Looks Like S&P Equity Anlaysts Are As Competent As Their Debt Analysts…..

Courtesy of Jan-Martin Feddersen at Immobilienblasen

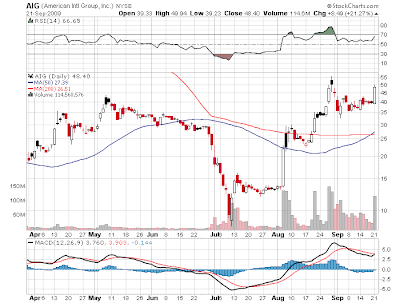

This kind of expertise from Wall Street Finest based only on hope of a better bailout deal ( proposed from a major sharholder…. ) sums the market action up….. At least S&P isn´t able to play the Pump & Dump like Goldman & others…. Keep in mind that AIG is one of the Zombie Stocks making up to 20 percent of daily NYSE volume…..

Diese "Expertenmeinung" die einzig und allein auf einem noch besseren Bailoutdeal ( passenderweise vorgeschlagen von einem der Hauptaktionäre ) basiert spiegelt recht schön wider was momentan an den Märkten abgeht…..Immerhin kann man S&P nicht wie z.B. Goldman vorwerfen das altbekannte Pump & Dump zu praktizieren…. Man sollte sich zusärtlich noch ins Gedächnis rufen das AIG eine der Zombie Aktien ist die momentan für knapp 20% des täglichen Handelsvolumens stehen…..

AIG Shares Shoot up on Proposal to Ease Government Loan Terms MarketBeat

AIG jumped roughly 11% today after the powerful House Oversight and Government Reform Committee confirmed receiving a proposal from former CEO Maurice “Hank” Greenberg to restructure the government’s bailout of the insurance giant.

The reports prompted S&P Equity Research to boost AIG to “hold” from “sell.”

“We see this news buoying the shares near term,” S&P’s Catherine Seifert wrote in quick squib earlier today. But before you sink the kid’s college fund into AIG shares, keep this in mind:

It’s far from clear that there’s actually any actual equity value in this company.

“We note June 30 tangible common equity was minus $261.66 per share,” Seifert states

Needless to say that according to Yahoo Finance there is no sell rating (10 hold) on AIG…..;-)

UPDATE: Traders Seek Fortune in AIG, a Stock Once Left for Dead WSJ