Global Market Comments

October 7, 2009

Featured Trades: (GOLD), (ABX), (GLD), (KGC), (JAG), (RGLD), (SLV)

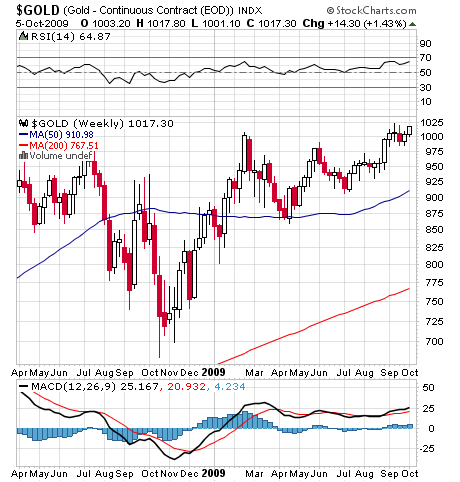

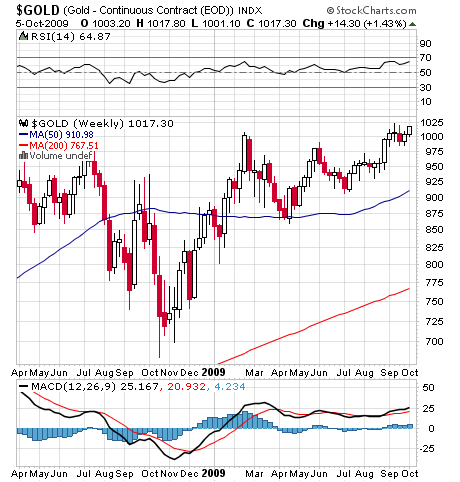

1) Of course you knew it was going to happen like this. After churning around just below the old high, and sucking in as many profit takers and short sellers as possible, gold blasted through to a new high for the year of $1,038. Never mind that the triggering event is complete balderdash, a story in Britain’s Independent newspaper asserting that the Middle East is holding secret global talks to price crude in the yellow metal or other currencies (click here ). It didn’t hurt that Australia cut its interest rates by 0.25%, the first G-20 country to do so. There probably isn’t enough gold in the world to finance more than a few weeks of global oil production. Total gold holdings would only fill two Olympic sized swimming pools. But never let the truth get in the way of a good trade. The confirming moves couldn’t be more ubiquitous, with the Canadian, New Zealand, and Australian dollars all up big, commodities strong, and silver also going ballistic.

Regular readers will all recognize these as old friends of mine, core longs that I have been strongly recommending since the beginning of the year. I have been trying to get investors into gold since it was at $800. If you aren’t in gold by now, I can only tear my own clothes and flagellate myself for my abject failure to convince you of gold’s merits. US government debt is exploding, and with foreigners holding a large part of our paper, the only way to get out of this mess is to devalue the dollar. It’s like Obama invited China’s president Hu Jintao to dinner at an expensive Upper East Side restaurant, fakes a sudden case of food poisoning, leaving him with a big fat bill. Next stop $1,200, then $1,500, then the old inflation adjusted high of $2,400. If you want me to help you get set up to trade futures in any of this stuff, please email me at madhedgefundtrader@yahoo.com. If you want to know where to buy physical gold and silver in size, or coins with the tightest spreads over spot, check with the experts at http://www.millenniummetals.net by clicking here.

