SPECIAL END OF CIVILIZATION ISSUE

Courtesy of The Mad Hedge Fund Trader

Featured Trades: (OBAMA), (BERNANKE), (TBT), (PCY)

1) Boy, are the Republicans really screwed. I was awed with Obama’s performance on the David Letterman show last night. This guy is relaxed, polished, cool, and a fabulous advocate and salesman of his policies. When asked a question, he is so focused you feel like he is burning holes straight into his interviewer with his laser eyes. Obama has never really stopped campaigning, with five talk show appearances on Sunday, constant reminders about the mess he inherited, and relentless attacks against the right. His online network is still operating with full force. I have noticed that the spending of the government stimulus package is being carefully metered out to create an economic miracle by 2012. What can the Republicans offer? Reigned in government spending? They just doubled that national debt from $5 to $10 trillion. Regulatory reform? The financial system blew itself up on their watch. The environment? Bush came into office arguing that global warming was a myth. A better life? Most Americans have either just lost everything, or saw their net worth drop by half.

The big problem for the GOP is they took their own moderates out and shot them. Moderate ideas and input might get a hearing in this environment. The end result is that the lunatic fringe has taken over the party, like Sarah Palin and Rush Limbaugh. Death panels? No one rational and substantial wants to step up and become the sacrificial lamb, the blame taker. This in fact could be the beginning of a 20 year reign for the Dems, much like Roosevelt brought on from 1932-1952, on the heels of Herbert Hoover’s great stock market crash. The Republicans could be in the wilderness for a really long time. Better structure your portfolio for the one party state before elephants become an endangered species. Think endless trillion dollar budget deficits, a weak dollar, continued massive debt issuance, ultra low interest rates as far as the eye can see, and strong commodity, energy, gold, and silver prices. I’m not trying to be partisan here. I’m just trying to call them as I see them.

2) I spent the evening with David Wessel, the Wall Street Journal economics editor, who has just published In Fed We Trust: Ben Bernanke’s War on the Great Panic. I doubted David could tell me anything more about the former Princeton professor I didn’t already know. I couldn’t have been more wrong. Bernanke was the smartest kid in rural Dillon, South Carolina, who, through a series of improbable accidents, ended up at Harvard. He built his career on studying the Great Depression, then the closest thing to paleontology economics had to offer, a field focused so distantly in the past that it was irrelevant. Bernanke took over the Fed when Greenspan was considered a rock star, inhaling his libertarian, free market, Ayn Rand inspired philosophy. Within a year the landscape was suddenly overrun with T-Rex’s and Brontesauri. He tried to stop the panic 150 different ways, 125 of which were terrible ideas, the remaining 25 saving us from the Great Depression II. This is why unemployment is now only 9.8%, instead of 25%. The Fed governor is naturally a very shy and withdrawing person, and would have been quite happy limiting his political career to the local school board. But to rebuild confidence, he took his campaign to the masses, attending town hall meetings and meeting the public like a campaigning first term congressman. The price of his success has been large, with the Fed balance sheet exploding from $800 million to $2 trillion, solely on his signature. The true cost of the financial crisis won’t be known for a decade. The biggest risk now that having pulled back from the brink, we will grow complacent, and let needed reforms of the system slide. How Bernanke unwinds this bubble will define his legacy. Too soon, and we go back into a depression. Too late, and hyperinflation hits. Let’s see how smart Bernanke really is.

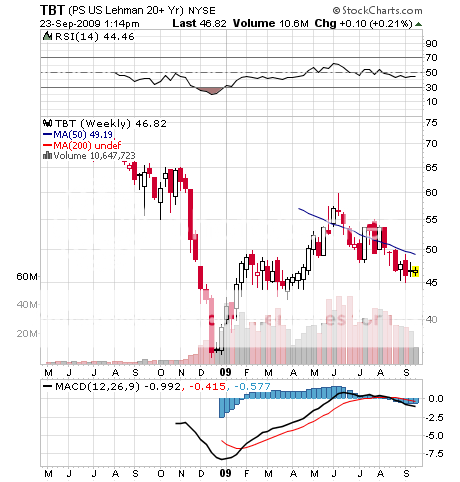

3) Reviewing the current political and monetary landscape, I would be remiss, irresponsible, even negligent, if I didn’t revisit one of my favorite ETF’s, the Proshares Ultra Short Treasury Trust (TBT). This is the 200% leveraged bet that long Treasury bonds, the world’s most overvalued asset, are going to go down. While the Fed is going to keep short rates low for the indefinite future, it has absolutely no direct control over long rates. The only political certainty we can count on is the continued exponential growth in the supply of government bonds of all maturities. Like all Ponzi schemes, their eventual collapse is just a matter of time. It’s simply a question of how many greater fools are out there (sorry China). Look at how they are trading now. We currently have the greatest liquidity driven market of all time, and the ten year is only eking out a 3.40% yield, pricing in near zero inflationary expectations. The average yield on this paper for the last ten years is 6.20%, a double from the current level. Get the yield back up to 5%, a distinct possibility in 2010, and that takes the TBT from the current $45 to $70. Sure, we may get a sideways grind in yields for a few months, which will be expensive due to the mathematic idiosyncrasies of the 2X ETFS. But a security that is unchanged if I am wrong, and doubles if I am right is the kind of risk/reward ratio that I will take all day. And I believe that in my lifetime Treasuries may lose their vaunted triple “A” rating and be priced closer to subprime (warning: I am old). That could enable the TBT to deliver the holy grail of trades, your proverbial ten bagger.

QUOTE OF THE DAY

“The fall of a great nation is always a suicide,” said the great British historian Arnold Toynbee.

This is not a solicitation to buy or sell securities. For full disclosures click here.

The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office. "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office.

Top Photo: Civilization by pummy_photo, at Photobucket.