Here’s Mish’s Response to Chris Martenson’s One Hand Clapping Theory. – Ilene

One Hand Clapping Theory Analyzed

Courtesy of Mish

Courtesy of Mish

Numerous people have asked me to comment on Chris Martenson’s article The Sound of One Hand Clapping – What Deflationists May Be Missing.

Chris Writes:

The hot topic of the day is "Inflation or Deflation?" and the camps are firmly divided into groups of inflationistas and deflationistas. When asked which camp I am in, I reply "Yes." Some would say that puts me in the confusionista camp, but I actually have an explanation for why are living in a world encompassing both.

From a technical perspective, we are absolutely in one of the most powerfully deflationary periods in history, yet, besides housing prices and a few over-produced consumer goods, we find that stocks, bonds, and commodities are all well-bid at the moment.

While we can ascribe some of this to the artificial wall of liquidity (come to think of it, is there any other kind?) currently being thrown into the financial market(s) by the Fed, it leaves hanging the question of why that money is not being completely swallowed into the bottomless black hole that the deflationist camp says lies at the heart of our current financial system.

And they are right; there is a black hole at the center. If we treat the credit doubling that occurred between 2000 and 2008 (from $26 to $52 trillion) as a normal bubble that will follow the same pattern of decline as numerous historical bubbles, then we might reasonably predict that some $26 trillion of debt will somehow "go away" over the next 6 years. This is indeed a massive black hole.

Mish: So far so good. No one should argue with the idea that we are in the "one of the most powerfully deflationary periods in history". However, many do so anyway, typically based on faulty definitions of inflation and deflation.

The pertinent question now is: does one judge a deflationary period by what stocks and corporate bonds are doing "at the moment"?

Creative Destruction

Let’s take a look at things in an appropriate timeframe.

Please consider some excerpts from Creative Destruction

Two Lost Decades

The Japanese Stock Market is about 25% of what it was close to 20 years ago! Yes, I know, the US is not Japan, that deflation can’t happen here, etc, etc. Of course deflation did happen here, so the question now is how long it lasts.

The five month, 50% rebound in the S&P 500 was certainly spectacular. However, the more important question is where to from here?

Take a look at Japan’s "Two Lost Decades" for clues.

Creative destruction in conjunction with global wage arbitrage, changing demographics, downsizing boomers fearing retirement, changing social attitudes towards debt in every economic age group, and massive debt leverage is an extremely powerful set of forces.

Bear in mind, that set of forces will not play out over days, weeks, or months. A Schumpeterian Depression will take years, perhaps even decades to play out.

The chart shows that over the last two decades, Japan had four rallies of 50% or greater, yet two decades later the Nikkei is 75% off its peak.

Is it impossible for that to happen here?

Chris:

Yet everything just keeps perking along. What gives?

The answer, I believe, requires us to ask a Zen-like question along the lines of, "What is the sound of one hand clapping?" That question is, "If nobody recognizes a defaulted debt on their balance sheet, does it exist?"

Suppose, for the sake of argument, that there is a world in which banks are allowed by their regulators to pretend their default losses simply do not exist. And, even more outlandishly, some of these banks are allowed to sell heavily damaged loans to their central bank at nearly their full original price.

What does "deflation" mean in such a world? Not much, as it turns out. At least from a monetary perspective, because money is not being destroyed at nearly the rate that would be expected or predicted by the size and rate of the defaults.

Mish: Just because the market is ignoring something now, does not mean it will continue to do so forever.

Furthermore, the pretending (or as Chris puts it "If nobody recognizes a defaulted debt on their balance sheet, does it exist?") started much sooner than just this March.

On March 29, 2008, I wrote SEC Openly Invites Corporations To Lie, a discussion of Securities and Exchange Commission letter on Fair Value Measurements that openly invited corporations to lie.

Not Practical To Tell The Truth

Inquiring minds are also considering Not Practical To Tell The Truth, written August 1, 2008.

FASB Postpones Off-Balance-Sheet Rule for a Year

The Financial Accounting Standards Board postponed a measure, opposed by Citigroup Inc. and the securities industry, forcing banks to bring off-balance-sheet assets such as mortgages and credit-card receivables back onto their books.

FASB, the Norwalk, Connecticut-based panel that sets U.S. accounting standards, voted 5-0 today to delay the rule change until fiscal years starting after Nov. 15, 2009. The board needs to give financial institutions more time to prepare for the switch, FASB member Thomas Linsmeier said at a board meeting.

