Here is a great metaphor for the emptiness of the global recovery:

An entire city in China, tens of billions of dollars in construction, sits empty. They also built the World’s biggest shopping mall, also empty. As they say in the video, people can’t move in because there is no economy. Yet the building of the city of Ordos and the Utopia mall have allowed China to hit their 8% GDP growth target because it doesn’t matter whether you build something worthwhile – as long as you build SOMETHING, it’s going to count as part of your GDP. It’s ironic that this country still hasn’t bothered rebuilding New Orleans, which was once a healthy, vibrant city and we are letting Detroit die a little more every day when it’s ideally situated to attract (comparatively) wealthy Canadian tourists but China is willing to build entire cities from scratch.

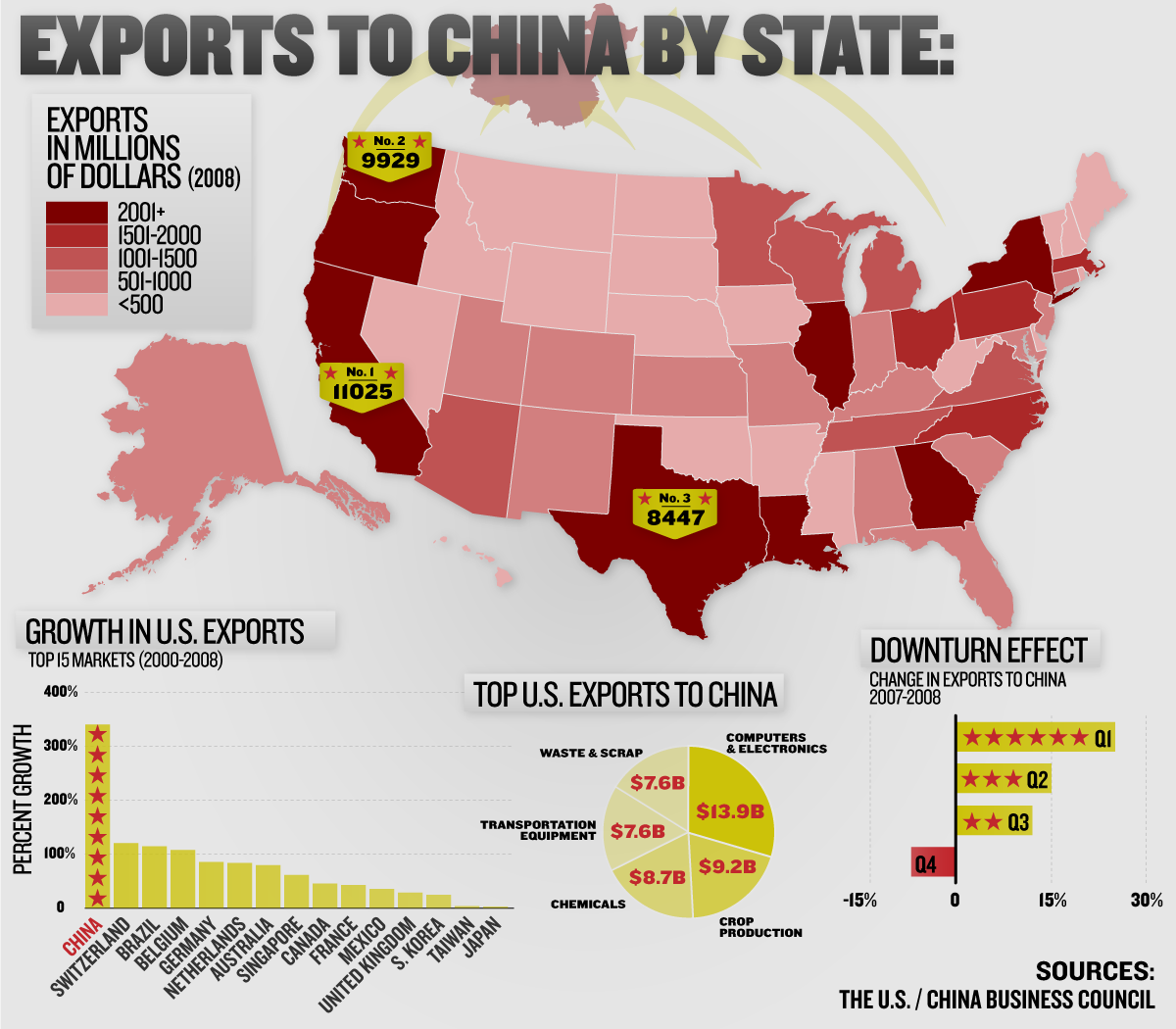

Ironically, Louisiana is one of 8 US states that export more than $2Bn worth of goods to China, who is, by far, our fastest growing trading partner. We get trade data later today and hopefully, at least one benefit of the week dollar will be to help boost our balance of trade but we’re a very, very long way away from balance and, as I pointed out last month, almost all of our gains are coming from lowered US consumption, not a real increase in exports.

Ironically, Louisiana is one of 8 US states that export more than $2Bn worth of goods to China, who is, by far, our fastest growing trading partner. We get trade data later today and hopefully, at least one benefit of the week dollar will be to help boost our balance of trade but we’re a very, very long way away from balance and, as I pointed out last month, almost all of our gains are coming from lowered US consumption, not a real increase in exports.

