The week has not started on a terribly great note as we are now 1/3 after Tuesday’s miss on Direxion Daily Bear Energy 3x ETF (ERY). I went against my investing rules with ERY by investing in something that had moved way too much in pre-market trading, and the ETF came down hard from those morning levels. It would have been a perfect short sale. Even with a lowered entry at 12.85, which I specified in my Oxen Group Morning Alert, we still were stopped out for a 3% loss within the first hour. The rally in oil came as the dollar lost ground and the ETF hit a peak that I did not see on the chart that was pointed out by a subscriber. Let’s get back on the right side of this thing today with two winners.

And here they are…

Buy Pick of the Day: Ultrashort Proshares Real Estate (SRS)

For some reason, I just cannot get bullish on this market. Futures are up significantly this morning, and I cannot find myself wanting to buy anything other inverse ETFs. I am led to this by the Nonfarm Employment Change, which I thought was a poor report. The report said that 203,000 people lost their job in October. That was better than September’s 227,000, but it missed the expectations of 190,000. I don’t see this as fundamentally good at all. We did see strong earnings from media giants Time Warner and Comcast this morning, but I do not think these can uphold the whole market. The Fed decision is usually not a day where we rally into the decision, but it stays neutral to down. I think that the market just is overvalued at the 70+ futures gains we are seeing on the Dow this morning.

The reason I like SRS especially were the weak earnings from Pulte Homes Inc. (PHM). The company reported an EPS of -1.15 vs. the expected -0.65. The company was positive, but they missed earnings, revenue, and showed worry about the non-extended tax credit.

"I question, especially if mortgage rates start going up, what’s going to be the real impact on housing sales," said Fox-Pitt Kelton analyst Robert Stevenson.

With the market turning around this morning, SRS will be in a great position to rally behind the PHM earnings. With most companies up in the green in pre-market, PHM is slightly devalued. Now, SRS does not exactly represent PHM in its holdings, but Pulte is one of those names that can move the entire real estate, corporate and residential. I think, at some point today, investors are going to have take into account the weak jobs data. We still have over 200,000 lost jobs last month…that is not something to rally behind.

SRS is definitely technically a bit toppy compared to what its done over the past three months, but I think with the entry we have laid out, we can benefit from getting at a high discount and riding this thing up to a nice 2% or so gain that really will not even start to move the technicals.

Entry: We are looking for an entry of 9.65 – 9.75.

Exit: We are looking for an exit of 2-4% on top of this entry.

Stop Loss: 3% on bottom of entry.

Short Sale of the Day: Cognizant Technology Solutions Corp. (CTSH)

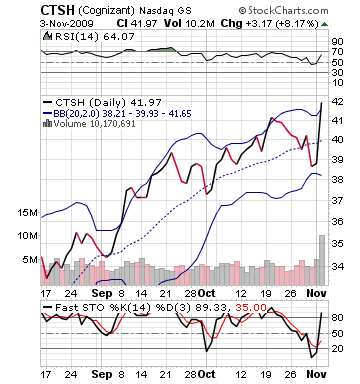

Today, Cognizant got an upgrade from Wells Fargo from Market Perform to Outperform. The company posted a 21% gain in profits yesterday morning, and the stock skyrocketed over 8%. The stock now received an upgrade and is up even further in pre-market trading. Right now, especially with the market looking to open up and get some quick sellers, will be the time to short sale CTSH. The stock is in a perfect position. We are ignoring the fundamentals on this one and looking strictly at market timing and patterns. A stock cannot jump 10% without some selling taking place. Others will be looking to do the same, short interest will rise, and CTSH will fall fast.

The fundamentals of this company are strong. The company raised revenue 16% and profits 21% in a tough market as they continues to become a larger player in the IT sourcing and consulting sector.

The fundamentals of this company are strong. The company raised revenue 16% and profits 21% in a tough market as they continues to become a larger player in the IT sourcing and consulting sector.

Wells analyst says, "We believe that Cognizant will remain a Tier I provider of offshore outsourcing and development services, and be a long-term beneficiary of the offshoring theme that we believe is still no more than the middle stages, although is currently challenged by an economically driven growth slowdown. Now it appears that CTSH has weathered the economic storm and is returning to strong double-digit growth and upward earnings estimate adjustments, although we doubt to 30% plus levels seen in the past…We are raising our EPS estimates notably: 2009 to $1.76 from $1.68, and 2010 to $2.02 from $1.80. 2009 revenue to $3.26 billion from $3.15 billion, and 2010 revenue to $3.95 billion from $3.60 billion."

This is all well and good in the long term, however, the stock is outside its upper bollinger band, jumped nearly 20 points on RSI (which I don’t think I have seen before), and moved from oversold to neutral on fast stochastics in one day. This is all on a stock that has beta of just 1.31. I think we can expect to see a quick pop from the upgrade and lag on earnings, followed by a nice sell off as the market goes flat.

Entry: 42.55 – 42.65

Exit: Looking for a cover of 2-3% on bottom of entry.

Stop Buy: 3% on top of entry.

Good Luck and Good Investing,

David Ristau