"We need to get a new standard into effect," Linsmeier said, though "it’s not practical" to begin requiring companies to put assets underlying securitizations onto their books this year.

Citigroup Weekly Chart

click on chart for sharper image

The SEC openly invited corporation to lie on March 31, 2008. On July 30, 2008, the FASB postponed mark-to-market rules until November 2009. They will most likely be postponed again.

Did those actions prevent Citigroup from crashing? Ambac? AIG? Fannie Mae? MBI? Anything?

Chris:

Trillions in probable and provable losses quietly exist, out of sight, on the balance sheets of the Federal Reserve and other financial institutions. If they ever come out of hiding and onto the books, I think the deflationists will be proven correct beyond all doubt.

But let me ask this: What prevents the authorities from simply storing them out of sight forever? Or at least long enough to allow the wave of liquidity to work its inevitable magic? So far, much to my great surprise, they’ve managed to do exactly that, with hardly a squeak from the mainstream press (although the blogsphere is on the job, as usual). I am now wondering if they cannot keep this up indefinitely.

If banks really believed their own mark-to-fantasy marks they would be lending. Instead, we see this.

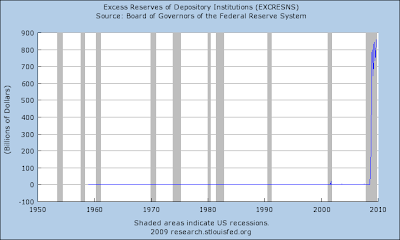

Excess Reserves At Depositary Institutions

Does that look like banks believe their own mark?

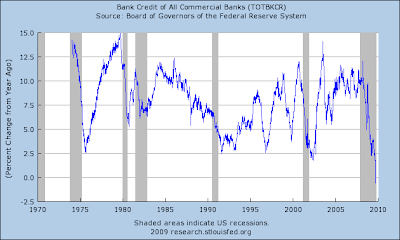

Bank Credit All Commercial Banks

Total Bank Credit is negative year-over-year for the first time in the data series, since 1974.

Chris:

So from a purely monetary perspective, money can only be "destroyed" if banks and other financial institutions are compelled to recognize the losses and take a hit to capital. If the loss is not recognized, no money is destroyed. At least it is not recognized as gone.

I like the structure of the argument because it implies agreement with my definition of deflation: A net contraction of money supply and credit, with credit being marked-to-market.

Indeed, in a credit based economy, it is vital to consider credit in any analysis of inflation and deflation.

However, argument itself is flawed. Money (credit really and there is a huge difference) is logically destroyed as soon as market participants realize things for what they are. All the pretending in the world can only have limited temporary effect as the share price of Citigroup, MBI, Ambac, Fannie Mae, Freddie Mac shows.

Greenspan Chastised Japan Over Failure To Write Down Debt

One irony in this mess is that Greenspan and the fed openly criticized Japan for failure to write down debts, telling Japan that writeoffs were the best way to end deflation.

Japan refused to do so. Did it help?

Japan refused to do so. Did it help?

All the pretending in the world, along with all its quantitative easing did not halt a deflationary collapse in Japan.

Will Pretending Work Here?

Japan has proven that pretending does not work, yet we try it anyway. And now the stock market has risen over 50% from the lows. Is this because of the pretending, or in spite of the pretending? There was a massive stock market rally early in 1930 as well.

Given that the pretending started 18 months ago with invitations to lie and suspension of rules, it’s a mistake to assign pretending as the reason for this rally.

In a credit based economy, the odds of a sustainable rebound without bank credit expanding, and consumers participating is not very good.

Even if one mistakenly assumes that the recent rally is a result of pretending, should we count on sustained success now more so than a measurement of stock prices in April of 1930, or any of Japans’ four 50% rallies?

I think not. Pretending cannot accomplish much other than prolonging the agony for decades. This is the message of Japan.

Moreover, the US is arguably is worse shape than Japan because our problems are unsustainable consumer debt, high unemployment, and massive retail sector overcapacity.

Those are structural problems that no amount of pretending in the world can possibly cure. In due time, the market will focus on those problems.

Question Answered

Thus, careful analysis shows the answer to the question: "If nobody recognizes a defaulted debt on their balance sheet, does it exist?" is yes.

Pretending that defaulted debts do not exist is itself the "Sound of one hand clapping". It did not work for Japan, and it will not work here.

Japanese scene photo courtesy of Crestock. See more high quality stock photos by visiting Crestock.