Endgame Near For CIT

Courtesy of Yael Bizouati at Clusterstock

*****

And don’t miss this, courtesy of Tyler Durden at ZH

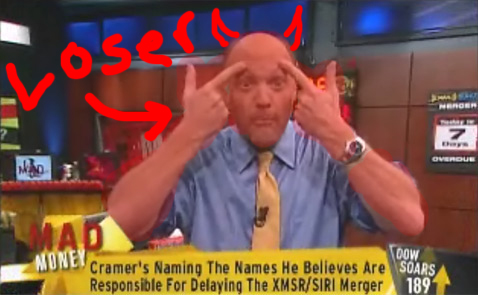

Jim Cramer’s Recommendation On CIT From Yesterday: "Primed For Upside. I Would Buy"

One can only hope that at some point irresponsible, speculative and highly destructive stock calls like this would see some regulatory intervention.

One can only hope that at some point irresponsible, speculative and highly destructive stock calls like this would see some regulatory intervention.

Citi and CIT Are Primed for Upside, by Jim Cramer, 9/29/2009, 1:54 PM EDT

Citigroup’s on the move, so is CIT . I think that Citigroup will be the biggest beneficiary of the new plan to buy toxic assets, because it is basically running its SIV as discontinued operations and it could benefit from the new program. CIT is about the possible IndyMac link-up courtesy of John Paulson, a real smart guy who was negative about mortgages before it paid to be negative. Dan Freed on CIT CIT Surges on Report of IndyMac Deal I put both of these up there as examples of companies that won’t die, and because they won’t die, they live. I know that seems a little circular in reasoning, but because Citigroup never suffered a run like Wachovia and Washington Mutual did, it made it and as our flagship site mentioned, it is safe. If it is safe, it can go higher. Because no one forced CIT into bankruptcy, it can live to play again, and when I read in the New York Post that Paulson owns CIT debt, I realized that he’s powerful enough to save this company, particularly because he is one of the investors in IndyMac and knows his way around the bottom of the debt barrel. These two stocks represent lottery tickets that are no longer rip-ups because they have made it out of the "critical care" stage and are recovering. I would buy them both.