Welcome to Shocked Investor, who’s first post here is about Brazil. Shocked Investor sent us an article on investing in Brazil, with an eye to the massive investments and profits he believes will be made for the Olympics/Rio 2016. Click here to read the pdf file. Enjoy! – Ilene

Rio 2016: Guide to Investing In Brazil

Courtesy of Shocked Investor

INTRODUCTION

With Rio de Janeiro having just being awarded the Olympics 2016 there will be enormous activity and interest in Brazil. There will be tremendous investments made in the city and in the country. Whether the government itself makes a profit money-wise is a difficult proposition, and difficult to measure. However, the benefits to the country are long term and in many other indirect areas. Many companies and sectors will certainly boom and make considerable revenue. Over the next months and years we will dedicate considerable effort to dissecting these companies and sectors to pinpoint the winners. Also, in future posts, we will be talking about other companies, while not directly Brazilian ADRs, but that do most of their business – of profits – in Brazil. I know these companies and the market well, and have very good connections over there. Much more on this later. Also, please see another recent post on Brazil on September 23, with expert interviews on BNN TV.

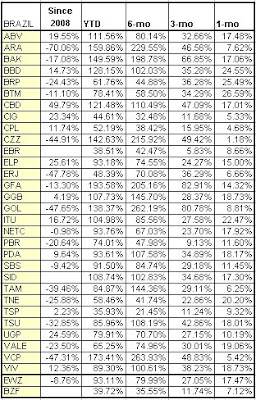

This article shows all the current Brazilian ADRs. These are securities that can be traded in North America, like regular stocks. Most have good volumes, and most of them have options as well. Some of the companies are very large and are among the biggest in the world. For example, ITUB has a market cap of over $90B, much higher than most banks in the world. VALE is at $120B, VIV $10B, ABV, $52B, BBD $61B, and so on.

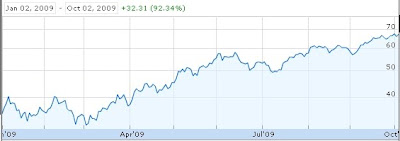

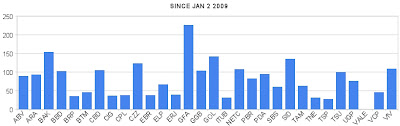

Two ETFs are also shown, EWZ for Brazilian stocks, and BZF which tracks the Brazilian currency. You will see that these stocks have gone up sharply this year. The EWZ is up over 93%, partly due to the appreciation of the Real and the drop of the U.S. Dollar. The top gainer year-to-date is a builder, whose shares (ADRS) have gone up nearly 200%. Other companies have gone up over 200% in the last 6 months. Their RSI values are stratospheric, so this is clearly a ‘buyer beware’ situation. If there is the long-awaited correction in the stock market and another safety flight to the U.S. Dollar occurs, these stocks could well be severely punished. There will be many opportunities for the patient investor.

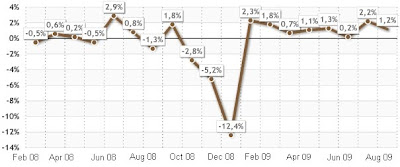

This weekend, Brazil just reported an 8th consecutive increase in industrial production:

(please click to enlarge, source: Agencia Estado)

The economy is not immune to the global crisis. However, the increase of its internal market, as well as its diversification of exports (China is now its largest export market) has certainly helped its resiliency. Overall production in 2009, however, is still down 12% compared with 2008.

Most of these companies with ADRs are world-class and leaders in their field. Names such as Petrobras, Vale do Rio Doce do not need introduction. Most are extremely reputable and well-managed companies.

We also maintain sites that track live all ADRs in Latin-America, as well as all global currency ETFs and ETNs. Click on the links to view intra-day prices and YTD charts.

COMPANIES AND ETFS, AND THEIR SECTORS

List of ADRs, ETFs, company names, and their sectors:

Note that all the Brazilian companies in the S&P Latin American 40 index are included in the group above. All these companies also trade in the Bovespa, Sao Paulo’s stock exchange (4th largest in the world).

Please note that you may receive technical analysis and alerts of these ADRs or other stocks, sent automatically to you, by entering the symbols in the Technical Trend Analysis Tool, (powered by INO).

PERFORMANCE

Performance since Jan 2008, Jan 2009, last 6 months, 3 months, and 1 month:

RSI VALUES

Below is the current table of RSI7 values (daily, weekly, and monthy) for all Brazilian ADRS plus the ETFs. The average values for the ADRs are:

daily: 58.2

weekly: 72.5

monthly: 64.6

The weekly is overbought, the monthly almost, and the daily is quite high. Note that for EWZ the values are 64/80/76, slightly higher than the average of all the companies. The top holdings of the ETF are included in the above list, but it’s not a perfect match.

Note that sell alerts were triggered for ELP and PDA. These are the RSI7s:

As you can see, many of the stocks are clearly overbought.

PRICE/EARNINGS RATIO

The table below shows the trailing and forward Price/Earnings ratios from various sources.

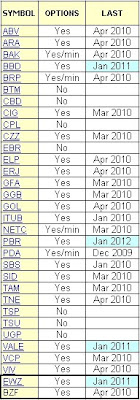

AVAILABILITY OF OPTIONS

The use of stock options is very important to reduce cost basis (by selling calls and puts) as well as for protection. In addition, options and LEAPS (long term options) allow for leverage on the stock price. If you believe these stocks will continue to rise into the far future, then buying LEAPS can be quite attractive. Selling them (or short term options) allows for good income generation. There are many other strategies that can be used with options. With regards to the Brazilian ADRs, these strategies will be discussed in more detail in future posts.

Copyright The Shocked Investor, http://shockedinvestor.blogspot.com.

p.s. Here’s a previous post, with some gorgeous photos.

Rio Wins Olympics 2016: Billions of Dollars of Costs, Profits, and Thousands of Jobs; Track Brazilian Stocks

More good news for Brazil. Rio de Janeiro has just been announced as the host city of the 2016 Olympics. This always means billions of dollars of costs, profits, and thousands of jobs created.

Location of sports venues: