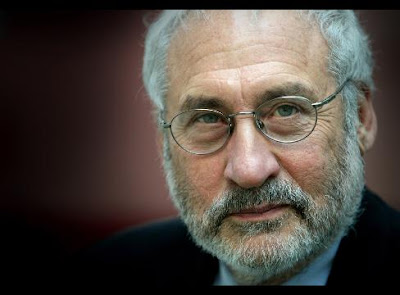

Stiglitz: The Banks Must Be Restrained, The Financial System Must Be Reformed

Courtesy of Jesse’s Café Américain

Courtesy of Jesse’s Café Américain

"We will have another armed robbery unless we prevent the banks, the banks that are too big to fail. We should say that if you’re too big to fail then you are too big to be. They need more restrictions, such as no derivative trading.” Joe Stiglitz

If a Nobel Prize winner in economics says the obvious, besides a few diligent bloggers, perhaps other economists will obtain ‘air cover’ in speaking about the economic and regulatory absurdity taking place today in the US and the UK. Winning the Nobel is even better than tenure.

Here is a video of his speech in Brussels, because this Bloomberg article leaves out some of the more ‘pithy’ remarks on the Wall Street bank bonuses, the errors efficient market theory, political and ideological capture, lies (his wording) told by central bankers including Alan Greenspan, unproductive "taxes" by banks on the real economy, ‘criminal’ management of beta, and the social costs of this financial crisis from Joe Stiglitz from the Brussels banking conference.

Stiglitz characterizes the reforms being put forward by the US Congress as completely wrong, and harmful. Watch the video, and compare what Joe Stiglitz is saying with the ponderous mendacity of Larry Summers, and you may better understand why Obama’s policies are doomed to failure.

It does not take much imagine to see how things might be quite different if Joltin’ Joe was the Chief Economic Advisor or Fed Chairman, rather than ‘Last War’ Larry or Zimbabwe Ben.

Again, here is a link to this ‘must see’ video which can be a bit slow to start because of Bloomberg’s video platform.

Bloomberg

Stiglitz Says Banks Should Be Banned From CDS Trading

By Ben Moshinsky

October 12, 2009 06:28 EDT

Oct. 12 (Bloomberg) — Large banks should be banned from trading derivatives including credit default swaps, said Joseph Stiglitz, the Nobel prize-winning economist.

The CDS positions held by the five largest banks posed “significant risk” to the financial system, Stiglitz said at a press conference in Brussels. Big banks should have extra restrictions placed on them, including a ban on derivative trading, because of the risk that they would need government money if they fail, he said in a speech today.

“We will have another armed robbery unless we prevent the banks, the banks that are too big to fail,” Stiglitz said. “We should say that if you’re too big to fail then you are too big to be. They need more restrictions, such as no derivative trading.”

Derivative trading and excessive risk-taking are blamed for helping to spark the worst financial crisis since World War II. American International Group Inc., once the world’s largest insurer, needed about $180 billion of government money after its derivative trades faltered and pushed the company toward bankruptcy.

Derivative trading and excessive risk-taking are blamed for helping to spark the worst financial crisis since World War II. American International Group Inc., once the world’s largest insurer, needed about $180 billion of government money after its derivative trades faltered and pushed the company toward bankruptcy.

Financial markets should be subject to taxes that will discourage “dysfunctional” trading and help pay for the effects that the global crisis had on poorer nations, Stiglitz said last week.

U.S. and European regulators have pushed for tighter regulation of the $592 trillion over-the-counter derivatives market, amid concerns that it could create systemic failures in the financial system. Lawmakers have called for global rules covering derivatives to prevent financial institutions from exploiting jurisdictional differences in regulation.

Stricter Standards

Former German finance minister Hans Eichel said in an interview today that global regulation would ultimately be needed. The European Union should enforce tougher legislation, even if the U.K. is reluctant to adopt stricter standards, he said.

“The Eurozone is strong enough economically to go it alone,” Eichel said. European legislation could then become the blueprint for global rules, said Eichel.