Here’s a scary chart pattern for you from our Chart School:

Here’s a scary chart pattern for you from our Chart School:

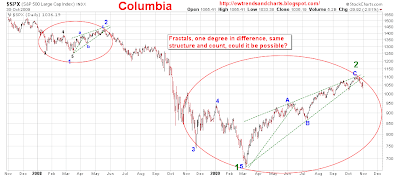

Elliot Wave Trends points out that the S&P has fallen into a fractal patten that may be repeating the behavior of the great drop of ’08, right here, right now. Of course patterns do SEEM to repeat themselves all the time – until they don’t – but it will be interesting this week and next to see if we follow-through with a flatline, followed by a drop to 1,000 from which we falsely back to 1,050 and then plunge to our doom as Santa foresakes us and we run all the way back down to our lows.

That’s where they lose me. Charts are fun and all but I see no basis for going back to our lows as our lows were ridiculous and caused by panic-selling in a doomsday scenario. Hard to imagine things will fall apart that badly between now and Jan earnings although I do believe we will have a rough time — just not that rough!

Barron’s surveyed Money Managers this weekend and they don’t seem to think things will be rough at all. 52% of those surveyed think there is NO WAY we will have a double dip recession. 76% believe that the decline in corporate profits has ended and 68% believe our GDP wil grow more than 2.5% in Q4 while just 10% believe it is possible for commodity pricing to fall in the next 6 months. You know what they say about when everyone is on the same side of a bet of course!

Barron’s surveyed Money Managers this weekend and they don’t seem to think things will be rough at all. 52% of those surveyed think there is NO WAY we will have a double dip recession. 76% believe that the decline in corporate profits has ended and 68% believe our GDP wil grow more than 2.5% in Q4 while just 10% believe it is possible for commodity pricing to fall in the next 6 months. You know what they say about when everyone is on the same side of a bet of course!

These are the people we give our money to – the biggest and "brightest" of hedge fund managers who control over $1Tn of assets under management. Favorite stocks in the group are: MSFT, ABT, BAC, BRK.A, CVS, GE, GS, LEG and QCOM. Stocks that are considered overvalued are: AIG, AAPL, GOOG, CAT, AMZN, C, GE, GMCR, VZ and YHOO. Ony 7% think Asian stocks are heading lowed, just 1% less than 8% who feel oil is going down; 92% don’t feel oil will go down.

Everybody likes Tech (just 0.9% think it will be the worst performing sector) and nobody likes the Financials (22.5% think it will be the worst performing sector) followed by Consumer Cyclicals (20.7%) and, oddly, Utilities (15.3%). The sectors picked as the best performers for the next 6-12 months are Tech (18.9%), Energy (17.1%) and Health Care (17.1%). Only 1.8% of those surveyed thought Transportation and Utilities would be leading sectors over the next 12 months.

Is it just me or do these people seem insane? Let’s try to figure out this premise – We’re not going to ship anything, production is so low that it impacts the utilities, the consumers won’t be buying anything BUT Tech will be popular and energy prices will keep rising. This is the same idiocy we saw from Fund managers back in (uh oh!) mid 2008, when they were almost uniformly on the wrong side of a market collapse betting that oil would go to $200 a barrel and Health Care costs (and profits) would keep skyrocketing but that this would not affect the jobless consumers who would continue to BUYBUYBUY on credit or government stimulus checks. How did that plan work out for everybody?

Hmm, maybe we should take those Elliot Wave guys a little more seriously! The crux of their pattern rests on the S&P failing to retake 1,056, which is a key watch level for us as well so let’s take a look at our own chart and think about the key support levels we’ll be looking at for the next week or so:

| Dow | S&P | Nasdaq | NYSE | Russell | Trans | HSI | Nikkei | FTSE | DAX | |

| Fri Close | 9,712 | 1,036 | 2,045 | 6,739 | 562 | 1,784 | 21,620 | 9,802 | 5,075 | 5,418 |

| 2.5% Up | 10,211 | 1,092 | 2,149 | 7,128 | 594 | 1,870 | 22,295 | 10,284 | 5,170 | 5,549 |

