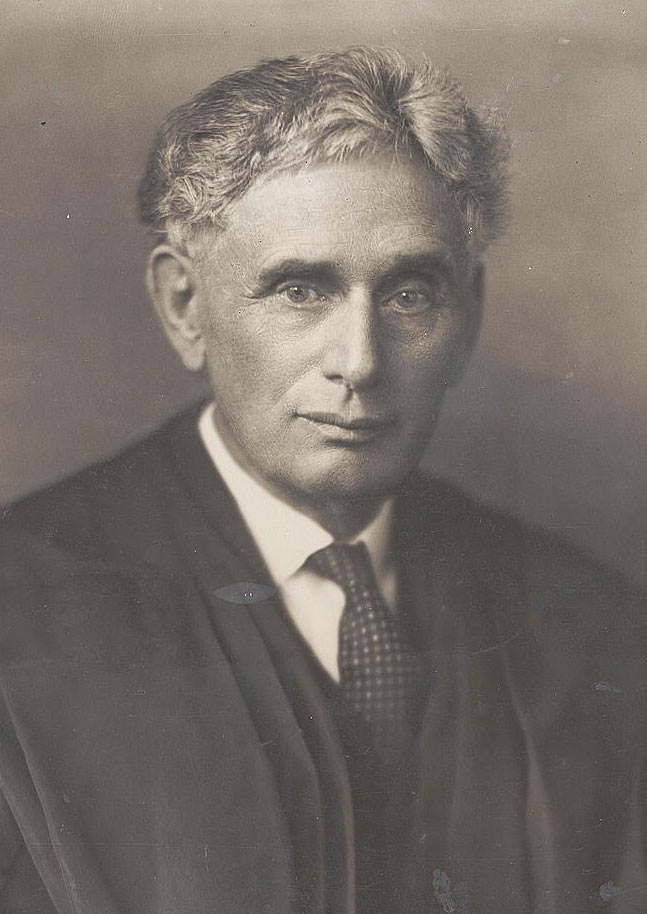

Perhaps the best introduction to this terrific article by (the other) George Washington is in the comment section. So why should we care about the crimes and the cover ups? Our freedom depends on our government enforcing and abiding by the law. It’s apparent that we are headed down the slippery slope Justice Louis Brandeis describes in Olmstead v. United States (1928):

"In a government of laws, the existence of the government will be imperiled if it fails to observe the law scrupulously. Our government is the potent, the omnipotent teacher. For good or ill, it teaches the whole people by its example. Crime is contagious. If government becomes a lawbreaker it breeds contempt for law: it invites every man to become a law unto himself. It invites anarchy."

We have the Federal government’s massive and flagrant display of lawlessness, and population somewhere on the way from apathy to dependency in the Fatal Sequence cycle of civilization. Not winning a combination if you ask me. – Ilene

The Ongoing Cover Up of the Truth Behind the Financial Crisis May Lead to Another Crash

Courtesy of George Washington’s Blog

William K. Black – professor of economics and the senior regulator during the S & L crisis – says that that the government’s entire strategy now – as during the S&L crisis – is to cover up how bad things are ("the entire strategy is to keep people from getting the facts").

Indeed, as I have previously documented, 7 out of the 8 giant, money center banks went bankrupt in the 1980’s during the "Latin American Crisis", and the government’s response was to cover up their insolvency.

Black also says:

There has been no honest examination of the crisis because it would embarrass C.E.O.s and politicians . . .

Instead, the Treasury and the Fed are urging us not to examine the crisis and to believe that all will soon be well.

PhD economist Dean Baker made a similar point, lambasting the Federal Reserve for blowing the bubble, and pointing out that those who caused the disaster are trying to shift the focus as fast as they can:

The current craze in DC policy circles is to create a "systematic risk regulator" to make sure that the country never experiences another economic crisis like the current one. This push is part of a cover-up of what really went wrong and does absolutely nothing to address the underlying problem that led to this financial and economic collapse.

Baker also says:

"Instead of striving to uncover the truth, [Congress] may seek to conceal it" and tell banksters they’re free to steal again.

Economist Thomas Palley says that Wall Street also has a vested interest in covering up how bad things are:

That rosy scenario thinking has returned to Wall Street should be no surprise. Wall Street profits from rising asset prices on which it charges a management fee, from deal-making on which it earns advisory fees, and from encouraging retail investors to buy stock, which boosts transaction fees. Such earnings are far larger when stock markets are rising, which explains Wall Street’s genetic propensity to pump the economy.

The media has largely parroted what the White House and Wall Street were saying. As a Pew Research Center study on the coverage of the crisis found:

The gravest economic crisis since the Great Depression has been covered in the media largely from the top down, told primarily from the perspective of the Obama Administration and big business, and reflected the voices and ideas of people in institutions more than those of everyday Americans…

Citizens may be the primary victims of the downturn, but they have not been not the primary actors in the media depiction of it.

A PEJ content analysis of media coverage of the economy during the first half of 2009 also found that the mainstream press focused on a relatively small number of major story lines, mostly generating from two cities, the country’s political and financial capitals.

A companion analysis of a broader array of media using new “meme tracker” technology developed at Cornell University finds that phrases and ideas that reverberated most in the coverage came early on, mostly from government, particularly from the president and the chairman of the Federal Reserve…

- Three storylines have dominated: efforts to help revive the banking sector, the battle over the stimulus package and the struggles of the U.S. auto industry. Together they accounted for nearly 40% of the economic coverage from February 1 through August 31. Other topics related to the crisis have been covered much less. As an example, all the reporting of retail sales, food prices, the impact of the crisis on Social Security and Medicare, its effect on education and the implications for health care combined accounted for just over 2% of all the economic coverage.

