Wow. what a fantastic week!

Wow. what a fantastic week!

Well, not for the markets but for us as we totally nailed it. It's hard to believe that it was just two weeks ago, on Monday, the 21st, after I posted the "Wrong Way Weekly Wrap-Up" as the Dow rose from 9,600 to 9,800, that I had to apologize to members, saying: "I’m sorry because I don’t like being bearish – I’m an optimistic guy usually but I can’t just sit here and tell people what they want to hear. It’s just too irresponsible not to be cautious here. We make plenty of bullish picks but I maintain a very wary outlook until we get some real fundamental improvements."

That's the funny thing about fundamentals, they don't matter until they do – and then they matter a lot. It's funny how I get labeled a perma bear when I'm shorting the market at the top and a perma bull when I'm buying the maket at the bottom. Gee, I always thought that's what you're supposed to do but it turns out that few people have the patience to work a market trading range and I don't blame them, I blame the mainstream media, who encourage this destructive herd mentality to investing that culminates in Jim Cramer and his sound-board, where all the complexities of the market are supposed to boil down to either BUYBUYBUY or SELLSELLSELL.

It makes me seem downright wishy-washy when I said to members on the 21st: "I don’t have all the answers, but I do have a lot of questions – too many to get comfortable buying at these levels." On the whole, as I explained in detail way back in late July, I am neither bullish nor bearish, I am Rangeish. Yes, it's a made-up word and I have to make it up because no other analysts these days seem to believe the market can go up AND down, everyone seems compelled to stick to one or the other AND THEY DO IT TO THE DETRIMENT OF THEIR READERS – I WILL NOT DO IT!

It makes me seem downright wishy-washy when I said to members on the 21st: "I don’t have all the answers, but I do have a lot of questions – too many to get comfortable buying at these levels." On the whole, as I explained in detail way back in late July, I am neither bullish nor bearish, I am Rangeish. Yes, it's a made-up word and I have to make it up because no other analysts these days seem to believe the market can go up AND down, everyone seems compelled to stick to one or the other AND THEY DO IT TO THE DETRIMENT OF THEIR READERS – I WILL NOT DO IT!

There are strong stocks and there are weak stocks and I can't believe I even have to write this out but the best strategy is to short weak stocks and ETFs that have gone too high and buy strong stocks and ETFs that have gone too low. As I explained in my LiveStock appearance back on March 6th (when I was called a "perma-bull" for calling a bottom), the market is like a huge tanker being pulled by individual stocks that are like tugboats. If all the boats go in the same direction, then the market will follow but if they all try to pull in different directions, the market will go nowhere and if one goes off on it's own, against the group, it will get dragged back in line. That, in a nutshell, is our investing premise – find stocks that have gone too far off the path and are likely to snap back to join the group and we identify these stocks by examining the fundamentals.

That's how David at the Oxen Group is able to have a successful long AND short pick of the day and how Optrader is able to have strings of momentum plays that pay off on both sides of the line – that's what we do at PSW, we look for trading opportunities in both directions and try to keep a balanced virtual portfolio that can take advantage of any market move. When things get cheap, we get more bullish – when things get expensive, we shift a bit more bearish – is that wrong?

So that's it, that's the "secret" – to make money in a down market, have some bearish bets. Being all bullish or all bearish means you only win half the time. The problem with the advice you get from most people is that they only tell you to diversify by sector but, as we've seen in the past two years, sometimes ALL the sectors go up and sometimes ALL the sectors go down. Diversifying by sector AND direction is the best way to ride out the markets. Rather than go over what I said about the markets this week, which you can read for yourelf by clicking HERE, let's just go over the trades as an example of how we like to mix things up but, keep in mind, we turned more bearish (about 60%) two weeks ago, which is about as unbalanced as we like to be:

Weekly Wrap-Up – The Return of Fundamentals

I reveiewed the previous week and we targeted the retrace levels of Dow 9,512 (now 9,487), S&P 1,020 (1,025), Nasdaq 2,030 (2,048), NYSE 6,496 (6,647) and Russell 556 (580). We had a good test of the first three but the NYSE and Russell held up strong and both are broader-based indexes so, overall, things are not so bad yet and that's why we shifted to neutral into this weekend. Trades I mentioned in that post that were ongoing positions were:

- SKF bullish at $21, now $26.90 – up 28%

- DIA bearish at $98, now $95 – up 3%

- FAZ bullish at $16, now $23.22 – up 45%

- OIH bearish at $120, now $111.65 – up 7%

- SRS bullish at $8.50, now $10.67 – up 25.5%

Note that a most of these positions had options plays that made ridiculous amounts of money but a lot of people ask me why I don't pick stocks and it's good to point out that EVERY directional (non-hedged) option play we take is also a stock trade, the option simply provides leverage to make the most of the directional move. In DIA for example, the index only dropped 3% but our DIA Jan $100 puts went from $5.25 when we rolled to them on the 23rd to $7.83 on Friday, up 49% – as I said, LEVERAGE…

