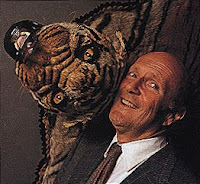

Julian Robertson’s Interview With The Financial Times

Courtesy of Market Folly

On his recent media escapade, Tiger Management founder and hedge fund legend Julian Robertson stopped off to chat with the Financial Times about many topics. He has been out talking a lot about his curve caps play lately where he essentially is buying puts on long-term treasuries as he expects prices to fall and yields to rise. Julian again touched on this position in this interview but we want to turn the focus to other topics that he hasn’t previously discussed in his other recent media appearances. Here are some notable excerpts from the Tiger Management founder and hedge fund legend’s interview with the FT:

On his recent media escapade, Tiger Management founder and hedge fund legend Julian Robertson stopped off to chat with the Financial Times about many topics. He has been out talking a lot about his curve caps play lately where he essentially is buying puts on long-term treasuries as he expects prices to fall and yields to rise. Julian again touched on this position in this interview but we want to turn the focus to other topics that he hasn’t previously discussed in his other recent media appearances. Here are some notable excerpts from the Tiger Management founder and hedge fund legend’s interview with the FT:

"Julian Robertson on market cycles and hedge funds

FT: You were famously bearish about technology stocks ahead of, during the tech bubble; did that experience influence you in predicting 2007, 2008?

JR: No, I don’t think so. What really caused me to predict the problems we had in 2007 and 2008 was the fact that we were spending so much more and no one was balancing the budget; no family can keep doing that forever, no corporation can keep doing that forever, and no nation can continue doing that forever. I think that’s, we did it on all three fronts; as individuals we did it, as corporations we did it, and as a nation we did it – and it blew up in our face.

FT: Why do you think corporations and in particular financial institutions were so bad at seeing that; why did they keep on dancing too long?

JR: Well, I think it goes back to greed and bad judgement, I mean that’s the thing I see. A lot of people were trying to get more risk in their balance sheets, they really were during that period, and once the risks caused their problems they then rushed out and blamed hedge funds – and that was ridiculous. These people were responsible for their own problems because they had levered up too much and made some very bad investments.

FT: One of the fascinating things about your own performance as a fund manager, particularly around the tech bubble is, you were right, but being right wasn’t such a great thing to be. How can people use that experience in the decisions that they make in their investments?

JR: Well, you’ve hit on something that I think is worthy of comment. I don’t believe people can invest for the short term; I think people can make good long-term bets, but I certainly don’t know what’s going to happen over the next six months. But I do know we’ve got to face this problem of the major purchaser of our bonds maybe not being around later, maybe not being around to bail us out, and I think that’s something we have to look at seriously. And because there is such a serious problem for us, that causes me to probably be missing out on a lot of the profitability that is inherent in today’s stock market.

FT: And you’re prepared to do that, you’re willing to miss out?

JR: Oh, yes.

FT: Why?

JR: Because I think the risks are too great, and I think the risks are too great to play that bigger fool game. Right or wrong, I’m going to be my best judgment; that’s what I’m supposed to do.

FT: Is it more important to avoid the big losses than to go for the short-term profitability?

JR: Let me put it this way; to avoid the big losses, if you can do that you can be an unbelievably successful money manager – that’s the big thing to do, is avoid the big losses. Now, right now a lot of people are not doing as well as they ordinarily would do, because they are taking a rather jaundiced approach because of the possibilities that are out there in the economic situation.

FT: A lot of people in 2007, 2008 were predicting that we would see the hedge fund industry decimated; is that going to happen?

JR: No ma’am, it is not going to happen. People are missing what is the best thing about hedge funds, and the best thing about hedge funds is that it is the best method of paying a good manager. So good managers will continue to go to the end of the hedge fund business, and I can assure you that most of us in the hedge fund business would rather compete with a bank, an insurance company, a mutual fund, or anybody rather than another hedge fund because they, generally speaking, are smart operators. And there’s a lot of built in restraints here; I mean in most instances the hedge fund owner has virtually all of his money in his hedge fund, so he’s not going to go wild risking every penny he’s got – and I think that’s a cause that the hedge fund industry will be one of those that breeds a lot of people who are very risk averse and who, in turn, will not have these huge losses. I think, far from being discouraged, I think we are about now to see a real rebound in hedge fund assets.

