We’re Speaking Japanese Without Knowing It

Courtesy of John P. Hussman, Ph.D.

All rights reserved and actively enforced.

Reprint Policy

“Tolstoy famously begins his classic novel Anna Karenina with “Every happy family is alike, but every unhappy family is unhappy in their own way.” While each financial crisis no doubt is distinct, they also share striking similarities, in the run-up of asset prices, in debt accumulation, in growth patterns, and in current account deficits. The majority of historical crises are preceded by financial liberalization. Perhaps the United States will prove a different kind of happy family. Despite many superficial similarities to a typical crisis country, it may yet suffer a growth lapse comparable only to the mildest cases. Perhaps this time will be different as so many argue. Nevertheless, the quantitative and qualitative parallels in run-ups to earlier postwar industrialized-country financial crises are worthy of note. For the five most catastrophic cases (which include episodes in Finland, Japan, Norway, Spain and Sweden), the drop in annual output growth from peak to trough is over 5 percent, and growth remained well below pre-crisis trend even after three years. The United States looks like the archetypical crisis country, only more so.”

“Tolstoy famously begins his classic novel Anna Karenina with “Every happy family is alike, but every unhappy family is unhappy in their own way.” While each financial crisis no doubt is distinct, they also share striking similarities, in the run-up of asset prices, in debt accumulation, in growth patterns, and in current account deficits. The majority of historical crises are preceded by financial liberalization. Perhaps the United States will prove a different kind of happy family. Despite many superficial similarities to a typical crisis country, it may yet suffer a growth lapse comparable only to the mildest cases. Perhaps this time will be different as so many argue. Nevertheless, the quantitative and qualitative parallels in run-ups to earlier postwar industrialized-country financial crises are worthy of note. For the five most catastrophic cases (which include episodes in Finland, Japan, Norway, Spain and Sweden), the drop in annual output growth from peak to trough is over 5 percent, and growth remained well below pre-crisis trend even after three years. The United States looks like the archetypical crisis country, only more so.”

Reinhart C. and Rogoff K., NBER Working Paper 13761, January 2008

[As of the second quarter of 2009, the cumulative drop in GDP during the recent downturn has been -3.9%.]

If one seeks analysis about the recent financial crisis, and what most probably lies ahead, it would be wise to place particular weight on the views of economists who saw it coming (and ideally those who provided careful analysis rather than hyperbole). I’ve cited a paper by Reinhart and Rogoff above, which was published by the National Bureau of Economic Research in January of 2008. At a speech at the Princeton Club last week, economist Carmen Reinhart reiterated that by propping up unhealthy banks, the U.S. is unwittingly committing the same mistakes as the Japanese did in their decade-long stagnation, saying, “These are not zombie loans. They’re just non-performing. We’re speaking Japanese without knowing it.”

Kenneth Rogoff, a Harvard economist and former chief of the IMF, noted elsewhere “The banks have been allowed to take these huge gambles, particularly problematic is their very short-term borrowing. And they always have to roll it over all the time and any time they can’t get money they run into trouble. They ought to have a lot of cash on hand in reserve for that and the system doesn’t require it.”

Historically and across countries, according to the IMF, 86% of systemic banking crises have ultimately required government restructuring plans that included closing, nationalizing and merging banks. Yet the policy response of the U.S. has been akin to putting a band-aid on an untreated infection. Worse, not only has the underlying infection been overlooked, but thanks to the easing of FASB mark-to-market rules early this year, we have at least temporarily stopped reporting on the status of that infection.

After the bubble burst in Japan in 1990, Japanese banks were not compelled to properly disclose their losses either. The predictable result is that the problems resurfaced later, but worse, because they had not been addressed.

This sort of “regulatory forbearance” – setting aside requirements for large loan loss reserves and timely loss disclosure – was helpful during the Latin American debt crisis of the 1980’s, but largely because it allowed time for negotiations with countries to restructure debt, first by rescheduling payments, and then ultimately through debt-equity swaps, exit bonds, and other major debt restructuring under the Brady Plan.