Note that a most of these positions had options plays that made ridiculous amounts of money but a lot of people ask me why I don't pick stocks and it's good to point out that EVERY directional (non-hedged) option play we take is also a stock trade, the option simply provides leverage to make the most of the directional move. In DIA for example, the index only dropped 3% but our DIA Jan $100 puts went from $5.25 when we rolled to them on the 23rd to $7.83 on Friday, up 49% – as I said, LEVERAGE…

Not just leverage of course, had we been wrong and gone long on the Dow with the DIA Jan $97 calls (which were also $5.25 on the 23rd), those would now be worth $3.30, a loss of $1.95, which is down 37% but 35% LESS ($1.95) than we would have lost ($3) with a straight purchse of DIA and we tie up 94.3% less capital to do it! Taking SENSIBLE long option contracts is not the all or nothing betting of the front-month plays – learning to play these positions allows you to diversify your portflio with a minimal allocation of funds.

I'm not going to get into the hedged plays here as we took a lot of them (as usual) and they play out over long periods, this post is more for examining the directional plays we took over the past week. Some stopped out (we pretty much call it a day with 50% profits on our option plays and we have rules for limiting losses and locking in gains) and some didn't but here's the raw entries and current prices:

-

GLD $100 puts at $3.10, now $2.55 – down 18%

GLD $100 puts at $3.10, now $2.55 – down 18%

- EDZ at $6.97, now $7.67 – up 10%

- FSLR $170 calls sold for $4.80, now $1.10 – up 77%

- SRS Nov $8 puts sold for .80, now .30 – up 62.5%

- USO $37 puts at $1.75, now $1.85 – up 5.7%

- OIH $115 puts at $2.55, now $5.45 – up 114%

- RIMM March $100 calls at $1.45, now $1.20 – down 17%

- MHP 2011 $25 puts sold for $5.20, now $5.80 – down 11.5%

Notice that our long positions are generally farther out in time. As we noted with the DIA example, going long in time with your option contracts actually reduces your exposure to short-term moves and we are short-term bearish so we are giving our long positions more time to mature while we put MORE leverage on our short positions, as we felt they had a better chance of paying off in the near-term. Another strategy we employ is called "scaling in" to a position, very much like dollar cost averaging except that, with options, you are not limited by simply buying more stock on the way down.

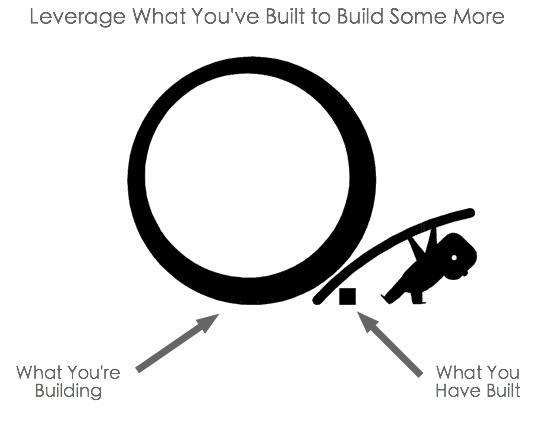

With option contracts that are going against you, you can buy more of the same contract, "roll" the contract out longer in time or down to a lower strike. You can also hedge the contract you have by selling other positions against it and this can help pay for your roll to offset the cost of repositioning yourself. Learning these strategies and getting comfortable with them is a very important part of what we try to teach at PSW. This is not about using options to make quick profits (although when that does happen we're not adverse to taking them), this is about having a diversified strategy that manages risk and allows us to let our winners run while giving us an opportunity to reposition our temporary losers to take advantage of the next turn in the market.

- IYT Dec $75 puts at $6.20, now $9.40 – up 52%

- AAPL Jan $165 puts sold for $7.40, now $6.65 – up 10%

- RIMM March $60 puts sold for $7, now $6 – up 14%

- BAC Oct $17 puts, sold for .97, now $1.10 – down 13%

Notice we do a lot of naked put selling to establish our longer-term bullish plays. This is a cornerstone of our underlying philosophy which is: Sell, premium – don't buy it. We WANT to own AAPL at net $157.60, we WANT to own RIMM for net $53, we WANT to own BAC for net $16.03. If you REALLY want to own the stocks you sell short puts against, then the dips don't bother you, especially if you are scaling in and willing to buy more if the stock goes even lower than your target. Also, knowing that we have a long-term strategy of selling calls to produce and income gives us a wider comfort zone than straight stock traders who may have a long, long wait for their assets to turn back up.

