GURU OUTLOOK: JIM ROGERS ISN’T BUYING THE EQUITY RALLY

Courtesy of The Pragmatic Capitalist

Courtesy of The Pragmatic Capitalist

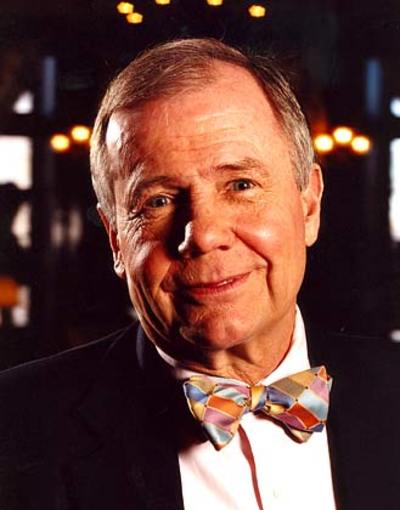

This week’s guru outlook brings you Jim Rogers. Rogers has become infamous in recent years for his prescient calls on the global meltdown and the commodity boom, but long before that Rogers became famous for co-founding the Quantum Fund with George Soros. Rogers and Soros helped steer the fund to a miraculous 4,200% return over the 10 year span of the fund (see here for the Soros Guru outlook) while the S&P 500 returned just 47%. They ran what is considered to be one of the first truly global macro hedge funds.

Rogers has an interesting outlook currently. He has been very vocal about his inflationary outlook, but doesn’t see the liquidity driven bubbles that some other see forming. In fact, he doesn’t see any bubbles in anything other than the U.S. treasury bond market:

“The only bubble I see forming in the Western world is in the U.S. government bond market. Other than that I don’t see any bubbles going on.”

Rogers, a follower of Austrian economics, absolutely hates that the Fed is bailing out the banks and attempting to print us to prosperity. He thinks the winners in this printing press environment are commodities which he believes are in the middle of a secular boom. Paper assets and the dollar are the losers in Rogers’ scenario of

“no new large gold mines have been opened in decades. Some of those mines are over 100-years old. They are all depleting. On the other hand, central banks have huge Gold reserves above ground — and they are less interested in selling than in the past.

If you adjust Gold for inflation and go back to its former all-time high in 1980, Gold should be over $2,000 an ounce right now if you want to say it’s reaching new inflation adjusted all-time highs. That does not mean Gold has to get back to a true all-time high. Nothing has to. However, I suspect that given all the money printing in the world, we will see much higher prices for hard assets.”

Despite his optimism regarding gold, Rogers is actually more optimistic about other commodities:

“Despite Gold’s potential, I think I will make more money in other commodities such as silver, cotton, or coffee — all of which are terribly depressed.”

What does Rogers think about the equity markets? He has been very vocal about his investments in China, but isn’t currently buying equities as they reach new highs:

“I am not buying any stock markets around the world right now, they have all gone up a lot and I do not like to buy anything when its been going straight up for a while.”

Rogers sees enormous headwinds for the global economy. He thinks the government has simply kicked the can down the road, but this doesn’t mean he is betting against

“This is one of the few times in my life I have not had shorts anywhere in the world. I have also not had a lot of longs in the stock market because I’ve chosen longs in commodities and currencies. I have kept away from shorts because there is a gigantic amount of money being printed and it has to go somewhere. I thought some of it would end up in the stock market, and it has.How much higher can the equity markets go? I don’t know. There are a lot of problems in the economy, but I don’t know when those problems will cause a downdraft in the stock market. All we’ve done is paper over the problem, so I expect we’ll have to deal with those issues in the future. Printing and spending money we don’t have simply prolongs the problems and makes them worse in the long run.”

In this scenario, he thinks commodities are a no-brainer:

“If the world economy improves, commodities will lead the way due to demand and shortages. If the world economy does not get better, commodities are still a great place to be because governments are printing so much money. And, if the world economy doesn’t get better, they will print even more money!”

What is his favorite investment? Rogers absolutely loves farmland:

“I’m convinced that farmland is going to be one of the best investments of our time. Eventually, of course, food prices will get high enough that the market probably will be flooded with supply through development of new land or technology. If you can tell me something else where the fundamentals are so attractive…I’d be happy to put my money there, but I don’t know of any other place.”