Unemployment benefits will now be extended to 79 weeks!

Unemployment benefits will now be extended to 79 weeks!

The Senate approved a measure to extend the current benefit program by another 33% and, in a bid to aid the property market, the bill would also extend for five months a tax credit for home buyers, AND expand it beyond first-time purchasers. There will ALSO be a new tax break for businesses would give large companies bigger refunds to make up for recent losses. Specifically, it would let large firms claim cash refunds on taxes they paid going back nearly five years. Will extending the unemployment checks currently being collected by 6M people save Christmas? Will GS et al now claim losses to get back the tax money they paid in ’05, ’06 and ’07?

This is a very stealthy and MASSIVE infusion of bailout capital and It is certainly saving the markets today as we bottomed out in the futures at 4am with our indexes all soundly below yesterday’s lows, 560 on the Russell, 1,038 on the S&P 2,040 on the Nas and 9,725 on the Dow… Asian markets put us in a bad mood as the Hang Seng once again had trouble with the 21,475 line we discussed in yesterday’s post and they finished the day at 21,479, failing the critical 21,500 mark that was their October break-out. Pathetic as that was, it was nothing compared to Japan’s AWFUL 1.3% drop to 9,717, also failing their October break-out and looking weaker by the day despite the BOJ keeping the dollar above 90 Yen.

The FTSE dropped off a cliff this morning after our very erratic US performance yesterday but the BOE pulled a "stick save" by keeping their rate at 0.5% and tossing another 25 Billion Pounds of stimulus on the fire ($41Bn) . The U.K. central bank’s extension of its program of buying government securities with freshly printed money to £200 billion was widely forecast by economists. Seventeen out of the 20 analysts polled by Dow Jones Newswires last week tipped an increase, although they were divided over the likely amount. The move by the Bank of England to continue showering money on the U.K.’s troubled economy comes as other countries are considering dialing back emergency relief measures.

The FTSE dropped off a cliff this morning after our very erratic US performance yesterday but the BOE pulled a "stick save" by keeping their rate at 0.5% and tossing another 25 Billion Pounds of stimulus on the fire ($41Bn) . The U.K. central bank’s extension of its program of buying government securities with freshly printed money to £200 billion was widely forecast by economists. Seventeen out of the 20 analysts polled by Dow Jones Newswires last week tipped an increase, although they were divided over the likely amount. The move by the Bank of England to continue showering money on the U.K.’s troubled economy comes as other countries are considering dialing back emergency relief measures.

We have Retail Sales Reports drifting in this morning and another 500,000 job losses will be reported at 8:30, which should keep the remaining workers (almost 90% of the people who haven’t given up on the workforce entirely) scared enough to give us some decent Productivity Numbers as they work unpaid overtime to keep up the illusion that the company didn’t need the workers they laid off, allowing them to report strong quarterly earnings despite a 25% contraction in revenues – Ah Capitalism, you never cease to amaze me…

