Global Market Comments

Courtesy of Mad Hedge Fund Trader

October 5, 2009

SPECIAL “I TOLD YOU SO” ISSUE

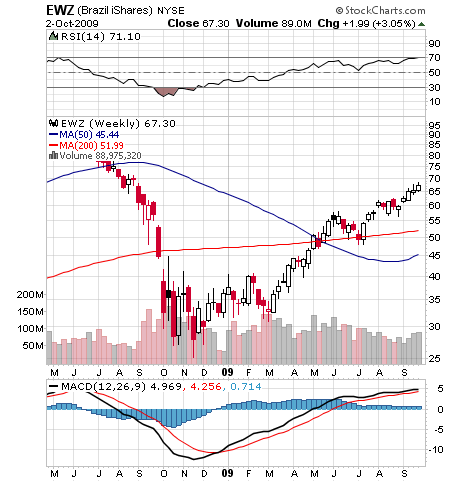

Featured Trades: (TBT), (BRAZIL), (EWZ)

1) For the last six months there has been a great big whopping contradiction in the markets. The stock market has been discounting a return to the “Roaring Twenties,” while the bond market has been anticipating another “Great Depression.” After yesterday’s publication of the Labor Department’s September nonfarm payroll number showing the loss of another 263,000 jobs, it looks like the bond market now has the upper hand. This takes the unemployment rate up 0.1% to 9.8%, and total job losses for this recession to 7 million. The really disturbing aspect of this number is that 57,000 teachers were fired, as states chop budgets to the bone. This is really eating our seed corn by the bushel full. Of course, I have been banging pots and pans, setting off distress flares, and yanking the fire alarm, trying to alert readers that this kind of disappointment was coming (click here for “Risk Reversals Can Be Such a Bitch” and here for “Stocks Offer No Value”). Shares have dropped 5% from last week’s peak, as the bond market soared, the ten year yield reaching nosebleed territory of 3.05%. The dollar maintained its flight to safety status, which to me is one of the great ironies of all time. It’s like that reprobate, alcoholic uncle with the bad teeth, who, when your car breaks down in the middle of a downpour in a bad neighborhood, will always let you crash on his sofa. Let’s call him your Uncle Sam. You have to hand it to PIMCO’s inveterate card counter, Bill Gross, who says this is all about transitioning to a “new” normal of 1%-2% real GDP growth. That’s why he was loading the boat with bond yields at 4%, a “ballsey” move at the time, which now smells like roses. I guess that’s why they call him the “Bond King.”

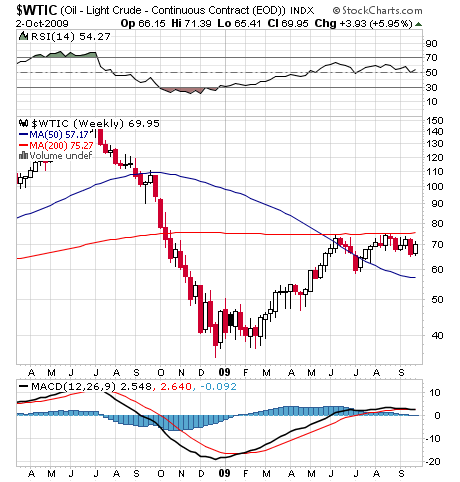

4) Since energy is going to be the dominant factor in making our investment decisions for the next decade, I thought it would be a good time to sit down with Carl Pope, Executive Director of the Sierra Club. Carl, who makes frequent appearances in this week’s PBS broadcast on the National Parks, is as sharp as a tack, with the fervor of an evangelist-always a dangerous combination. In the spirit of full disclosure, I have to tell you that I was a member of the Sierra Club back in the sixties when they were mostly interested in identifying mountain wildflowers and bird calls. They changed a little after that. Carl says that the “Earth has a fever,” with temperatures rising, glaciers melting, forests burning, oceans rising and acidifying, and the overwhelming cause is hydrocarbon burning. The US needs to cut CO2 emissions to 2 tons per person, per year, by 2050, or down 90% from today’s levels. To do this we need to ban the burning of coal by 2030, unless it is sequestered, and stop all petroleum consumption by 2040. We can accomplish this by converting all cars to electric and moving freight via an electrified rail system. Petroleum needs to be classified as toxic waste, and a cleanup superfund needs to be set up, funded by 10% of the earnings of the oil companies for the next ten years. If we eliminate oil consumption, our trade deficit will improve by $100 billion/year, that money can be invested in the US to create 10 million jobs, and we will all be a lot healthier.

“If we don’t get our macro house in order, it will put the dollar in danger, and the most critical element there is long term fiscal stability,” said Chairman of the Federal Reserve, Ben Bernanke.

This is not a solicitation to buy or sell securities. For full disclosures click here

The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protect by the United States Patent and Trademark Office. The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office.