| Prev Close | 9,962 | 1,066 | 2,097 | 6,955 | 580 | 1,825 | 21,752 | 10,034 | 5,044 | 5,414 |

| 2.5% Down | 9,712 | 1,039 | 2,044 | 6,781 | 565 | 1,779 | 21,208 | 9,783 | 4,917 | 5,278 |

| July Base | 8,200 | 880 | 1,750 | 5,600 | 480 | 1,650 | 17,500 | 9,200 | 4,200 | 4,600 |

| 20% Up | 9,840 | 1,056 | 2,100 | 6,720 | 576 | 1,980 | 21,000 | 11,040 | 5,040 | 5,520 |

| Retrace | 9,512 | 1,020 | 2,030 | 6,496 | 556 | 1,914 | 20,300 | 10,672 | 4,872 | 5,336 |

Not a very pretty chart but notice that Europe and Asia have NOT dropped 2.5% and the US indexes are sitting right on that line. This means the game is ours to win or lose today but we are not going to be very impressed with a market move back up until we see the full 5% back up to the 2.5% up mark. The Transports topped out at 2,045 in Sept so they should have no trouble getting back over 1,870 if there is any life in the economy. The Dow is down from 10,119, needing a new high to break up. The S&P was up at 1,101 so the 2.5% goal is within their grasp and the Nasdaq was at 2,190 just 6 sessions ago so they should have no trouble getting back over 2,149 – especially with 18.9% of the fund managers targeting Tech as their favorite buying opportunity.

The NYSE has a long way to go to get back to their high of 7,241 and we’re still using 6,900 as our on/off switch for bullish plays while the Russell is still going to be our canary in the coal mine, coming off highs at 625 and 594 will be a real challenge for them as it’s also the 50 dma and I WOULD consider it a nice bullish move if they can get back over that mark – which is pretty much where they began last week.

The NYSE has a long way to go to get back to their high of 7,241 and we’re still using 6,900 as our on/off switch for bullish plays while the Russell is still going to be our canary in the coal mine, coming off highs at 625 and 594 will be a real challenge for them as it’s also the 50 dma and I WOULD consider it a nice bullish move if they can get back over that mark – which is pretty much where they began last week.

Action in Asia was interesting this morning as the Hang Seng did, in fact, open at the 2.5% line, which was down 600 points from Friday’s close but then staged a SPECTACULAR rally back to down just 0.6% as the Shanghai Composite climbed 2.7% a report showed the nation’s manufacturing industry expanded at the fastest pace in 18 months (which was just 0.2% better than last month but – if we can’t blindly celebrate the same number over and over again, what’s the point?). Unfortunately Asian fund managers aren’t as easy to fool as the fools who are polled by Barrons: “I can’t expect government stimulus measures to continue to shore up company earnings,” said Hiroshi Morikawa, a senior strategist at MU Investments Co., which manages the equivalent of $14 billion. “Doubt is rapidly growing that corporate profits will continue to improve next year. The global economy can’t stand on its feet yet without government support, an end to stimulus is an end to a recovery.”

The Nikkei was not as lucky as the Hang Seng as big names like Toyota, Sony and Mitsubishi led Japan lower as the dollar once again lost ground against the Yen, barely holding on to 90 during the trading session after falling below 89.5 Yen in late Friday trading. The Nikkei, like the Hang Seng, dropped like a rock at the open but, unlike the Hang Seng, they had a very mild recovery that barely got them back over 9,800 and down 2.3% for the day. There is a great (and scary) article on Japan in the Sunday Telegraph by Ambrose Pritchard where he says: "Japan is drifting helplessly towards a dramatic fiscal crisis. For 20 years the world’s second-largest economy has been able to borrow cheaply from a captive bond market, feeding its addiction to Keynesian deficit spending – and allowing it to push public debt beyond the point of no return." Very good reading but not if you are trying to stay bullish…

