And we are off!

And we are off!

AA beat earnings yesterday and the dollar continued to dive to the lowest level since July of 2008, when the $168Bn Bush stimulus package was considered highly inflationary but that didn’t stop oil from diving from $147.90 on July 1st all the way down to $35.13 in December and it didn’t stop gold from falling from $989.60 all the way down to $681 as quickly as October. Gold has me particularly worried at the moment because half the investors are piling into low interest T-Bills and half the investors are putting all their money into shiny bits of metal and no matter what happens, half the investors are going to be very, very wrong.

Nonetheless, today seemed as good a time as any to put up a new Watch List for Members as we are way too bearish if we are going to make new closing highs and we need to balance out with some more bullish positions. We’ll be looking for action that beats our best September closes of Dow 9,829, S&P 1,071, Nas 2,146, NYSE 7,047 and RUT 620 to confirm that this really is a new rally and not just the double top we’ve been thinking it was. Our plan for today is to roll our short plays along as October if we are clearing those levels but, otherwise, we will simply be scaling in and rolling our long put covers higher.

My overriding concern is still that the dollar is way too low and although it’s making China happy (their Yuan is pegged to the dollar so Chinese exports are super-cheap again), it’s making Japan miserable and Europe is starting to get very nervous as well. Remember that China played this perfectly as they stockpiled 50% of the world’s annual supply of copper earlier this year as well as many other precious metals and then they began making comments that took down the dollar, giving them a huge windfall on their trading.

My overriding concern is still that the dollar is way too low and although it’s making China happy (their Yuan is pegged to the dollar so Chinese exports are super-cheap again), it’s making Japan miserable and Europe is starting to get very nervous as well. Remember that China played this perfectly as they stockpiled 50% of the world’s annual supply of copper earlier this year as well as many other precious metals and then they began making comments that took down the dollar, giving them a huge windfall on their trading.

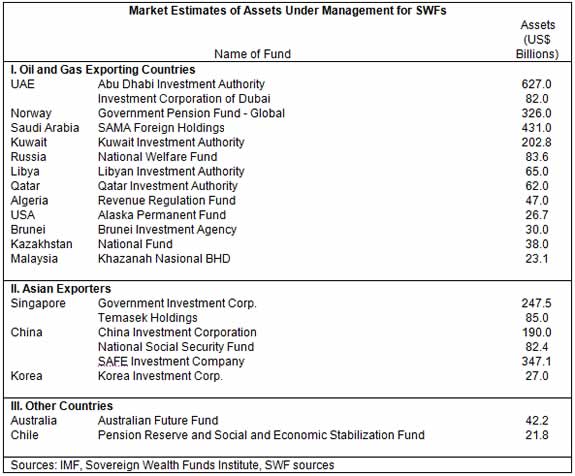

Of course China is only the 7th largest Soveriegn Wealth Fund playing our markets with the cash we’ve sent them over the years. China’s 3 SWFs rank only behind the UAS combined $709Bn from the Abu Dhabi Investment Authority and the ICD. Saudi Arabia’s has just the one $431Bn SAMA Foreign Holdings to represent their interest in global commodity bidding. China and the UAE are eclipsed only by our own Goldman Sachs (technically not a government fund despite the bailout), who have $884Bn in assets – now THAT’s market power!

For comparison, this year’s Forbers 400 list of the richest Americans have "only" a combined $1.3 Trillion. That’s just an average of $3.25Bn each – these are indeed tough times… The CIC (China Investment Corporation) controls $190Bn worth of assets (still mainly cash) and is headed up by a guy who would not make the Forbes 400 list, or the Forbes 100,000 list if there were one. The CIC is run by Lou Jiwei, who was formerly China’s Vice Minister of Finance and has been a card-carrying member of the Communist Party since 1973. Not your normal profile for one of the World’s biggest hedge fund managers…

China’s other major fund, SAFE, is run by Yi Gang, who used to teach economics at Indiana University and later served as Deputy Governor of the PBOC before being put in charge of this $347Bn fund this year. In addition to the Fund, SAFE also writes the rules and regulations governing China’s FOREX markets and they also manage China’s $2.1 Trillion of currency reserves. And you thought GS had a lot of power…