My comment in last week's Wrap-Up for the week ahead was:

It’s going to be a race between those retrace levels turning red or the 20% up levels turning green but if they can’t get the Nikkei to join the party (and that’s a tough trick with the dollar down at 89 Yen) then it’s not likely the other indexes will be able to gain much momentum. If oil fails $65, that sector has a long way to fall and metals and miners are also teetering on the verge of a correction so many, many things that can go wrong next week with lots of data on deck.

Monday Morning – 6 Unemployed People Per Job?

This is what amazes me about the mainstream media and the analysts they use. They have access to the same Bureau of Laobor Statistics data that I headlined my Monday morning post with yet they still predicted that Friday's Non-Farm Payroll number would IMPROVE from August's 216,000 lost jobs to "just" 175,000 lost jobs (we ended up losing 263,000). Can they really be THAT bad at estimating? Can they really be off by 50% after trying their absolute best and, if so, shouldn't we get new analysts or perhaps a whole new media? Oh wait, that's me – Never mind…

I am proud to be part of the so-called "new media" and it's great that we are able to support a network of truly independent writers who answer directly to our public, even EXCHANGING ideas with them – rather than making pronouncements from on high. Unfortunately, the old guard remain firmly ensconced in their ivory towers and those that I lovingly refer to as "the beautiful sheeple" still follow them off whatever cliff they point them to and it's not enough for us to be right – we also have to take into account how wrong our fellow investors are going to be so we can plan on getting the best entries for ourselves.

My Monday morning game plan was fairly negative as I said in the post:

Metals and miners are also teetering on the verge of a correction so many, many things that can go wrong this week with lots of data on deck including Tuesday’s Case-Shiller Index and Consumer Confidence Survey ahead of the bell, our final Q2 GDP (-1%) on Wednesday with ADP Employment and the Chicago PMI. Thursday is the very dangerous Personal Income and Spending along with Jobless Claims, ISM, Construction Spending, Pending Home Sales and Auto Sales. Friday is our Non-Farm Payroll Report along with August Factory Orders – busy, busy…

- DIA 9/30 $97 puts at .30 tripled the next day – up 200%

That was the only directional play we took on Monday. We already had all the above bearish positions and the market was going against us so we simply hung on tight and waited for sanity to return. The market was flying up at the open but I said to Members right in our 9:53 Alert: "Hopefully, straight up action on no volume and no news already makes you suspicious… I will be looking for this to reverse tomorrow unless they come up with something to back up this rally." We did take FXI as a day trade but that one went nowhere.

Testy Tuesday – Confidence is Key

In the morning post I noted that I had missed the 20,536 points worth of upside index targets I had set on Monday morning by a grand total of 47 and decided that was a good indicator that I should stick with my bearish instincts saying:

So the question for today is: Did they come up with something to back up this rally? Well we have the FDIC proposing banks pre-pay them 3 years of assessments ($36Bn) to keep them from having a negative balance sheet. No, that’s not it – in fact, that makes me kind of nervous as they sound desperate. The SEC is holding hearings to restrict short selling. Nope, we tried that last year and that was also desperate. Japan’s CPI fell 2.4% in August. No, I’m pretty sure that’s a bad thing. No, nothing concrete has been done to justify yesterday’s excitement so I’m going to listen to the guy who was off by 0.2% yesterday and plan for a reversal a volume picks up.

I went over a fairly detailed explanation of why I thought the market rally was unsupportable, using my "car lot" model and my 9:50 Alert to members planned on the Consumer Confidence numbers giving us the turn we'd been waiting for and giving us some excellent entries on short plays:

- SRS at $9, now $10.67 – up 18.5%

- SRS Nov $8 puts sold for .75, now .30 – up 60%

- DIA 9/30 $99 puts at $1, which hit $3 the next day and finished at $1.70 – up 70%.

- FCX Oct $70 puts at $3.60, now $5.30 – up 47%

- RL Oct $75 calls sold for $4, now $1.55 – up 61%

- BXP Oct $60 puts at .90, now $1.60 – up 77%

That's another nice trick we have when the markets go the wrong way – we sell calls that have high premiums to someone else and let nature take it's course. Selling calls is more dangerous than selling shorts as we can only lose when the stock moves against us so we tend to use tighter stops. We can, of course, also roll the caller higher but this is something we usually do only for stocks that go stupidly high, like RL did after Cramer herded his sheeple into the stock that day. Taking advantage of Cramer and his followers is an excellent way to play the markets!

Wednesday – End of Quarter, End of Pump?