Forbearance only works, however, if you’re buying time to do something to restructure debt. Instead, we’ve celebrated bailouts and the easing of reporting requirements as if they are a substitute for restructuring. In my view, this is a mistake that will haunt us.

As Resolution Trust chairman William Siedman once noted in regard to the U.S. savings and loan crisis, “Sometimes forbearance is the right way to go, and sometimes it is not. In the S&L industry, all rules and standards were conveniently overlooked to avoid a financial collapse and the intense local political pressure that such a collapse would have generated. But in this case there was not a visible plan for a recovery, so the result of this winking at standards was, as we know, a national financial disaster. On the other hand, in the case of Latin American loans, forbearance gave the lending banks time to make new arrangements with their debtors and meanwhile acquire enough capital so that losses on Latin American loans would not be fatal.”

Our response to the recent crisis has thus far repeated the mistakes made during the Japanese and S&L debacles.

The continued urgency of debt restructuring

With the financial markets cheerily celebrating the end of the recession, credit spreads back to 2007 levels, and analysts referring to the mortgage crisis as largely a thing of the past, it is natural to ask why I would start pounding the tables again about debt restructuring. Old news. Problem solved. Why even bring it up?

The simple answer is that we have not solved the mortgage mess. We have temporarily buried it under a pile of public money, bailing out bank bondholders at public expense. As I’ve noted before, the best time to panic, in the financial markets, is before everyone else does. Similarly, the best time to consider responses to credit strains is before they surface. My sincere hope is that if, and I believe when, financial trouble resurfaces, we will be wise enough as a nation to prevent policy makers like Geithner and Bernanke from making the same bailout mistakes twice, protecting irresponsible lenders, and further burdening the nation with debt in the process.

With regard to the banking system, we still have no mechanism by which large undercapitalized banks would be able to absorb large losses with their own balance sheets, in lieu of going into receivership or default. The problem is that there is too much on the balance sheets in the form of debt, and not enough in terms of equity. Citigroup, with about $2 trillion in assets, continues to fund about $600 billion of that through debt to its own bondholders. Customers would never be at risk of loss in the event that Citigroup was to “fail.” The bondholders would. But we have chosen to defend the bondholders. A cushion on the balance sheet that can’t be touched is no cushion at all.

The proper solution is not to bail out the banks, but to create a regulatory structure that allows losses to be absorbed from the capital of bondholders. An ideal mechanism for this would be to require a substantial portion of bank debt to be in the form of bonds having a mandatory conversion feature. In response to a “trigger” event, which could include action by the FDIC, a decline in the bank’s stock price to a level some amount below tangible book value for say, 30 days or more, or other possible triggers, those bonds would automatically convert to equity. Yes, the holders of those convertible securities could suffer potential losses, particularly in the event that the bank did not recover. But it would avoid default on the senior bonds or the need for regulatory receivership of the institution.

I should emphatically note that last year’s crisis was not caused by the “failure” of Lehman. The problem was not that Lehman failed. It was that Lehman was allowed to fail in a disorganized way, forcing liquidation of positions, because no regulator had the authority to take receivership of a non-bank financial company. The FDIC was, is, and should be the proper regulatory body to effect such receivership, because that sort of solvency analysis is the specific expertise of the FDIC, and because the FDIC has a singular focus on consumer protection (and is not in the pocket of major banks or Goldman Sachs).

The mechanics of PARs

On the mortgage side, I noted in March (On the Urgency of Restructuring Bank and Mortgage Debt, and of Abandoning Toxic Asset Purchases) “If there is any good news at present, it is that the capital infusions of late-2008 have temporarily stabilized the banking system, and that the U.S. economy is presently enjoying a brief and modest reprieve from the financial crisis. This is largely the result of an ebbing in the rate of sub-prime mortgage resets, which reached their peak in mid-2008, with corresponding mortgage losses and foreclosures a few months later. Since this crisis began, the profile of mortgage resets has been well-correlated with subsequent foreclosures. This reset profile is of great concern, because the majority of resets are still ahead. Moreover, the mortgages to which these resets will apply are primarily those originated late in the housing bubble, at the highest prices, and therefore having the largest probable loss. Undoubtedly, some Alt-A and option-ARM foreclosures have already occurred, but the likelihood is that major additional foreclosures and mortgage losses lie ahead. If we fail to address foreclosure abatement during the current window of opportunity (early to mid-2009), there may not be time for legislative efforts to contain the resulting fallout.”

