Thank you all for bearing with me on the missed report yesterday. What a day Wednesday was for us though, as we had three big winners. The first was our Buy Pick of the Day Direxion Daily Bear Housing ETF (DRV). We chose to go with DRV directly after we saw the homebuilder news on new home sales was poor and had missed earnings. We got in at 20.75 and exited at 21.46 for a solid 3% gain. Our Short Sell Pick of the Day was another winner, as well. We got into Switch and Data Facilities (SDXC) at 17.60, and we were able to exit for a great 2% gain at 17.25. The stock just missed our 3% exit. Finally, our Longer Play of Aetna Inc. (AET) worked out well for us. We were able to exit on our third day of holding for a solid 2% gain, entering at 25.25 and exiting at 25.80. If we had sold on Tuesday, we could of had a much better sale price, and if you held into earnings, we could have made around 10%. We still made a nice chunk of change. That is what matters in this market.

Thank you all for bearing with me on the missed report yesterday. What a day Wednesday was for us though, as we had three big winners. The first was our Buy Pick of the Day Direxion Daily Bear Housing ETF (DRV). We chose to go with DRV directly after we saw the homebuilder news on new home sales was poor and had missed earnings. We got in at 20.75 and exited at 21.46 for a solid 3% gain. Our Short Sell Pick of the Day was another winner, as well. We got into Switch and Data Facilities (SDXC) at 17.60, and we were able to exit for a great 2% gain at 17.25. The stock just missed our 3% exit. Finally, our Longer Play of Aetna Inc. (AET) worked out well for us. We were able to exit on our third day of holding for a solid 2% gain, entering at 25.25 and exiting at 25.80. If we had sold on Tuesday, we could of had a much better sale price, and if you held into earnings, we could have made around 10%. We still made a nice chunk of change. That is what matters in this market.

Let’s move onto today’s market…

Buy Pick of the Day: Ultrashort Proshares Energy/Oil ETF (DUG)

Today does not look like a great day for the markets. In the middle of the bear market that we are in, yesterday’s rally was a reason for some quick profit taking to be taken. The market had a solid rally, but the futures this morning are showing that investors are not impressed. As of 8:15 AM, Dow futures were down 40 points and Nasdaq futures were down 2 points. After a series of economic data, futures have still stayed down. We got some poor news on consumer spending and income. Consumer spending was down -0.5% versus the -0.4% and down from August’s 1.3% increase in personal spending. Personal income was neutral but down from one month ago, which was down from the 0.2% increase last month.

The market, therefore, is not looking to be bullish in any sense whatsoever. For that reason, I think we can look to an ultrashort ETF that could have some major movement upwards. DUG is a great play because it is undervalued compared to the other ultrashort ETFs due to some decent earnings from Chevron this morning, when they beat earnings reporting an EPS of 1.72 versus an EPS of 1.47. Further, the oil market is starting to see some serious weakness this morning, down over a dollar at this point in time.

Technically, DUG is in a great position to trend upwards even from its start in the positive. The stock is in the middle of a major upwards trend on slow stochastics, and it is just breaking into a zone where it is seeing a lot of buying. It is still relatively undervalued, as well. However, the stock on fast stochastics is at its peak, therefore, we could expect the stock to hit a top around the high 13s.

Entry: We are looking for an entry of 12.75 – 12.85l

Exit: We are looking for an exit of 2-4% on top of this entry price.

Stop Loss: 3% on bottom of entry.

Sell Pick of the Day: Tyson Foods Inc. (TSN)

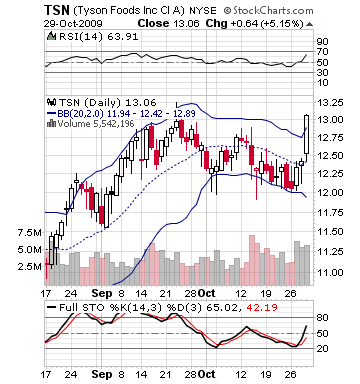

Tyson Foods looks like a solid short sale for the day because of a combination of a downgrade it received this morning and its overvalued price as of now. Tyson Foods has seen a really solid run up this morning in the last few days, moving up nearly 8% in three days. One can definitely expect some solid profit taking to occur in this sort of trend. BB&T Capital Markets downgraded TSN this morning on this run up. Further, hog prices have reached a three month high and one can expect these to come down, as well.

downgraded TSN this morning on this run up. Further, hog prices have reached a three month high and one can expect these to come down, as well.

Tyson Foods has moved outside of its upper bollinger band, which is a perfect sign for a short sale. The charts show that the stock should move naturally down to a price of 12.75 before moving down further on the news of downgrade and a lower market. The stock is currently sitting at 12.70 in pre-market. The downgrade, the overvalue, and the market’s movement downwards will compound and create a lot of selling interest, which will compound on itself.

The Relative Strength Index (RSI) also has moved nearly to the 70 range, which is another red alarm for a short sale. The stock will definitely over the long term move upwards with a returned economy, but the hold position that BB&T gave is due to the overvalue we are seeing in this stock.

Entry: We are looking for a short sale at 12.75 – 12.85.

Exit: We are looking for an exit of 2-3% below entry for cover.

Stop Buy: 3% on top of entry.

Good Luck and Good Investing,

David Ristau