Here Comes the Monetary Expansion Bubble

Courtesy of Jesse’s Café Américain

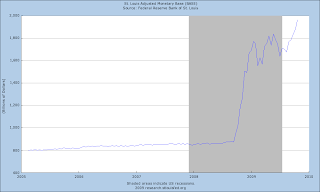

The best looking economy that debt money can buy. We have included some graphs to put this in perspective. But the bottom line is that the economy may be growing nominally based on an explosion in Federal Debt. We are almost certain that the debt is being applied in ways that will do no good, provide no sustained benefit, to anyone except a few narrow sectors and especially the FIRE sector.

The best looking economy that debt money can buy. We have included some graphs to put this in perspective. But the bottom line is that the economy may be growing nominally based on an explosion in Federal Debt. We are almost certain that the debt is being applied in ways that will do no good, provide no sustained benefit, to anyone except a few narrow sectors and especially the FIRE sector.

Too bad the chain deflator is broken, but it may catch up on adjustments. These positive numbers, especially if there is an upside surpise, are due to an unprecedented monetary inflation, not seen since the early 1930’s, and a bringing forward of future sales in automobiles through government programs.

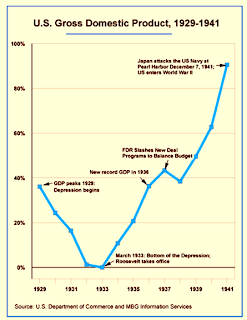

We would submit that despite the myths that have been spread, the programs instituted by FDR were significantly effective in providing the impetus to lift the US out of the Depression. However, most of the programs were later overturned by the Supreme Court, and the Fed prematurely tightened its monetary policy, caused an ‘echo slump’ in the late 1930’s.

There is a difference this time. FDR had accompanied his dollar devaluation (vis a vis its then gold standard, about 40%) and stimulus with programs that targeted job creation and reforms of the financial sector. There was the creation of the SEC, the advent of Glass-Steagall, and widespread investigations of the corruption of the late 1920’s.

We are seeing little to none of that today, since the stimulus is largely in the form of monetary inflation and debt creation, with a small amount going to jobs, and the vast majority of the money flowing to a relatively few Wall Street banks.

Stay out of the way of the propaganda rally, but watch for the double dip W in real life.

Bloomberg

GDP Probably Grew as Stimulus Took Hold: U.S. Economy Preview

By Timothy R. Homan

Oct. 25 (Bloomberg) — The economy in the U.S. probably grew in the third quarter at the fastest pace in two years as government stimulus helped bring an end to the worst recession since the 1930s, economists said before reports this week.

The world’s largest economy grew at a 3.2 percent pace from July through September after shrinking the previous four quarters, according to the median estimate of 65 economists surveyed by Bloomberg News. Other reports may show sales of new homes and orders for long-lasting goods increased.

The world’s largest economy grew at a 3.2 percent pace from July through September after shrinking the previous four quarters, according to the median estimate of 65 economists surveyed by Bloomberg News. Other reports may show sales of new homes and orders for long-lasting goods increased.

Americans flocked to auto showrooms and real-estate offices last quarter to take advantage of government programs such as “cash-for-clunkers” and tax credits for first-time homebuyers. Growing demand caused stockpiles to keep falling, which will prompt companies to rev up assembly lines and help sustain the recovery into 2010 even as unemployment climbs. [Click on charts for larger images.]

“The recovery is off to a decent but unspectacular start,” said Joe Brusuelas, a director at Moody’s Economy.com in West Chester, Pennsylvania. “While another large drawdown in inventories will be a drag on third-quarter growth, it sets the stage for a longer and stronger upturn in manufacturing.”

The Commerce Department’s report on gross domestic product is due Oct. 29. The four consecutive decreases through the second quarter marks the longest stretch of declines since quarterly records began in 1947. The economy shrank 3.8 percent in the 12 months to June, the worst performance in seven decades.

Stocks Climb

Stocks have rallied as earnings at companies from Caterpillar Inc. to Morgan Stanley topped estimates. Profits exceeded expectations at about 80 percent of the companies in the Standard & Poor’s 500 Index that have released results, according to Bloomberg data. That marks the highest proportion in data going back to 1993. The S&P 500 closed at a one-year high on Oct. 19.

Consumer spending last quarter probably jumped at a 3.1 percent annual rate from the previous three months, the biggest gain since the first quarter of 2007, the GDP report is also projected to show.

Consumer spending last quarter probably jumped at a 3.1 percent annual rate from the previous three months, the biggest gain since the first quarter of 2007, the GDP report is also projected to show.

September readings on household purchases, due from the Commerce Department on Oct. 30, may show the quarter ended on a soft note after the Obama administration’s car incentive expired the month before. Spending probably fell 0.5 percent last month as car sales slowed after jumping 1.3 percent in August, the biggest gain since 2001.

The so-called cash-for-clunkers program offered buyers discounts of as much as $4,500 to trade in older cars and trucks for new, more fuel-efficient vehicles. The plan boosted sales by about 700,000 vehicles, according to a Transportation Department estimate.

Homebuyer Credit

The administration’s $787 billion stimulus package, signed into law in February, included an $8,000 tax credit for first- time homebuyers that expires at the end of November.

New-home sales last month increased 2.6 percent to an annual pace of 440,000, the highest level since August 2008 and reflecting the boost from the credit, according to economists surveyed. The Commerce Department’s report is due Oct. 28.

New-home sales last month increased 2.6 percent to an annual pace of 440,000, the highest level since August 2008 and reflecting the boost from the credit, according to economists surveyed. The Commerce Department’s report is due Oct. 28.

Lawmakers in Washington are debating an extension of the credit through June, and are discussing expanding it to all buyers under an income cap.

A report from S&P/Case-Shiller home-price index due Oct. 27 may show home values in 20 U.S. metropolitan areas declined in the year ended August at the slowest pace since January 2008, according to the survey median.

More Orders

Orders for durable goods rose 1 percent in September, economists project the Commerce Department will report Oct. 28. A gain would be the fourth in the last six months and indicates companies are starting to invest in new equipment.

Business spending and housing “stand ready to provide the oomph necessary to generate continued optimism until consumer activity stabilizes,” said Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott LLC in Philadelphia.

Business spending and housing “stand ready to provide the oomph necessary to generate continued optimism until consumer activity stabilizes,” said Guy LeBas, chief fixed-income strategist at Janney Montgomery Scott LLC in Philadelphia.

Optimism among U.S. consumers in October is forecast to rise even as unemployment probably also increased, economists said. The Conference Board’s confidence index, due Oct. 27, climbed to 53.5 from 53.1, according to the survey median.

The economy will likely grow at a 2.4 percent annual rate from October through December, according to a Bloomberg survey earlier this month. GDP will also expand 2.4 percent next year and 2.8 percent in 2011, the survey showed, compared with an average of 3.4 percent growth over the past six decades.

“This has been the mother of all recessions in our working lifetime,” Jim Owens, Caterpillar’s chief executive officer, said on a conference call last week. The Peoria, Illinois-based company, the world’s largest producer of backhoes and bulldozers, predicted on Oct. 20 that sales may rise as much as 25 percent next year.

You might be surprised to see this chart of GDP in the United States from 1929 to 1940. See The FDR Failed Myth for more information. If there is a difference with our current monetary expansion, which is on a par with the Fed actions in 1933 and the exit from the domestic gold standard, it is that the vast majority of the liquidity is going directly to the banks this time, and not to the public and for specific employment projects. It is a New Deal for the wealthy financiers.