FT: Does this conservative bent mean you’re very interested in gold right now?

JR: I’m interested in gold but not for the reason that a lot of other people are interested. First let me say, I don’t believe in gold – no one has ever, since it was ever discovered, really ever used up any gold. So all of it is here, there’s no supply and demand situation; you can’t eat it. So I think it’s a psychological store of value and I think that probably a psychiatrist is better able to analyse gold than I am. But we do have here the world’s, I think, leading authority on gold – as a matter of fact, he’s giving a talk downstairs now – and I think that’s why we seated him was because I knew he was the world’s best in this.

FT: And who was that?

JR: Not because I believed in gold; because I don’t believe in gold. But he is competing … he’s the perfect example of what you look for when you’re a hedge fund manager. You look to get a good hitter; you look to have Babe Ruth playing in a little league game.

FT: So who is your Babe Ruth of gold?

JR: You can check him out but he’s a terrific man, and probably has as good a record as anybody in the world over the last five years. And one of the other things about gold – not just the gold bugs who, generally speaking, are some of the craziest people on the face of the globe, but people like me who suddenly get worried and people like you who are concerned about inflation and you say, show me how do I get into gold? And our man will say, Julian, you don’t get into gold now; the price of mining gold, the cost of mining gold is going down very fast and it’s very possible that the companies can make a fortune on the planning price of gold, simply because the costs are going down. So the point is, to buy gold stocks instead of gold.

FT: Are there any parts of the world that you’re more bullish about – maybe China, for example?

JR: I think it’s good to find countries that look very good. Norway has four million, probably, people with maybe the highest net worth of any country in the world. I suppose the Middle Eastern countries have a higher per capita net worth, but Norway certainly has a high net worth; the Norwegians do. And they have the great oil resources; they also have huge reserves which have been reinvested in stocks and other things, which are the result of their oil reserves which the government has sold. It’s quite an amazing little country of great companies, great people and the proper type of, I’d say, spending by government.

You can also watch Julian’s video interview in a 3-part series starting with part 1 here. At the end, they also played a game of ‘long/short’ where Julian identified some of his favorite plays at the moment:

"LONG/SHORT

FT: US dollar?

JR: Short.

FT: Copper?

JR: A belated short.

FT: Google?

JR: Long.

FT: Gold?

JR: Gold stocks.

FT: Goldman Sachs?

JR: Bullish.

FT: Australian dollar?

JR: Bullish.

FT: Barack Obama?

JR: Ambivalent.

FT: Visa?

JR: Love it.

FT: China?

JR: Don’t understand it; trying to understand it and a great opportunity for a long/short fund.

FT: Apple?

JR: Long."

Thanks to the FT for another great interview. We think a key point he touches on here is the notion of focusing on avoiding big losses rather than gunning for big gains. That’s what can truly set a fund manager apart from others an where the true talent shines. Generating returns in a market rally is one thing, but protecting from drawdowns is an entirely different beast. We also found it curious that Robertson avoided the question as to who his ‘Babe Ruth of Gold’ was. Anybody out there have any ideas as to which manager he might be talking about? Robertson has seeded a bunch of managers, so we can certainly narrow down the list but just found it peculiar he wouldn’t outright mention the manager’s name.

Lastly, we found it intriguing that Robertson finds gold stocks more appealing than gold itself. Many other prominent hedge fund managers we cover have entered gold plays over the course of the past year so it’s always good to find someone who has a bit of a different opinion regarding the precious metal. For more recent insight from hedge fund legend Julian Robertson, make sure to check out his Bloomberg interview, as well as our detailed post on his curve caps play which he has been talking about a lot recently. If you’re not familiar with Robertson, then read up on him here.

Source: FT interview