And the nonsense continues…

I don't even have to write today's column, I wrote all about how silly the market move was last Tuesday and, if you look at a 10-day chart, you'll notice that they are running the same bull-trap pattern they ran last Monday and Tuesday which allowed me to predict in yesterday's 9:21 Alert to Members that a positive move in gold, oil and copper (we got all 3) would take us up to Dow 9,535, S&P 1,032, Nas 2,070, NYSE 6,768 and RUT 586. At the day's end, we found ourselves at Dow 9,599, S&P 1,040, Nas 2,068, NYSE 6,795 and Russell 591 so past our bounce zones, except on the Nasdaq, who used to be our leader.

After going wisely neutral into the weekend, we may have gone a little too bearish yesterday as we don't have the same catalyst today (Consumer Confidence) to take down the market that we had last week. We have another Consumer Confidence report this evening at 5pm but that doesn't stop the pump-monkeys from attacking the dollar this morning as they float rumors that the dollar will be replaced by OPEC as an exchange currency, which sent the dollar down to 89 Yen and $1.475 to the Euro and $1.605 to the Pound – all based on nothing but a rumor.

Aside from making someone sensible wonder why oil-producing nations, who hold $1.5Tn in reserves, would want to devalue their holdings, it also would boggle the mind of people who can do math (and the market manipulators count on the fact that you can't) who might wonder where the extra $2Tn worth of Euros is going to come from to pay for a year's worth of global oil at $70. I know $2Tn doesn't sound like a lot of money these days but there are only $727Bn Euros in circulation on the planet Earth. The entire M3 supply of Euros (all of them) ever created is, as of April, 9.5Tn so is the plan to divert 20% of all the Euros on Earth to the oil trade or are they just going to print 20% more? Heck, why not? The M1 supply of Euros is already up 13.6% for the year and are trending to be up 21.9% at the rate of growth in Q3.

There is already a supply of 14Tn Dollars in the world and $2Tn worth of them are exchanged for oil during the year and $3.5Tn is sitting in bank accounts and Trillions more in various safes around the world (Saddam had a Billion hidden in his walls) and, if I understand this correctly, the plan is to print enough Euros to replace the dollar without devaluing the Euro AND get all of the people who hold dollars to trade them in — when? Next year, two years… 10 years???

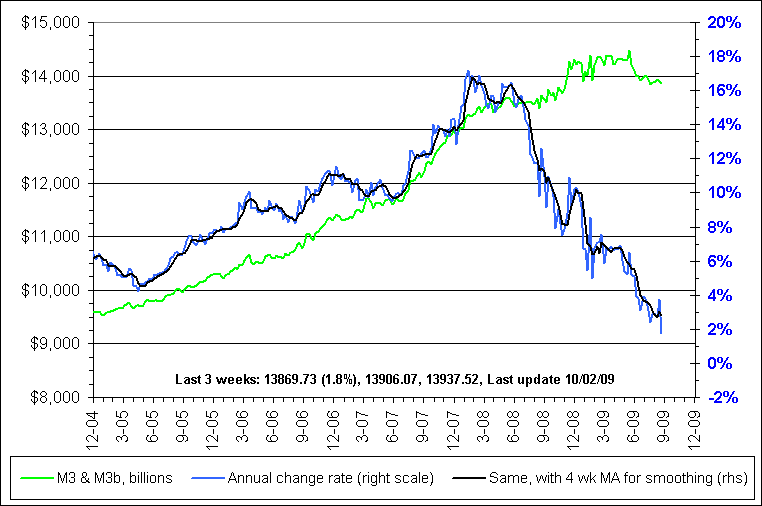

Notice on the above chart, the dollar supply has actually been CONTRACTING this year, not expanding, as $500Bn worth of US credit has been paid down – that's 23% in the OPPOSITE direction of the Euro's runaway currency growth but the myth of the weak dollar persists, promoted by commodity pushers and their media lackeys. The reason money is flying into US treasuries from overseas is NOT because people want to take advantage of the 3% interest rates – it's because investors are buying DOLLARS at what they know to be ridiculous lows and those 3% notes will appreciate another 20% if the dollar gets back just to this year's high.

Notice on the above chart, the dollar supply has actually been CONTRACTING this year, not expanding, as $500Bn worth of US credit has been paid down – that's 23% in the OPPOSITE direction of the Euro's runaway currency growth but the myth of the weak dollar persists, promoted by commodity pushers and their media lackeys. The reason money is flying into US treasuries from overseas is NOT because people want to take advantage of the 3% interest rates – it's because investors are buying DOLLARS at what they know to be ridiculous lows and those 3% notes will appreciate another 20% if the dollar gets back just to this year's high.

Let's also keep things in perspective. At the end of Clinton's Presidency, the dollar was .85 to the Euro, by the end of Bush's Presidency, it cost $1.80 for a Euro – that's a 100% decline in the buying power of the dollar vs. the Euro in just 8 years so the people buying 10-year notes now for 3% interest are expecting that the dollars those notes are denominated in will rise fast enough to offset the very poor rates of interest that are offered. And who is buying all these notes? The same people (China, Russia and OPEC) who are talking down the dollar! They sell their goods and commodities for lots of cheap dollars and then put their money into treasuries where they'll make a quick 10% on the smallest of dollar bounces and they can convert their notes at will in the World's most liquid currency. That's all this is!