We have done nothing material on this front. I continue to believe that foreclosure abatement requires debt restructuring. Short of major voluntary write-downs by lenders, which are unlikely, the best approach would be to use the Treasury as a coordination mechanism to administer what I’ve called “Property Appreciation Rights” or PARs (skip to the next section if you believe the credit crisis is over).

Here is some additional detail on how these might work. A homeowner with a mortgage of say $350,000 would renegotiate the debt with the lender, replacing it with, say, a $200,000 mortgage obligation plus a $100,000 PAR (and an outright reduction of $50,000). The PAR would not be payable directly from the homeowner to the mortgage lender. Instead, two things would happen. First, the homeowner would owe the PAR amount to the Treasury out of any future appreciation of the home, or if sold, appreciation on subsequent property, and ultimately out of the homeowner’s estate (possibly less some exclusion based on the size of the estate). Second, the Treasury would aggregate all PAR payments received from the pool of homeowners owing them, and would distribute them proportionately to the mortgage lenders holding the PARs. In this way, the PARs would be fully tradeable and investable instruments, similar to closed-end mutual fund shares, with the Treasury acting essentially as a payment collector (through the IRS) and transfer agent. The PARs would most likely trade at a discount to their face value. More on that below.

In order to prevent advantages or disadvantages based on the date one enters the PAR pool, new revenues would be distributed to PAR holders in proportion to their remaining unpaid claims. The “Face Value” of each share would be calculated by the Treasury as the ratio of unpaid PAR claims to the number of PAR shares in existence. In practice, it would be reasonable to have several “tranches” of PAR shares, reflecting differing loan-to-value (or better yet, PAR-to-value) classes, which clearly have differing probabilities of being paid off in full.

For example, suppose the pool begins with $100,000 in PAR obligations from a homeowner, and the Treasury issues 100,000 PAR shares to the mortgage lender, for a Face Value of $1 a share. If $20,000 of payments are made, the new Face Value for a share would be reduced to the ratio of Unpaid Claims to Outstanding Shares, or $0.80.

Suppose now a new $100,000 of obligations enters the pool. In this case, the mortgage lender receives 125,000 PAR shares ($100,000 / $0.80). There are now $180,000 in unpaid obligations, and 225,000 outstanding shares, not surprisingly, representing $0.80 of unpaid claims per share. If a payment of $45,000 was now received, $20,000 would go to the mortgage lender who has 100,000 PAR shares), and $25,000 would go to the second lender (who has 125,000 PAR shares). In each case, the amount received is proportional to the outstanding amount of unpaid claims due to each holder.

Would the PAR securities trade at face value? Probably not, and that is a great advantage, because it provides a natural way for the underlying mortgage debt to be restructured while at the same time pooling the losses across all participants.

Specifically, in addition to satisfying payment of a PAR obligation by paying money to the Treasury, the homeowner could tender PAR shares (purchased on the open market) directly to the Treasury, and have the obligation canceled at the then prevailing Face Value of those PARs. I know that sounds complicated, but consider an example.

Suppose that a homeowner has a $100,000 obligation to the Treasury. Suppose also that the current Face Value of a PAR is $0.80, and PAR shares can be purchased on the open market (from mortgage lenders liquidating their questionable loans) for say, $0.60 a share. In lieu of paying $100,000 to the Treasury, the homeowner could tender 125,000 shares ($100,000 / $0.80 face value), to the Treasury, which would in turn retire the outstanding PAR shares as well as that homeowner’s obligation. As a result, the Face Value of other outstanding PARs would be unchanged, so no existing holder would be helped or harmed by the transaction. Those 125,000 shares would cost the homeowner only $75,000 on the open market, even though it would cancel a $100,000 obligation.

