Taylored Tales of the Monetary Bards

Courtesy of Jesse’s Café Américain

The title of this blog may appear a bit rude, and it is not intended to be denigrating of this particular paper from the Kansas City Fed linked below, but rather the organizational mindset that uses it to adjust anything more complex than the timing on a 1967 small-block Chevy with a straight face and a clear conscience.

Although a bit wonkish, "Was Monetary Policy Optimal During Past Deflation Scares?" does an exceptionally good job of explaining the Taylor Rule, how it has been derived and is utilized by Central Banks in evaluating and formulating monetary policy, ie., short term interest rate targets. The author gets high marks for clarity of language and a willingness to allude to some of the shortcomings of the method which is remarkable for most Fed research papers.

Financial engineering reminds one of saying we used to have in Bell Labs , when some individual or group was trying to formulate a practical response to a complex problem based on dodgy theories and elaborate field data: "Measure it with a micrometer, mark it with a grease pencil, and cut it with a hatchet."

One suspects that in this case, reducing the complexities of the economy to the output gap, real inflation gap, and the equilibrium nominal interest rate is like trying to arrive at the average depth of the ocean by using a micrometer to take a few ocean depth readings in a hurricane.

Yes each component has additional inputs, that vary widely and are difficult to measure, but to paraphrase, it does not matter if your calculation works, as long as it looks good, and darling doesn’t this economy look marvelous.

It would be interesting to see the fun that Benoit Mandelbrot would have dissecting the Taylor Rule equation, derived from an ‘optimal period’ in US monetary policy. His book The The Misbehaviour of Markets is a must read for anyone who needs to be convinced that much of modern financial engineering and risk models are exercises in mathematical oversimplification and misdirection.

For those that are not so inclined to read this paper, let us just say that the data going in to the equation is subject to wide disagreement, adjustment, and interpretation, and the data coming out has enough spread from lack of modeling robustness to support just about anything, any outcome. Given the ‘thinness’ of the equation, which as the author refreshingly and freely admits, can choose from widely varying measures of ‘core inflation,’ while taking no account of asset prices and government industrial policy among other things.

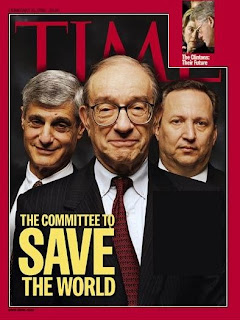

I am sure the Board of Governors would respond that this Taylor Rule is merely one input into the collective decision-making of a group of wise men, who at the end of the day are combining their various perspectives into a judgment as to the optimal course of action, which includes their vast experience and readings of not only tools such as this, but anecdotal data from their various regions.

Too bad that our last Fed Chairman was a dissembling, blithering idiot, a standing joke in his private practice, who could not find the optimal monetary policy with both hands. But he was a masterful politician and bureacrat, surrounded by fellow sycophants, and did know how to serve the banking interests and make himself look credible, at least to outsiders. And in retrospect, this paper asserts that in fact the Committee under Chairman Greenspan did make a mistake in easing too aggressively for too long a period in the early 2000’s. (well, duh).

Too bad that our last Fed Chairman was a dissembling, blithering idiot, a standing joke in his private practice, who could not find the optimal monetary policy with both hands. But he was a masterful politician and bureacrat, surrounded by fellow sycophants, and did know how to serve the banking interests and make himself look credible, at least to outsiders. And in retrospect, this paper asserts that in fact the Committee under Chairman Greenspan did make a mistake in easing too aggressively for too long a period in the early 2000’s. (well, duh).

And too bad the Fed has a significant amount of influence and power, so that even academic economists are too cowed by fear and greed to have said much while Sir Alan and His Merry Pranksters blew serial bubbles in support of the new banking economy. Because if Her Majesty the Queen wishes to be truly illuminated, that is why most economists failed to see the Crash coming: you get what you pay for.

Like Elliot Waves, this Federal Reserve process and these tools ‘look good’ when applied to historic examples, but one wonders who could possible use it to predict anything and take action on that with any level of success. Has the US Fed really had any unqualified successes based on their own initiatives, other than when Volcker took the economy in hand and, applying a sufficient amount of will, personal resolve, and common sense, tamed the pernicious inflation of the 1970’s? They appear to have created more problems than they have solved.

So what is the answer? To do nothing and let the markets play themselves out? That is folly as well, because for better or worse, markets are highly subject to manipulation from a number of sources, and the distortions caused therein are potentially devastating, when one considers the willingness for example of the Asian states to manipulate their currencies in support of a mercantilist policy of importing jobs as a means of solving domestic social problems. Or the propensity of the Anglo-American establishment to perpetuate gross fraud as a means of ravaging foreign peoples that too trustingly adopted the globalist model of deregulated banking and modern derivative financing.

The answer of course is that only a significant systemic change can take us out of this cycle. It will have to be one that recognizes that globalism is not an a priori good in a world where nations and peoples wish to settle on their own way of life, and solution set to particular problems in ways that suit them.

We are probably nearing the end of a long cycle of economic deregulation and monetary mysticism, in which old barriers and protections and particularities were struck down, often with little or no serious thought to the policy implications and long term social practices. The zenith of this trend is the consideration of the IMF or some such body as the global Central Bank, with a council of global governors setting everything from trade rules to de facto living standards. One way to make the models work and end conflict among the nations is to make everyone a slave.

When the financial and social engineers fail, their natural response is to make excuses and seek more power. If the CPI is proving to be an impediment to our calculations, let’s change how we measure it. If the measurement of inflation is now adjusted, but gold keeps signaling inflation, let’s manage the price of gold. And if people keep making independent choices that are not consistent with the predictions of our model, let us manage their perception, influence their judgement, override their own experience and the advice of their parents, and persuade them to take on more debt than they can possibly ever repay, and still remain free.

Hopefully this trend will fall apart before the globalists can do any more damage in the real world, but if it does not and we do get a Council of Global Governors, remember that their oracle is likely to be in dodgy, over simplistic equations such as this, which will be used to throw some clothing around what is most likely to be an exercise in influence peddling, elitism, and raw, naked power of the few over the many.

"Those in possession of absolute power can not only prophesy and make their prophecies come true, but they can also lie and make their lies come true."

Eric Hoffer