In the morning post, I reviewed the poor consumer confidence numbers as well as the poor Investor Confidence numbers and I categorized both GE's Jeff Immelt and WMT's Robson Walton as "Debbie Downers," as both gave poor outlooks for the economy at a CEO conference. My comment was:

In the morning post, I reviewed the poor consumer confidence numbers as well as the poor Investor Confidence numbers and I categorized both GE's Jeff Immelt and WMT's Robson Walton as "Debbie Downers," as both gave poor outlooks for the economy at a CEO conference. My comment was:

If you don’t think Immelt is in touch with the economy despite GE’s Global footprint and $180Bn in sales, perhaps we can listen to WMT CEO Robson Walton (yes, nepotism), who oversees $400Bn in annual sales and he said at yesterday’s CEO conference: "The World recovery is going to be led by Asia although it’s going to be very challenging. I think this recovery is going to be a slow one – sales have been tough." Volume had "fallen off a cliff" and I noted that the last two times we had such low volume several days in a row, it was followed by pretty steep drops.

- AA at $13.30, now $12.91 – down 3%

- DIA 9/30 $96 calls at .50, finished at $1 – up 100%

- ICE Oct $100 calls sold for $3.50, now $1 – up 71%

- ERY Oct $14 calls at $1.05 (avg), now $2.05 – up 95%

- FSLR Oct $155 calls sold for $7.40, now $4.20 – up 43%

- EDZ at $6.87, now $7.67 – up 12%

Jobless Thursday – REITs Turn Rotten

This was, by far, the most interesting turn of events for the week. GS, who has done nothing but upgrade and boost the markets for a month, suddenly decided that the REIT sector is 25% overvalued (at the time I had taken the 15% at face value but Cap pointed out that was net of dividends expected). GS also predicts that we are "just beginning what could be a multi-year down cycle." We got a poor unemployment report with another 551,000 jobs lost (yet still analysts couldn't figure out that Friday's NFP number was going to miss) and I predicted we'd be starting to test our 33% (off the top) levels of Dow 9,394, S&P 1,056, Nas 1,917, NYSE 6,959, and Russell 574 and we've got a mixed bag of results so far.

- USO $37 calls sold for $1, now .70 – up 30%

- OIH Oct $110 puts at $1.82, now 2.90 – up 59%

- DIA Nov $92 calls at $5.40, now $5 – down 7.5%

- SKF Apr $30 calls at $4.20, now $4.60 – up 10%

Friday – Is Anybody Working For the Weekend?

Not much to say about Friday – we got the poor jobs report we expected but the markets held up surprisingly well. In the morning post I said we should expect a 1.5% drop on the indexes and a 1% bounce back, which is pretty much exactly what happened with some great roller coaster action on the day.

Not much to say about Friday – we got the poor jobs report we expected but the markets held up surprisingly well. In the morning post I said we should expect a 1.5% drop on the indexes and a 1% bounce back, which is pretty much exactly what happened with some great roller coaster action on the day.

The only new play we made for the day was the RIMM Nov $65 puts sold for $3.60, now $4 – down 10%. Otherwise we were adjusting our existing positions, especially the DIA cover spread to get ourselves to a neutral stance for the weekend. Our 5% Rule target numbers for a 20% retrace of the drop were Dow 9,535, S&P 1,032, Nas 2,070, NYSE 6,668 and Russell 586 – all of which failed so we're not terribly enthusiastic about next week but clearly, from the above plays, we have no need to get more bearish at the moment and we have plenty of gains to protect – too much to leave to chance over the weekend.

So far this weekend I see that Ireland finally passed the EU's Lisbon Treaty and that should keep the dollar at bay. A dollar rally would be a real nail in the coffin for commodities and the markets and we face a critical test next week at the 77.50 line, which will possibly be a make or break moment for Q4's dollar direction. Also adding pressure to the dollar is the very likely passage of an extension of the "enhanced unemployment-insurance program," which also offers tax credits for 65% of COBRA benefits. Extending this program, while expensive, will also help avert a total Christmas disaster as benefits on 1.5M people are scheduled to run out over the next 90 days.

After being vigorously bearish for the past few weeks, we are more than satisfied with our 5% drop and we'll be maintaining a more reactive stance into earnings. While we'd like to see the market complete a downward move of 10% (to Dow 9,100 and S&P 900), we're certainly not going to be shy about cashing our short plays out after such a great week and we will wait for the next opportunity to play for the stocks that seem to have lost their way. We have very little data with ISM Services Monday, Consumer Credit and our Joke of a Treasury Budget on Wednesday, Jobless Claims and Wholesale Inventories on Thursday and Trade Balance on Friday – not in the least bit exciting, which will put the focus on early earnings reports.

We'll be watching MOS, PBG, YUM, COST, FDO, HELE, LNN, MON, WWW, AA, RT, MAR, PEP, PGR, INFY and TSCM – it's going to be another fun one!