Actions by government officials and business leaders drove much of the coverage. The White House and federal agencies alone initiated nearly a third (32%) of economic stories studied through July 3. Business triggered another 21%. About a quarter of the stories (23%) was initiated by the press itself and did not rely on an external news trigger. Ordinary citizens and union workers combined to act as the catalyst for only 2% of the stories about the economy.

Fully 76% of the datelines on economic stories studied during the first five months of the Obama presidency were New York (44%) or metro Washington D.C. (32%). Only about one-fifth (21%) of the stories originated in any other city in the U.S., and about a quarter of those emanated from two other major media centers: Atlanta and Los Angeles.

As I have previously reported, concentration in the mainstream media (along with a number of other dynamics) has severely undermined the credibility of the media.

Why Should We Care?

Why should we care if there has been a cover up?

Well, initially, if there has been activity which is harmful to the economy and may lead to another financial crisis, wouldn’t we want to know about it, so that we prevent it from happening again?

The answer is obviously yes.

But if the government, Wall Street, and the media are all in cover-up mode, then independent auditors, financial analysts and economists cannot shine a light into financial practices to find out what really went wrong.

In addition, if we don’t know what’s really going on, we can’t gauge whether the government’s economic policies are working. For example, Time Magazine called Tim Geithner a "con man" and the stress tests a "confidence game" because those tests were so inaccurate.

William Black said:

How do you think we did the stress tests? Like doing a stress test on an airplane wing, but you don’t actually have airplane wing. And don’t know what airplane wing is made out of. It’s a farce.

I agree.

Without accurate information, we will not know if we’re heading in the right or the wrong direction.

Fraud

One of the foremost experts on structured finance and derivatives – Janet Tavakoli – says that rampant fraud and Ponzi schemes caused the financial crisis.

University of Texas economics professor James K. Galbraith agrees:

You had fraud in the origination of the mortgages, fraud in the underwriting, fraud in the ratings agencies.

Congress woman Marcy Kaptur says that there was rampant fraud leading up to the crash (see this and this).

According to economist Max Wolff:

The securitization process worked by "packag(ing), sell(ing), repack(aging) and resell(ing) mortages making what was a small housing bubble, a gigantic (one) and making what became an American financial problem very much a global" one by selling mortgage bundles worldwide "without full disclosure of the lack of underlying assets or risks."

Buyers accepted them on good faith, failed in their due diligence, and rating agencies were negligent, even criminal, in overvaluing and endorsing junk assets that they knew were high-risk or toxic. "The whole process was corrupt at its core."

William Black says that massive fraud is what caused the economic crisis. Specifically, he says that companies, auditors, rating agencies and regulators all committed fraud which helped blow the bubble and sowed the seeds of the inevitable crash. And see this.

Indeed, as I have previously noted, the giant ratings agencies have a culture of covering up improper ratings (and they essentially took bribes for giving higher ratings).

- Everyone involved knew that the CDOs which packaged subprime loans were not AAA credit-worthy (which means that they are completely risk-free). He also said that the exotic instruments (CDOs, CDS, etc.) which spun the mortgages into more and more abstract investments were intentionally created to defraud investors

- The government knew about mortgage fraud a long time ago. For example, the FBI warned of an "epidemic" of mortgage fraud in 2004. However, the FBI, DOJ and other government agencies then stood down and did nothing. See this and this

- "Accounting is the weapon of choice in the financial sphere", with the top executives involved in these fraudulent schemes vacuuming out huge profits for themselves and select insiders, and having auditors rubber stamp what’s being done

- In November 2007, one rating agency – Fitch’s – dared to take a look at some loan files. Fitch concluded that there was the appearance of fraud in nearly every file reviewed

Black and economist Simon Johnson also state that the banks committed fraud by making loans to people that they knew would default, to make huge profits during the boom, knowing that the taxpayers would bail them out when things went bust.

The Economy Won’t Recover Until We Prosecute

So there was a little fraud, no big deal, right?

Wouldn’t looking backwards at fraudulent conduct be distracting for the people, the government, and the economy? Shouldn’t we look forward so we can recover?

No.

Specifically, the Wharton School of Business has written an essay stating that restoring trust is the key to recovery, and that trust cannot be restored until wrongdoers are held accountable.

The Wharton paper states:

The public will need to "hold the perpetrators of the economic disaster responsible and take what actions they can to prevent them from harming the economy again." In addition, the public will have to see proof that government and business leaders can behave responsibly before they will trust them again…

For more on the importance of trust in the economy, see this.

The stakes are high. As Pam Martens, who worked on Wall Street for 21 years, writes:

The massive losses by big Wall Street firms, now topping those of the Great Depression in relative terms, have yet to be adequately explained. Wall Street power players are obfuscating and Congress is too embarrassed or frightened to ask, preferring to just throw money at the problem and hope it goes away. But as job losses and foreclosures mount and pensions and 401(k)s shrink, public policy measures to address the economic stresses require a full set of unembellished facts…

It was four years after the crash of 1929 before the major titans of Wall Street were forced to give testimony under oath to Congress and the full magnitude of the fraud emerged. That delay may well have contributed to the depth and duration of the Great Depression. The modern-day Wall Street corruption hearings in Congress … must now resume in earnest and with sworn testimony if we are to escape a similar fate.