Speaking of lowered US consumption, just as we predicted, crude oil fell to the lowest in a month yesterday as the inventory report showed inventories in the

“The

Of course oil and mining stocks put pressure on the Asian markets this morning, as they did on ours yesterday. As I’ve been saying for weeks – the very obvious lack of true demand for commodities is nothing compared to the hell those markets will go through if the dollar stages a rally. Since, unfortunately, we are riding at the top of a stimulated commodity bubble market, things are not likely to go well for the markets if that happens. "Most sectors are down on profit-taking across the board, while defensives have held up better as investors question the U.S. economic outlook after the crude oil inventories data," said Macquarie Private Wealth Private Client Advisor, Marcus Droga in Sydney. "The U.S. economy is not generating the demand for oil that people expected."

Of course oil and mining stocks put pressure on the Asian markets this morning, as they did on ours yesterday. As I’ve been saying for weeks – the very obvious lack of true demand for commodities is nothing compared to the hell those markets will go through if the dollar stages a rally. Since, unfortunately, we are riding at the top of a stimulated commodity bubble market, things are not likely to go well for the markets if that happens. "Most sectors are down on profit-taking across the board, while defensives have held up better as investors question the U.S. economic outlook after the crude oil inventories data," said Macquarie Private Wealth Private Client Advisor, Marcus Droga in Sydney. "The U.S. economy is not generating the demand for oil that people expected."

Even China is now planning new measures to close factories to curb overcapacity and pollution after this year rejecting requests to build industrial projects worth almost 200 billion yuan ($29 billion). The government will target the steel, aluminum, coke, cement, paper and utility industries, Zhu Xingxiang, director of environment evaluation department at the Ministry of Environmental Protection, said today in Beijing. “The steel industry is the focus of our supervision,” Zhu said. “There is too much capacity being built without government approval.” The government’s 4 trillion yuan stimulus spending has spurred overproduction of steel and rising inventories has led to lower prices, the China Iron & Steel Association said this month. The U.S. this year imposed antidumping charges on some Chinese steel products, which U.S. Commerce Secretary Gary Locke said today weren’t protectionist measures.

The Hang Seng managed to pull up after lunch and made it back to the just under the September high of 22,600, which is close but no cigar on our tracking chart, so no green box for them. Meanwhile, of more concern to global chart-watchers is the Nikkei falling another 34 points, heading back to test the Nov 5th lows which, like the Oct 5th lows, came at the bottom of Dow pullbacks. If we rally from here and pull Japan back with us, that will be fine but if we fall from this level, then our 15% spread to the Nikkei over the past 60 days may come into question.

The Hang Seng managed to pull up after lunch and made it back to the just under the September high of 22,600, which is close but no cigar on our tracking chart, so no green box for them. Meanwhile, of more concern to global chart-watchers is the Nikkei falling another 34 points, heading back to test the Nov 5th lows which, like the Oct 5th lows, came at the bottom of Dow pullbacks. If we rally from here and pull Japan back with us, that will be fine but if we fall from this level, then our 15% spread to the Nikkei over the past 60 days may come into question.

As I’ve been saying for quite some time, we are reaching the point at which the falling dollar (which has been the main driver for our rally) has the opposite effect on Japan, as well as our other trading partners other than China, who peg their currency to ours. “There are still skeptical investors out there who don’t think the global recovery will be sustained and this is tempering the advance in equities,” said Allan Yu, who helps manage $4.24 billion at Manila-based Metropolitan Bank & Trust Co. “The market is trying not to run ahead of itself.”

Europe is flatlining ahead of our open. I said in yesterday’s post that either the Dax breaks over 5,750 and the global markets head up or the FTSE fails 5,250 and the global markets go down and they BOTH spiked towards those levels yesterday and today both are drifting along in between, so no commitment into their afternoon trading and we’ll need to watch closely. EU GDP came in at 0.4% vs 0.6% expected but CNBC is telling us that the EU GDP has gone back to expansion, somehow omiting the part where it is a generally disappointing number. That was of great help to the futures markets, which were up over half a point early this morning but now that real traders have come in (9am) it looks like we’ll be lucky to break even at the open.

As I pointed out to Members yesterday, our tracking chart has gotten redder this week and we’re just going to be happy to hold the LOWER of our September highs OR the 2.5% lines from Monday’s opening chart today on 3 of our 5 indices to keep us a little less bearish (we’re going to be bearish no matter what) into the weekend. Those levels will be Dow 10,119, S&P 1,095, Nasdaq 2,164, NYSE 7,131 and Russell 594. We’ve already blown them all except the Dow so let’s keep an eye on that as well as that 43.50 line on the Qs (Nas 2,125ish) that MUST hold.

We had great fun playing the Dow yesterday in Member Chat as we opened the day with the $101 puts at .55 and we quit those at .82 (up 49%) at the day’s end. We also had great timing on the Dec $102 puts we sold to cover our longer DIA puts and hopefully we’ll get the opportunity for a repeat performance today. Our ERY and GLL plays paid off and, other than rolling some existing postions, we did very little yesterday as the action was exactly what we expected. Today we’d love to see the selling cycle complete so we can buy a few longs but I think that, like Europe, we may flatline again and have to wait for Monday.

Have a great weekend,

– Phil