Now it's all lots of fun to talk about silly things that aren't real like the Dollar being replaced as a global currency but how about something that is real like 5,438,000 unemployed people who haven't worked in 6 months or more? As you can see from Barry Ritholtz's chart below, it's not just a lot – it's the most ever by a country mile and, as we saw last week, it's not getting better at all.

Are these 5.4M people going to be rusing out to buy gold, silver and oil this Christmas? They aren't renting apartments, apartment vacancies are now 7.8%, a 23-year high and that's with rents already down 2.7% so figure a 10.5% drop in revenues for landlords so maybe they are going to be buying big gold and silver rings that have been dipped in oil for their sweethearts this holiday season? According to the ICSC Same-Store Sales numbers, those 5.4M people surprisingly aren't shopping at them mall either as Retail Sales for September are down 2% from last year (which wasn't very good either). We get Redbook Chain Store Sales at 8:55 so we'll see how that goes.

Perhaps it's not the 5.4M people who have officially been loafing about for 6 months or longer on unemployment… Perhaps it's the 4M people who are newly unemployed or perhaps it's the 10M people who have left the workforce entirely since Jan 2008 and are no longer counted or perhaps it's the 10% drop in the average workweek for those who are lucky enough to have jobs or perhaps it's the 6% reduction in take-home pay since just last year for the average worker. With 75 shopping days until Christmas, they'd better figure out what it is and do something about it pretty soon or there will be many lumps of coal in investors' stockings this year.

Earlier this year I picked Australia as the World's strongest economy and the Aussie Dollar as the best currency to hold onto (it's already up 25% against the dollar this year) and today the ACB did me proud as the first Central Bank to raise their rates, up a quarter-point to 3.25%, miles ahead of the rest of the G20. "The risk of serious economic contraction in Australia now having passed, the Board's view is that it is now prudent to begin gradually lessening the stimulus provided by monetary policy," ACB Governor Stevens said.

Meanwhile, weaker Asian economies who depend on exports are scrambling to curb the rise of their own currencies against the dollar as Asian currencies rose this morning to a 12-month high against the Dollar. Kim Ik-joo, Director General of the International Finance bureau in South Korea's Ministry of Strategy and Finance, blamed "foreign players" for the rapid rise of the won, which has climbed 8.2% against the dollar over the last three months. Korean traders said the central bank appeared to step in since early trade to buy the dollar, possibly with the intention of keeping it above 1,170 won.

This is what makes currency trading such a fun game, you can manipulate the markets to the point where the Central Banks have to step in to support the dollar and then you have a bottomless buyer to dump your trading profits into while you pick up dollars in safety as a floor becomes set for them. I'm not saying we'll turn around right here, the bottom of the dollar trade usually comes in a panic sale and we're not there yet.

This is what makes currency trading such a fun game, you can manipulate the markets to the point where the Central Banks have to step in to support the dollar and then you have a bottomless buyer to dump your trading profits into while you pick up dollars in safety as a floor becomes set for them. I'm not saying we'll turn around right here, the bottom of the dollar trade usually comes in a panic sale and we're not there yet.

Asian markets rose for the first time in 4 days, reacting to our own great day yesterday and headlines in Asia played up our "strong" ISM number. Shanghai was closed but the Hang Seng gained 382 points today with 230 of them coming in the last 40 minutes of trading. Despite a big bounce in the Auto sector, the Nikkei gained just 17 points and is laying around the 9,700 mark (10,200 was our breakdown watch). With 75 shipping days until Christmas, the Baltic Dry Index is also not looking very peppy and will be in trouble if they can't retake the 2,400 mark this month.

Europe is flying ahead of the US open, up about 1.5% led by the commodity sector despite the fact that UK Manufacturing fell to the lowest level in 17 years in August. Please folks – commodities don't have to be USED to be valuable, they just have to be stored somewhere by idiot investors or ordered for delivery by speculators who have no use for them whatsoever and would be mortified if they were actually forced to take delivery.

Steel is a commodity that does actually have to be used to keep it's value and Russian speculators like Severstal, who bought $4Bn worth of US Steel plants a few years ago are now near bankruptcy and having trouble finding buyers at less than 1/3 of what they paid. “Russian steelmakers’ acquisitions in the U.S. were all unsuccessful,” said Dan Yakub, a Citigroup Inc. analyst in Moscow who recommends investors sell Evraz and who has a “hold” rating on Severstal. “The management wanted a global business, to get more flags on the map. They overestimated the potential of the U.S. market and underestimated the depth of the price collapse.”

Don't worry though, I'm sure copper is a COMPLETELY different story (end sarcasm font).

Maybe we are too bearish but we'll be rolling up our puts and doubling down on our entried BEFORE we capitulate and pick up long positions this morning as, so far, it's the same old song with a few new lines…