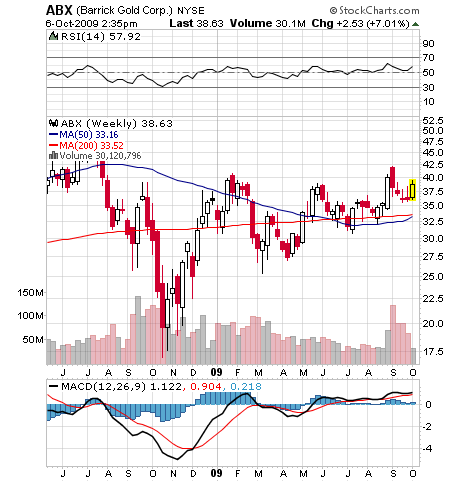

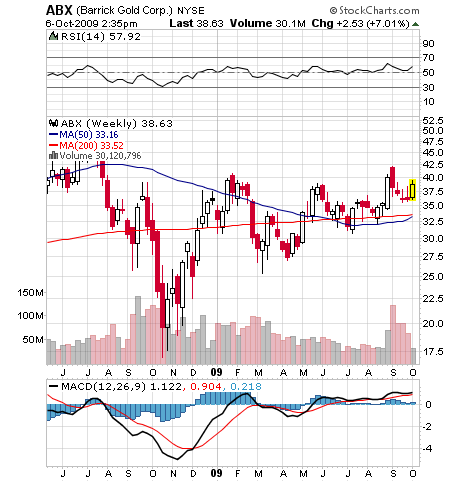

2) The precious metals markets were stunned when Peter Munk’s Barrick Gold (ABX) floated a $3.5 billion public offering in September to retire its gold hedges in the futures markets. This means that the world’s largest producer is cashing in its downside protection and gearing itself for a ballistic move up in the price of the barbaric relic. The timing of the announcement, the day that the yellow metal broke $1,000 for the first time since February couldn’t have been more auspicious. I have been a huge fan of Peter Munk’s ABX all year, cajoling readers into the stock at $27 in January before its 56% run, and I am certainly not interested in betting against him. Imagine what he is seeing to prompt a radical move like this. South Africa’s largest gold miner, AngloGold Ashanti’s CEO, Mark Cutifani, says his company put its money where its mouth is, taking off its hedges some time ago. “People are doing what they have been doing for 5,000 years, and that is buying gold as the only hard currency,” opines Cutifani. In the meantime, the Street Tracks gold ETF (GLD) announced that it has $34 billion of gold holdings, making it the largest ETF of all, and the fifth largest owner of gold in the world after four central banks.

3) Just as it is prudent to top up your flood insurance ahead of the hurricane season, investors are loading up on gold ahead of the worsening economic environment. Today’s $40 move shows that attempt number six to run the yellow metal up to a new high has succeeded. Historically, the fall is the best time of the year to own the barbaric relic, showing an average 3.5% gain over the last 20 years. The onset of the Indian wedding season, Ramadan, and the run up to the Christmas and the Chinese New Year jewelry buying binge are all conspiring to give the yellow metal a boost. A tip off this was coming was the big put selling seen for the shares of the gold ETF (GLD), and Kinross (KGC) early in September. One good way to play gold at this late stage might be the shares of highly leveraged unhedged producers like Rangold resources (GOLD), Jaguar Mining (JAG), and royal Gold (RGLD). If gold does break on big volume, it could tack on 20% very quickly to $1,200. Load up on those American gold eagles!

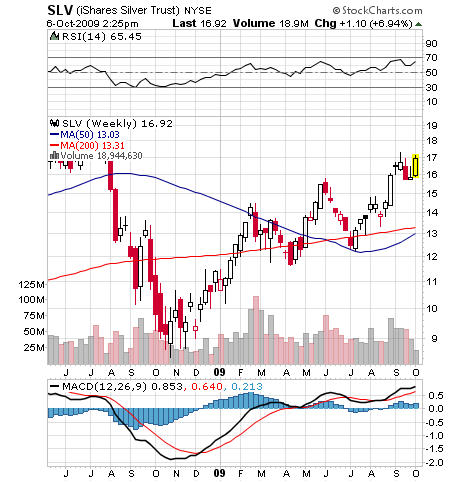

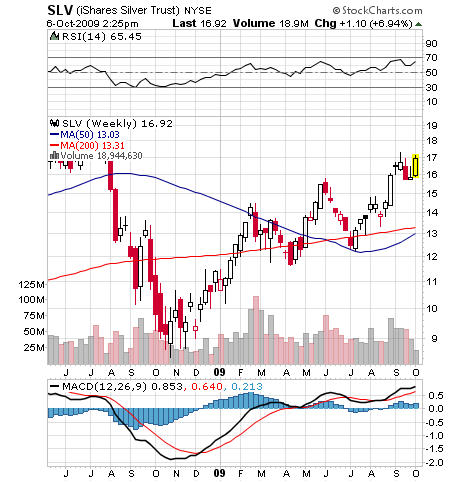

4) The big thing for me today is the long awaited (well, maybe not so long) upside breakout in silver to a new six months high of $17.40, a double from year ago lows. Please see my warning of the impending move by

clicking here . The metal is at the bottom end of its historic valuation relative to gold, which has ranged between 12:1 (Remember the Hunt Brothers?) and 70:1 and is currently 60:1. Geologically, silver is 17 times more common than the yellow metal. All of the gold ever mined is still around, from King Solomon’s mine, to Nazi gold bars in Swiss bank vaults. But most of the silver mined has been consumed in various industrial processes, and is sitting at the bottom of toxic waste dumps. Silver did take a multiyear hit during the nineties when the world shifted from silver based films to digital photography. Now, rising standards of living in emerging countries are increasing the demand for silver, especially in areas where there is a strong cultural preference, as in Latin America. That means we are setting up for a classic supply/demand squeeze. I think we could run to the old high of $50/ounce in the next economic cycle. Since silver can trade with double the volatility of gold, this forecast could prove conservative. Take a look at the silver ETF (SLV), which popped to a new high today.

QUOTE OF THE DAY

“George Bush spent eight years digging our grave without any trade policy, and Obama is going to spend the next four years burying us with the lack of fiscal discipline,” said Dr. Peter Navarro, of the University of California at Irvine, a noted China basher.

This is not a solicitation to buy or sell securities. For full disclosures

click here.

The "Diary of a Mad Hedge Fund Trader"(TM) and the "Mad Hedge Fund Trader" (TM) are protected by the United States Patent and Trademark Office. The "Diary of the Mad Hedge Fund Trader" (C) is protected by the United States Copyright Office.