This is important: notice that what has happened here is that some existing PAR holder has, in effect, negotiated a reduced mortgage settlement with some homeowner (in this case, a $25,000 reduction in the mortgage obligation), canceling that portion of the mortgage debt, even though the PAR holder may not have been that specific homeowner’s lender in the first place.

In short, by creating a tradeable instrument, administered by the Treasury (but not requiring any public funds other than those administration costs), a market mechanism would be created to settle troubled mortgage obligations, even between unrelated participants.

Headwinds

Over the weekend, John Mauldin published some comments by economist David Rosenberg (another voice to monitor because Rosenberg is one of the few who also saw the crisis coming):

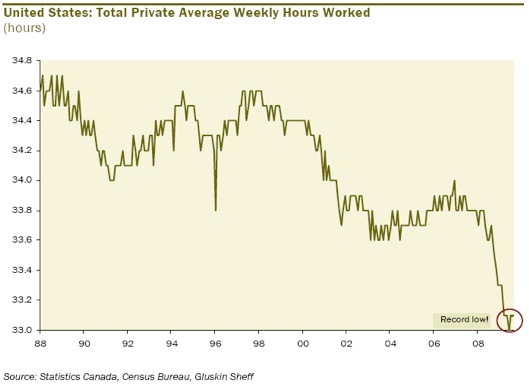

John wrote “Going back to the part-time workers, there are roughly 9 million people who are working part-time because of business conditions, or those are the only jobs they could find. The average work week is at an all-time low of 33 hours. The chart below is from my friend David Rosenberg.”

“David wrote in a special report today:

"What does all this mean? It means that when the economy does begin to recover, when we finally get to the other side of the mountain, companies are going to raise their labour input first by lifting the workweek from its record low. Just to get back to the pre-recession level of 33.8 hours would be equivalent to hiring three million workers. And, the record number of people working part-time against their will are going to be pushed back into full-time, which will be great news for them, but not so great news for the 125,000 – 150,000 new entrants into the labour market every month. They won’t have it so easy because employers are going to tap their existing under-utilized resources first since that is common sense. Also keep in mind that there are at least four million jobs in retail, financial, construction and manufacturing jobs lost this cycle that are likely not coming back. In fact, the number of unemployed who were let go for permanent reasons as opposed to temporary layoff rose by more than five million this cycle."

John finished by saying “ While the numbers may say recovery, it is not going to feel like one.”

My concern is that the numbers will only say recovery until delinquencies and foreclosures ramp up on newly reset Alt-A and Option-ARM mortgages. Those resets are beginning now, so at a lag of about 6 months between reset and foreclosure (which is roughly what we saw in last year’s experience), the first and second quarter of 2010 may be more violent than the pleasant recovery investors seem to have in mind.

Market Climate

As of last week, the Market Climate for stocks remained mixed, with moderately unfavorable valuations, generally strong price trends and breadth, but a strenuous overbought condition and weak sponsorship evident in trading volume. The Strategic Growth Fund remains fully hedged here, but this does not reflect forecasts of an imminent decline. Rather, the overall return/risk profile of the market, given present conditions, is not sufficient to accept a significant amount of market risk. We would be inclined to re-establish our “anti-hedge” in index calls, or establish an otherwise marginally positive exposure, if the present overbought condition is cleared without a corresponding deterioration in market internals. For now, we remain defensive.

In bonds, the Market Climate remained characterized last week by relatively neutral yield levels and modestly positive yield pressures. The Strategic Total Return Fund continues to have an average duration of about 3 years (meaning that a 100 basis point move in Treasury yields would be expected to impact the Fund by about 3% on the basis of bond price movements). The Fund has only about 1% of assets in precious metals shares at present, having liquidated our position on recent price strength. We continue to hold about 4% of assets in foreign currencies, and another 4% in utility shares.

******

Prospectuses for the Hussman Strategic Growth Fund and the Hussman Strategic Total Return Fund, as well as Fund reports and other information, are available by clicking "The Funds" menu button from any page of this website. Click here for John Hussman’s website to learn more.