What a morning already!

What a morning already!

The Dow is up 100 points since 10pm in the futures (as of 7:30 am), having fallen almost 100 points between Friday’s close and Sunday night as early Asian trading sold the markets off heavily. Gold is back at 1,055 now but oil is failing to hold $79, although we usually get the big push right before the US open to maximize the effect. Thank goodness actually as we took some new bullish positions last week (as noted in the weekly wrap-up) and it would have been very annoying to think we wasted our time trying to get more a little more bullish just when the market started falling apart (although we did maintain our 55% bearish stance over the weekend).

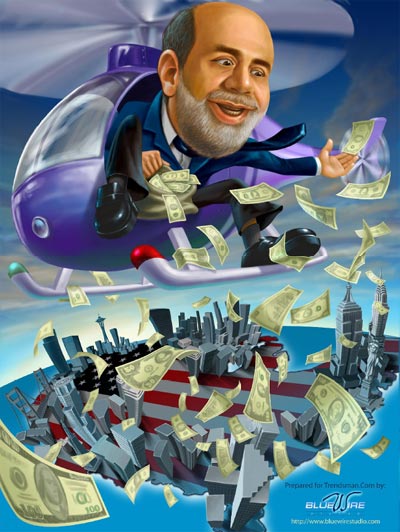

Bernanke spoke at the Fed’s Asia Economic Policy Conference, that the world financial crisis signals the need for global rebalancing. Though Mr. Bernanke didn’t specifically set out what rebalancing means, most interpret that to mean that debtor countries like the U.S. save more and that countries with surpluses like China spend more. It also could mean the dollar weakening at the expense of other rivals. Bernanke is due to make another speech on Asia and the financial crisis this morning at 11 am. Harvard’s Niall Ferguson says the dollar may fall another 20% in the next two to five years – the "simplest solution to most of America’s problems," but terrible news for everyone who isn’t the U.S. or China.

England went market boosting crazy this morning with talk of the BOE extending their asset-purchase program to help revive the economy. That means the worse the British economy looks in upcoming data, the more chance of stimulus and the better for the markets so bad news will be good news for the bulls (not dissimilar from US market logic). Meanwhile, London home prices rose to record HIGHS as there is now a shortage of properties for sale. The average cost of a home in the capital rose 6.5 percent, the most since records began in 2002, to 416,157 pounds ($680,000), the owner of the U.K.’s biggest residential property Web site said today in a statement. Prices climbed 2.8 percent across Britain as transaction levels dropped by half from 2007. So, no one is buying any homes but, if they do – they cost a lot!

China chipped in with global cheerleading this morning, forecasting a sharp rise in Q3 GDP to 9% from the Chinese Academy for Social Sciences, helping lift economic expansion for the full year to a projected 8.3%, the report said. But others expressed doubts, saying Chinese bureaucrats are likely massaging financial data to meet the economic targets laid out by the government. Thailand-based economist Marc Faber said in September he doesn’t trust the government’s numbers. In reality, he believes, the mainland economy is growing at around 3%.

I’m inclined to agree with Faber as the FACT is that, in another sign of how deep the global recession has become, the ports of Los Angeles and Long Beach on Friday reported their worst combined import statistics for September in nine years. September is often the busiest month at the nation’s biggest port complex, making it one of the best barometers of the health of the economy and international trade. The port of Los Angeles received 309,078 containers packed with imported goods in September, representing a decline of 16% from the same month last year and 27% from September 2006.

I’m inclined to agree with Faber as the FACT is that, in another sign of how deep the global recession has become, the ports of Los Angeles and Long Beach on Friday reported their worst combined import statistics for September in nine years. September is often the busiest month at the nation’s biggest port complex, making it one of the best barometers of the health of the economy and international trade. The port of Los Angeles received 309,078 containers packed with imported goods in September, representing a decline of 16% from the same month last year and 27% from September 2006.

The Hang Seng didn’t care about the fact that none of the goods being produced in China are being shipped anywhere and that index recovered from a 150-point gap down at the open to put up a 270-point gain for the day, finishing right at 22,200 on the button, almost the EXACT same spot they were gapped up to on Thursday morning but couldn’t hold. Thank goodness we’ve been assured that this market isn’t manipulated or a move like that may seem suspicious… The Shanghai put up a 2% gain on the day and the Nikkei pulled an amazing 100-point stick save into the close, that didn’t quite get them green but did bring them back to — SURPRISE — Thursdays gap up open at 10,236.

In an AMAZING coincidence, the FTSE gapped up this morning to Thursday’s open at 5,260, the DAX zoomed up 1.25% to 5,820 and is still 40 points shy (.75%) of hitting Thursday’s 5,860 so we’ll keep an eye on them and the CAC is also up at the 1.25% mark and right on the button for Thursday’s open at 3,880. I could tell you about the news over in Europe but really, what’s the point? Do you really think that millions of people reading the news and reaching individual invesment decisions have anything at all to do with this kind of market movement?

In an AMAZING coincidence, the FTSE gapped up this morning to Thursday’s open at 5,260, the DAX zoomed up 1.25% to 5,820 and is still 40 points shy (.75%) of hitting Thursday’s 5,860 so we’ll keep an eye on them and the CAC is also up at the 1.25% mark and right on the button for Thursday’s open at 3,880. I could tell you about the news over in Europe but really, what’s the point? Do you really think that millions of people reading the news and reaching individual invesment decisions have anything at all to do with this kind of market movement?

So let’s look at what does matter – where were the US markets on Thursday morning? Dow 10,014, S&P 1,090, Nasdaq 2,164, NYSE 7,182 and Russell 621. Those are going to be this morning’s "must hold" levels for the bulls and then we have last week’s highs to make if they want to really impress us and those were Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623. While we’re at it we can watch SOX 335 and the high of 338 as well as the Transports, which topped out at 1,989 on Wednesday and fell hard but bounced to close at 1,968 on Friday.

When fundamentals don’t work, we play the technicals so we’ll be watching the action today and ready to press our bets on the working side as we’re fairly well-balanced overall and happy to partake in additional market madness if that’s where we’re going but we’re certainly NOT going to make the mistake of thinking about it. We’ll just be watching our levels and acting accodingly. Our long plays are mainly hedged as we weren’t expecting a real breakout while our short plays are more directional so adjustments do need to be made if we break over but that’s still an IF as pre-market moves, though impressive, don’t mean very much in the grand scheme of things.

Let’s be careful out there!