On Tuesday, the Oxen Report picked TWO winners for you both in our Buy Pick and Short Sale Pick of the Day. We will start with the buy. I recommended to you to buy Penske Automotive Group (PAG) out of the gates because it was going to rally to start the day. We were able to get in at 16.71 and take 2% profits after 10 AM at 17.04. The stock was helped by the market and CarMax’s bullish earnings. On the short sale side, we picked up some positions in Macy’s after the stock appeared way too overvalued and overpriced after receiving an upgrade from Citigroup. The upgrade drove te price up over 6% in pre-market, and we got in at 18.95 for a great price. The stock pulled back for the next thirty minutes to 18.54 where we exited. That buy/sell was good for 2%. After going 2/2 yesterday, what do we have in store for today to make you some more $$$.

start with the buy. I recommended to you to buy Penske Automotive Group (PAG) out of the gates because it was going to rally to start the day. We were able to get in at 16.71 and take 2% profits after 10 AM at 17.04. The stock was helped by the market and CarMax’s bullish earnings. On the short sale side, we picked up some positions in Macy’s after the stock appeared way too overvalued and overpriced after receiving an upgrade from Citigroup. The upgrade drove te price up over 6% in pre-market, and we got in at 18.95 for a great price. The stock pulled back for the next thirty minutes to 18.54 where we exited. That buy/sell was good for 2%. After going 2/2 yesterday, what do we have in store for today to make you some more $$$.

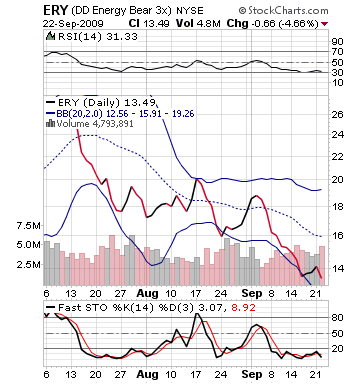

Buy Pick of the Day: Direxion Daily Energy Bull/Bear ETF (ERX/ERY)

Today is one of those days where the market looks pretty darn flat, and its hard to find those gems that can buck the trend. I am always looking for something that will really move a group of stocks, and there is not a lot out today that could do that. The market has some nice indicators in great General Mills earnings that came out this morning, as well as some upgrades on Lowe’s, Southwest Airlines, and two on Seagate Tech. Yet, these stocks just don’t  seem to have the power to make the sort of impact I am want to see.

seem to have the power to make the sort of impact I am want to see.

Therefore, I am going to do an either/or pick based on the 10:30 AM announcement of crude oil inventories. Oil is sort of lingering currently at $71 per barrel, which is basically halfway between the $65 – $75 range it has been trading within for the past couple months. Oil prices dropped in Asia overnight and are down, but it would not take much to reverse this price. Prices are down mostly because there is not anything so far to rally around this morning. The inventories will give the market a great idea of how the market is currently playing oil, and since the price of oil is so fickle, it will have a lot of shift with the inventory report.

Last week, inventories dropped by 4.7 million barrels, which is good because it means less oil was in storage with similar production. Thus, demand must be higher, which raises the price. With two straight weeks of large drops, the same will be expected for ERX to be the play. If the inventories come out neutral or increased, ERY will be the play. What makes this play even more intriguing is that to start the day, ERY should be in the green. However, the stock has decayed so much over the past weeks that it has tons and tons of upside. Therefore, even if it is in the green up 2%, it could move another 5-6% on some really weak demand figures. ERX will be in the red or hopefully close to neutral, and it has upside to around the high 44s before feeling a lot of selling pressure.

around the high 44s before feeling a lot of selling pressure.

Entry: Set up two buy picks for each one, watch carefully for the crude report. If we gained in inventories, buy ERY. If inventories were dropped, then buy ERX.

Exit: 2-3% from the entry price.

Stop Loss: 2-3% in reverse direction.

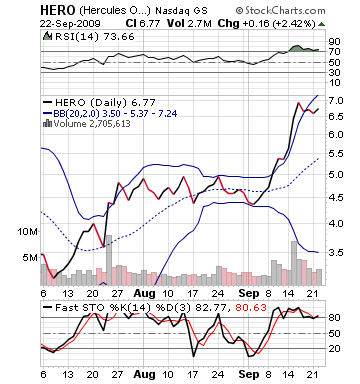

Short Sale of the Day: Hercules Offshore Inc. (HERO)

This short sale of the day, similar to the buy, is straight fundamentals without any tinkering. Hercules Offshore was the only stock to get downgraded to a sell today, which came from the brokerage Jesup & Lamont. While J&L is not a high powered firm, the downgrade comes after HERO has increased its market value 50% in three weeks. The stock has been moving on really nothing. It is affected by the price of oil, but that has been fluctuating up and down. The stock is just one of those that got some momentum and has not looked back.

J&L picked up on that and lowered thier price target to $4 per share for the stock, which would take it back to its pre-rally levels three weeks ago. The news has lowered the stock in pre-market around 4%. That is a lot for me, and I do not like to play stocks with that much pre-market movement. However, HERO is extremely overvalued, near its upper bollinger band,  and overbought on…nothing! The first major news for HERO is this downgrade since beating earnings back in late July. This stock is going to come under some serious downward pressure today, especially with the market not having a ton of strength to move upwards.

and overbought on…nothing! The first major news for HERO is this downgrade since beating earnings back in late July. This stock is going to come under some serious downward pressure today, especially with the market not having a ton of strength to move upwards.

The stock has not been traded in pre-market since 8:56 AM, so it is hard to get a read on where it will open, but I think it safe to say we want to buy this one in a range of 6.50 – 6.60 to be on the safe side. The stock, literally, has downward room to move til around 4, so it should be interesting to see where it finishes today.

Entry: Look for an entry around 6.50 – 6.60, but it may open lower and decay quickly from there, so if it hits 6.25 before 6.50 – 6.60 go with that.

Exit: 2-3% below entry price for cover.

Stop Loss: 2-3% higher than buy in price for cover.

Good luck today and Happy Investing!

David Ristau