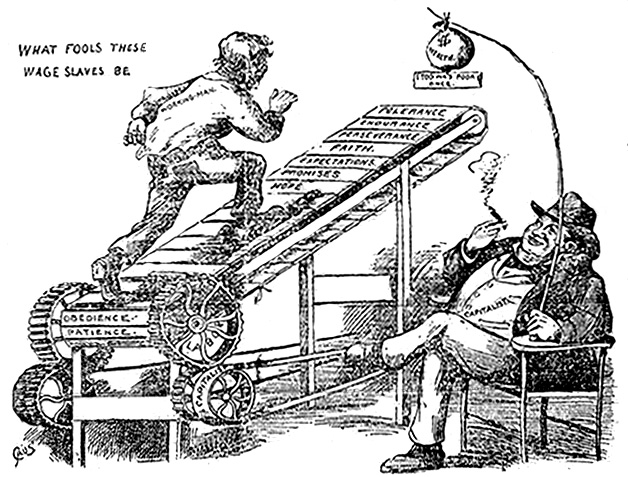

8:30 Update: Holy Cow! Productivity is up 9.5%!!! I gues we didn’t need those 6M people after all. It’s a good thing we extended their benefits because, at this pace of productivity, those seats are going to be empty for a long time… Unit labor cost is down 5.2%, that accounts for a HUGE chunk, perhaps all, of Q3 corporate profits. If you also factor in the declining dollars we are paying our workers, you are talking about 13.5% labor cost savings for corporations on this latest report. Big productivity gains aren’t uncommon at the end of a recession or beginning of a recovery. But the increases come at the expense of jobs. You can BUYBUYBUY the companies or you can CRYCRYCRY for the wage slaves who are stumbling further and further into the void that is sending this country into 3rd World status at the fastest pace of empire decline in recorded history.

Oh well – what can you do, right? Of course this number is rocketing the markets and it’s very appropos that we were just discussing in Member Chat this morning the reality of inflation in which I mentioned: "You can’t have real inflation without wage inflation. Right now, the government is borrowing and spending $1.5Tn extra dollars this year to make up for the $1.5Tn that is not being spent by 10% of the population who is unemployed and businesses who have cut back 10% of their own spending. That’s not inflationary, that’s treading water…"

Oh well – what can you do, right? Of course this number is rocketing the markets and it’s very appropos that we were just discussing in Member Chat this morning the reality of inflation in which I mentioned: "You can’t have real inflation without wage inflation. Right now, the government is borrowing and spending $1.5Tn extra dollars this year to make up for the $1.5Tn that is not being spent by 10% of the population who is unemployed and businesses who have cut back 10% of their own spending. That’s not inflationary, that’s treading water…"

I mentioned that gold, oil and other commodities were merely the illusion of inflation while the 512,000 people who lost their jobs last week (and can now remain on unemployment life-support for 79 weeks) go from being moderately productive members of the worforce to wards of the state. Tomorrow we get Non-Farm Payrolls and we see how many net of the 2M people who got pink slips in October managed to find a new job. The good news is that it should be about 1.8M of them so "only" 200,000 people should be added to the long-term unemployed list. Continuing claims did drop by 50,000 in October

Another frightening stat for the bottom 90% of the country is hours worked, which fell 5% last quarter, the 9th quarterly decrease in a rowl. We are hitting the wall on productivity though as hourly compensation in the business sector rose 3.8%, but a lot of that was Wall Street bonuses – Real Compensation, adjusted for inflation, rose just 0.2% – treading water indeed! This is not just me being a bleeding-heart Liberal and caring about the workers – take a look at this chart next to a chart of the Dow and you tell me if low Unit Labor Costs are actually good for the economy:

You can get a very brief surge in corporate earnings that LOOK good by screwing over your workers but, at the end of the day, most companies don’t really make money unless, not SOME, but A LOT of people can buy their products. A failure to share the wealth by corporations ultimately leads to less wealth for all. Right now global consumers are suffering from another shakedown at the hands of the commodity pushers, who are banging the drum on inflation while slashing wages, cutting hours worked and squeezing every last ounce of productivity out of the skeleton crew they have left to man the machines, all so they can send those poor, exhausted suckers home to pay for their dinner after stopping for a $75 tank of gas along the way. Ain’t that America?

This is not an economic recovery, this is the boot of the investor class stomping on the face of the workers and you can only say "let them eat cake" and placate them with extended jobless benefits for so long before they begin to get angry – something the incumbents got a taste of in Tuesday’s elections. As proud members of the investor class, we simply try to stay ahead of this little game and we shorted into yesterday’s rally (as planned in yesterday’s post) and we will be shorting into this "productivity bounce" as well if they once again fail our level (as laid out yesterday).

We are still short on oil and gold here because PEOPLE CAN’T AFFORD IT and we’ll be using that logic to find the companies that are irrationally exuberant by "good" economic numbers that are merely a reflection of the impoverishment of their long-term customer base.