China’s other major fund, SAFE, is run by Yi Gang, who used to teach economics at Indiana University and later served as Deputy Governor of the PBOC before being put in charge of this $347Bn fund this year. In addition to the Fund, SAFE also writes the rules and regulations governing China’s FOREX markets and they also manage China’s $2.1 Trillion of currency reserves. And you thought GS had a lot of power…

I point out the background of these fund managers because we need to consider that they probably have more cash on hand than any other fund on the planet and both men come to the table with very different agendas than your typical Western capitalist. China’s SOVs are all about doing what is best for China because China is the investor, not the Forbes 400 looking to make an extra Billion this year.

If China needs a cheap dollar, they MAKE a cheap dollar and if China needs cheap oil, they MAKE cheap oil. There is no SEC looking over their shoulder – they are the SEC! We’ve been trying to piece together who it was that is benefiting from such a weak dollar and it was only yesterday that I was reminded that the Yuan is pegged to the dollar. China stocked up on commodities (which are priced internally according to strict controls) and THEN took down the dollar because taking down the dollar is taking down the Yuan and pushing money into the US markets at the same time makes the dollar collapse and commodity rally more palatable over here so consumer confidence goes up and Chinese workers can go back to the factory making Nike’s and Barbie dolls for the holidays.

![[retail1008]](http://s.wsj.net/public/resources/images/OB-EQ016_retail_DV_20091008092041.jpg) So that’s what we’ve been missing in the big picture, and we’ll have to stay on our toes as this is something new in the marketplace and we can’t rely on the old models to hold up. While our markets are partying like it’s 1999, the Hang Seng was up just 1.2% today with virtually all of the day’s gains coming after lunch, when the Nikkei closed. The Nikkei is, of course, not as happy as China is with the weak dollar and remains at a 2-month low 9,822, which is still 7.5% below the September 24th top at 10,600. It is very rare for the Nikkei and the Dow to diverge this far apart (12.5% since 8/17) and we’ll be looking for a big move up in Japan to confirm the Dow otherwise it’s the Dow that will be coming down hard. EWJ Dec $10 calls are just .30 (EWJ is at $9.84) and are a good way to play the upside in Japan, a nice cushion to Dow shorts.

So that’s what we’ve been missing in the big picture, and we’ll have to stay on our toes as this is something new in the marketplace and we can’t rely on the old models to hold up. While our markets are partying like it’s 1999, the Hang Seng was up just 1.2% today with virtually all of the day’s gains coming after lunch, when the Nikkei closed. The Nikkei is, of course, not as happy as China is with the weak dollar and remains at a 2-month low 9,822, which is still 7.5% below the September 24th top at 10,600. It is very rare for the Nikkei and the Dow to diverge this far apart (12.5% since 8/17) and we’ll be looking for a big move up in Japan to confirm the Dow otherwise it’s the Dow that will be coming down hard. EWJ Dec $10 calls are just .30 (EWJ is at $9.84) and are a good way to play the upside in Japan, a nice cushion to Dow shorts.

Europe is up about 1% ahead of the US open but off their highs despite the fact that both the BOE and the ECB announced they would be holding rates steady. Latvia is on the verge of collapsing and that will affect the Swiss banks, who are into them for about $45Bn in projected losses and I’m sure German and British banks would take a hit as well so we’ll keep an eye on that one.

Retail sales looked very good this morning overall, albeit on very low expectations. "Only" 521,000 peopple lost their jobs this week with Continuing Unemployment Claims falling from 6,112,000 to 6,040,000 so that’s another green feather we can stick in our caps. We have Wholesale Inventories at 10am and they should be well down thanks to Cash for Clunkers so there is not reason we can’t get to new highs if this rally is real.

I still think we’ve come too far too fast and this "great" data is already baked into the valuations but it doesn’t matter what I think – it matters what Yi Gang thinks so we’re just going to watch our levels and buy accordingly.