The Nikkei was not as lucky as the Hang Seng as big names like Toyota, Sony and Mitsubishi led Japan lower as the dollar once again lost ground against the Yen, barely holding on to 90 during the trading session after falling below 89.5 Yen in late Friday trading. The Nikkei, like the Hang Seng, dropped like a rock at the open but, unlike the Hang Seng, they had a very mild recovery that barely got them back over 9,800 and down 2.3% for the day. There is a great (and scary) article on Japan in the Sunday Telegraph by Ambrose Pritchard where he says: "Japan is drifting helplessly towards a dramatic fiscal crisis. For 20 years the world’s second-largest economy has been able to borrow cheaply from a captive bond market, feeding its addiction to Keynesian deficit spending – and allowing it to push public debt beyond the point of no return." Very good reading but not if you are trying to stay bullish…

As noted in the chart above, Europe is drifting ahead of the US open. The European Union statistics agency Eurostat said the unemployment rate in the 16 countries that use the euro rose to the highest level since records began in 1999. The euro-zone jobless rate inched up to 9.7% in September from 9.6% in August. Data from Germany’s Federal Statistics office showed retail sales in the euro zone’s largest member fell in September for the second straight month, down 0.5% from August, when retail sales posted a fall of 1.8%, despite an only modest rise in the country’s unemployment rate. "With auto sales also down sharply as payback for the surge in the first half of the year, German consumption clearly contracted sharply," said David Mackie, an economist at JP Morgan.

In our October Overview this weekend, I mentioned that we had decided to go 55% bearish into the weekend as we expected some form of government intervention to prop up the markets this morning as well as the usual tendency to get some kind of bounce off the 5% rule. We didn’t have to wait long as, just after Friday’s bell, the FDIC announced revised rules to allow banks to keep loans on their books as ‘performing’ even when the underlying properties no longer cover the outlay. This is HUGE as over 50% of the $1.4Tn of commercial mortgages that will mature in the next 5 years are currently underwater. Allowing banks to ignore this pesky fact is just another subtle way our government can shower the banking sector with hundreds of Billions of dollars in stealth aid.

According to the WSJ: Banks have generally been keeping a lid on commercial real-estate losses by extending these mortgages upon maturity. However, that practice, billed by many industry observers as "extending and pretending," has come under criticism by some analysts and investors as it promises to put off the pains into the future.

Now federal regulators are essentially sanctioning the practice as long as banks restructure loans prudently. The federal guidelines note that banks that conduct "prudent" loan workouts after looking at the borrower’s financial condition "will not be subject to criticism (by regulators) for engaging in these efforts." In addition, loans to creditworthy borrowers that have been restructured and are current won’t be reclassified as "high risk" by regulators solely because the collateral backing them has declined to an amount less than the loan balance, the new guidelines state.

Now federal regulators are essentially sanctioning the practice as long as banks restructure loans prudently. The federal guidelines note that banks that conduct "prudent" loan workouts after looking at the borrower’s financial condition "will not be subject to criticism (by regulators) for engaging in these efforts." In addition, loans to creditworthy borrowers that have been restructured and are current won’t be reclassified as "high risk" by regulators solely because the collateral backing them has declined to an amount less than the loan balance, the new guidelines state.

Critics say the new rules are yet another example of a head-in-the-sand approach by regulators, pointing to the relaxed accounting standards last year that enabled banks to avoid marking the value of the loans down. This is doing long-term damage to the economy, they say, because it ties up bank capital, preventing them from resuming lending.

Yes, everything old is indeed new again and the solution to our problems seems to be doing more of the same thing that got us into trouble in the first place. We remain bearish but cautiously so until we get below Friday’s lows. We have an ISM report at 10 am along with Construction Spending (if any) and Pending Home Sales (if any). Congress is conducting a hearing on Residential and Commercial Real Estate at 11:30 so that should be fun to watch and we had a big beat from F this morning with earnings also coming in from CLX, CSE, CTB, DF, HUM, L and SYY this morning with APC, AXS, CAR, CHK, FST, HL, KGC, MNKD, PFG, RSG, SM and VMC on deck this evening.

Watching and waiting today until we get a clear signal but let’s be careful out there…