to therefore readjust our entry price upwards to account for this market. We want to now set our entry price at 34.20 – 34.30." After getting in at 34.30, we were able to exit for a 3% gain at 33.27 nearly 15 minutes into the trading day! We got into DUG at 14.35 and were looking for an exit price originally of 14.64 and up. However, in my Oxen Report Midday Message Alert for Oxen Alert Members I signalled to readers, "We are going to have to adjust our exit down to about 1% as the market has rallied over the past hour on strong biotech and medical stocks." That readjustment brought our exit price around Noon to 14.50. The stock never got back up to that level, and we had to settle for a small loss at 14.20. Got one out of two and were so close to 2/2.

Yesterday was another pretty solid day for The Oxen Report picks. Our short sale of the day, Cytec Inc. (CYT), was a gem. The stock opened way too high for its market value, and we got in at my suggested range in my Oxen Report Morning Levels Report for Oxen Alert members: "CYT has moved all the way up to 34.00 in pre-market trading. We are going to therefore readjust our entry price upwards to account for this market. We want to now set our entry price at 34.20 – 34.30." After getting in at 34.30, we were able to exit for a 3% gain at 33.27 nearly 15 minutes into the trading day! We got into DUG at 14.35 and were looking for an exit price originally of 14.64 and up. However, in my Oxen Report Midday Message Alert for Oxen Alert Members I signalled to readers, "We are going to have to adjust our exit down to about 1% as the market has rallied over the past hour on strong biotech and medical stocks." That readjustment brought our exit price around Noon to 14.50. The stock never got back up to that level, and we had to settle for a small loss at 14.20. Got one out of two and were so close to 2/2.

So, what is on our plate for today’s picks?

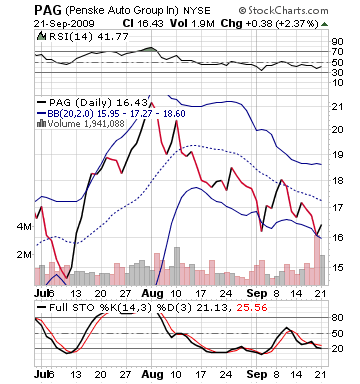

Buy Pick of the Day: Penske Automotive Group (PAG)

The market looks set for a rally today, as the Americans market are influenced by the world markets rebound. China led the way Tuesday with its 1.5% recovery from yesterday’s sell off. The Asian Development Bank commented that it was upgrading its growth forecasts for China and India and said that these economies were leading the way in the global recovery.  Great news for China and India. It appears American investors are taking it well as futures are up with the Dow up above 50 points and the Nasdaq near 10 as of 8:45 AM.

Great news for China and India. It appears American investors are taking it well as futures are up with the Dow up above 50 points and the Nasdaq near 10 as of 8:45 AM.

The market is also being led, however, by some important earnings data, which is the first that we have seen in awhile and could be a slight signalling of what is to come in October for the important Q3 earnings. ConAgra Foods beat estimates with a 0.38 EPS vs. the estimated 0.34 EPS. The real gem, however, was Carmax Inc. (KMX), which beat earnings by 100% grabbing 0.36 EPS vs. the estimated 0.18 EPS. The company, which is a major auto retailer, was helped significantly more than thought by the "Cash for Clunkers Program." Sales were up 13%, and income rose sevenfold from one year ago. The company’s shares have risen over 6% in pre-market trading.

So, why Penske Automotive instead of CarMax. KMX has already rised 6% in this morning trading, meaning it is going to open with a severe premium to yesterday’s closing price. Penske, on the other hand, is a smaller cap stock with less trading but great volatility – a beta over 2. The company is going to benefit significantly from the KMX news that came out, as well as, a general market that is looking up. While the company’s business model is not an exact replica of KMX, Penske sells engines and provides repairs. Auto parts stocks have been right there with the auto and dealers on the cash for clunkers rally, and the last month’s pullback after the program closed down.

PAG is very undervalued, oversold, and near its lower bollinger band. The stock has had a lot of investors getting out of it after the CARS program closed. Since its close, PAG has dropped more than 10% in value. The stock should be ready to rally today on the bullish news from KMX. Penske does not trade in pre-market, so it is going to open at a mystery. My guess is that it does not open at significantly high levels but rallies very quickly.

Entry: Get into this one right off the bat. My guess is that it will rally quickly on the news, and we don’t want to miss it.

Exit: 2-3% from entry price at buy in on opening minutes.

Stop Loss: 3% down from entry price.

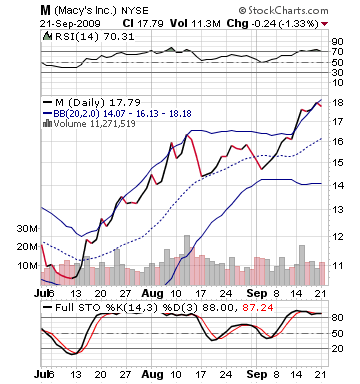

Short Sale of the Day: Macy’s Inc.

Macy’s got a significant upgrade from Citigroup today. The company increased its price target to $30 per share for the company because of top line valuation.

From TheStreet.com, "Citi analyst Deborah Weinswig said the company’s localization initiative should continue to gain traction and is encouraged by the consistent, positive results it has reported from its 20 pilot markets since the end of 2008."

From TheStreet.com, "Citi analyst Deborah Weinswig said the company’s localization initiative should continue to gain traction and is encouraged by the consistent, positive results it has reported from its 20 pilot markets since the end of 2008."

This is interesting, however, because last week the company was listed on Audit Integrity’s list of company’s most likely to declare bankruptcy if someone is going to declare. The company, however, ignored this news and has continued to rally. In fact, Macy’s has gained just under 20% in the past three weeks.

That large gain has made the stock very overvalued, overpriced, and overbought in the near term. The upgrade has sent the stock even higher, up over 5% in pre-market trading, taking it outside its upper bollinger band. Even with the market rally, I think this stock is going to come off these highs. There are just too many question marks with the stock, and it looks to be on its way down, technically and fundamentally, not up. Very confused by Citi, but they are taking a very long term approach.

The thing you should remember is that most investors aren’t that long…

Entry: Let’s wait for to gain a bit more to 18.85 – 18.95 before entering our short sale.

Exit: Cover at 2-3% from entry.

Stop Loss: 3% on top of buy in price.

Happy Investing,

David Ristau