The Speculative Bubble in Equities and the Case for Deflation, Stagflation and Implosion

Courtesy of Jesse’s Café Américain

As part of their program of ‘quantitative easing’ which is another name for currency devaluation through extraordinary expansion of the monetary base, the Fed has very obviously created an inflationary bubble in the US equity market.

Why has this happened? Because with a monetary expansion intended to help cure an credit bubble crisis that is not accompanied by significant financial market reform, systemic rebalancing, and government programs to cure and correct past abuses of the productive economy through financial engineering, the hot money given by the Fed and Treasury to the banking system will NOT flow into the real economy, but instead will seek high beta returns in financial assets.

Why lend to the real economy when one can achieve guaranteed returns from the Fed, and much greater returns in the speculative markets if one has the right ‘connections?’

The monetary stimulus of the Fed and the Treasury to help the economy is similar to relief aid sent to a suffering Third World country. It is intercepted and seized by a despotic regime and allocated to its local warlords, with very little going to help the people.

Deflation

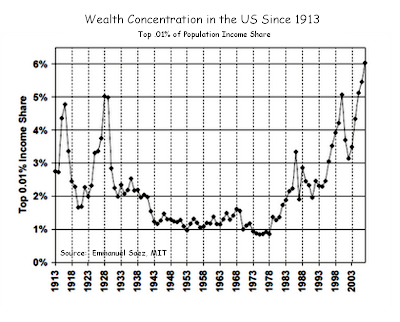

By far this presents the most compelling case for a deflationary episode. As the money that is created flows into financial assets, it is ‘taxed’ by Wall Street which takes a disproportionately large share in the form of fees and bonuses, and what are likely to be extra-legal trading profits.

If the monetary stimulus is subsequently dissipated as the asset bubble collapses, except that which remains in the hands of the few, it leaves the real economy in a relatively poorer condition to produce real savings and wealth than it had been before. This is because the outsized financial sector continues to sap the vitality from the productive economy, to drag it down, to drain it of needed attention and policy focus.

At the heart of it, quantitative easing that is not part of an overall program to reform, regulate, and renew the system to change and correct the elements that caused the crisis in the first place, is nothing more than a Ponzi scheme. The optimal time to reform the system was with the collapse of LTCM, and prior to the final repeal of Glass-Steagall, and the raging FIRE sector creating serial bubbles.

Stagflation

These injections of monetary stimulus to maintain a false equilibrium is in reality creating an increasingly unsustainable and unstable monetary disequilibrium within the productive economy. As the real economy contracts, the amount of money supply that the economy can sustain without triggering a monetary inflation decreases, and in a nonlinear manner. This is because the money multiplier does not ‘work’ the same in reverse, owing to the ability of private individuals and corporations to default on debt.

Ironically, with each iteration of this stimulus and seizure of wealth, the dollar becomes progressively weaker because there is a smaller productive economy to support it, even if there are less dollars, despite the nominal gains in GDP which are an accounting illusion. This has been further enabled by the dollar’s status as reserve currency backed by nothing since 1971, which has created an enormous overhang of dollars in the hands of other nations.

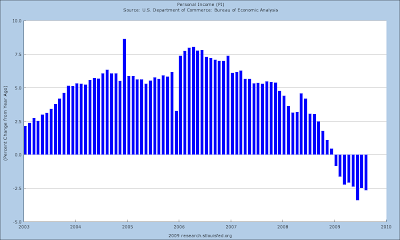

One cannot have a sustained economy recovery in which the real median wage and domestic employment are stagnant or declining, and Personal Income is declining, as wealth is being increasingly concentrated in corporations and the upper 2% of the population.

This is why stagflation, rather than hyperinflation or a sustained monetary deflation with a stronger dollar, is most likely. There will be a mix of falling and rising prices, depending on the elasticity and source (imported content) of the products, with a wildly staggering dollar that could destabilize other parts of the world, and pernicious underemployment and growing civil unrest domestically.

Those who have taken a huge share of the last three bubbles would like to stop the bubble now, keep their gains, and return to a system of fiscal restraint with light taxation on their windfall of assets.

So why does this not just simply happen? Because the political risks become enormous. It is difficult to reduce a population of free men into debt slaves, without risking a significant reaction. Therefore, it seems most likely that the government and the Fed will try to ‘muddle through’ for the time being, and look for an exogenous event to break the stalemate.

The traditional solution has been a military conflict, which stifles dissent against the government while generating artificial demand sufficient to energize the productive economy. It is a means of exporting your social misery, official corruption, and fiscal irresponsibility to another, weaker people.

Implosion

One only has to look at the "German miracle" of the 1930’s to see this progression from artificial stimulus, to domestic seizure of assets, to scapegoating and aggressive wars of acquisition, as described above. But this progress out of economic depression had made Hitler and Mussolini the darlings of Wall Street and the international financiers. Indeed, Time Magazine had even named Hitler their "Man of the Year" for this economic miracle, even though it was a fraudulent house of cards.

If the Fed continues to apply monetary stimulus and subsidy into this system, without a significant reform, the dollar will eventually "break" and the real economy will temporarily collapse. This will result in the mother of all stagflation, with a hyperinflationary edge to it, and a breakdown in the electoral process, the rise of demagogues, and soaring interest rates.

At this point the cure will not be a monetary stimulus, but more like a surgery to remove a life-threatening cancer, fraught with risk and a significant challenge to the continuing governance of the US not seen since the 1860’s.

Conclusion

As you know, our own judgement on this is that we will go through a cycle of demand deflation, which we are in now, and then most likely a pernicious stagflation which may see some episodes that will be remniscent of the inflation of the 1970’s. A persistent deflation with a stronger dollar, as well as hyperinflation, seem to be outliers that are dependent on exogenous factors.

If the world dumped its dollars tomorrow, we would see a US hyperinflation. If the Fed raised short term rates to 20 percent tomorrow under duress we would see a ture monetary deflation. As a reminder, in a purely fiat currency regime with an absence of external standards, the question of iflation and deflation is a policy decision. The limiting factor is the latitude with which that policy decision can be made.

The most probable path is a lingering death for the dollar over the next ten years, with a produtive economy that continues to stagger forward under the rule of the financial oligarchs.

See Money Supply: A Primer and Price Demand and Money Supply As They Relate to Inflation and Deflation. You might also take a look at Some Common Fallacies About Inflation and Deflation and Gold: Until the Banks Are Restrained and Balance Is Restored. And finally, if you intend to trade and invest in these markets, you really ought to take a look at A Priori Vs. Empirical Reasoning and Practical Decision-Making.