Hello Oxen Report family.

I am sorry I have been in and out this week. I have had a really hectic week and just have not been able to get to everything I needed to here on the Oxen Report. I apologize for that. I was not able to advise on KSS and JCP this morning, but I hope you all sold out on KSS this morning. As for JCP, we are still holding this one until after tomorrow morning. The market has been pretty bearish on the earnings of the retail sector, and we have not been able to make much money off these.

Enough about that. Let’s turn our attention to what is going on today.

Buy Pick of the Day: Direxion Large Cap Bull/Bear (BGU/BGZ)

The market today seems to have quite a mixed bag of tricks. On one side, we have some really great earnings from Abercrombie and Fitch, JCPenney was better than a lot of people had priced the stock even though it was below analysts, and Agilent Tech was a huge beat. The market in pre-market prior to 8:30 AM release of the Trade Balance was positive with futures up around 15 points going into the announcement. The trade balance came back at an unexpectedly higher deficit than predicted at $36.5 billion while estimates were at $32 billion. Futures have not changed significantly from there levels, but there has to be an inkling of fear that we are going to plummet out of the gates. At the same time, can we bounce back and retail will bolster the market? I am not completely positive.

The market today seems to have quite a mixed bag of tricks. On one side, we have some really great earnings from Abercrombie and Fitch, JCPenney was better than a lot of people had priced the stock even though it was below analysts, and Agilent Tech was a huge beat. The market in pre-market prior to 8:30 AM release of the Trade Balance was positive with futures up around 15 points going into the announcement. The trade balance came back at an unexpectedly higher deficit than predicted at $36.5 billion while estimates were at $32 billion. Futures have not changed significantly from there levels, but there has to be an inkling of fear that we are going to plummet out of the gates. At the same time, can we bounce back and retail will bolster the market? I am not completely positive.

Therefore, when we can’t be sure, it is best to position ourselves to profit from something we think we can have the most control over. One thing I am pretty sure of is if I am confused most investors will be, and they will look towards something to help them grasp what is going on in the markets…today that should be the Michigan Consumer Sentiment Index. This index seems to always set a tone for the market even though it really is not extremely significant compared to the trade balance or important earnings. If it is good, I think we will see a definite positive day. If it is bad, I don’t think we will plummet; however, the market will most likely waver around 30-40 points down for a lot of the day.

So, we want to play something volatile that will move quickly on the news…that would be anything Direxion. I am taking a market neutral play since the index can affect a lot of sectors, almost all of them. If the news is good, we should see BGU build on its gains and if it is bad see BGZ reverse its current price and move upwards. What I like about BGU and BGZ is they are not already priced in at 3-4% like a lot of ETFs have this morning and some of the other volatile stocks I like. Further, BGU has a lot of upside even though its a bit overbought, and BGZ has tons of upside since it is a bit oversold.

What we want to do is set up two screens with both plays already ready to go at market price. Wait for the news, and buy right away. The important number is 71.20. We beat that – BUY BGU. We don’t – BUY BGZ.

Good luck!

Entry: We are looking for an entry based on Michigan Consumer Sentiment Index. Index above 71.20 is a buy fro BGU, below 71.20 is a buy for BGZ.

Exit: 2-3% from entry at 9:55 AM.

Stop Loss: 3% on bottom.

Short Sale of the Day: Abercrombie and Fitch (ANF)

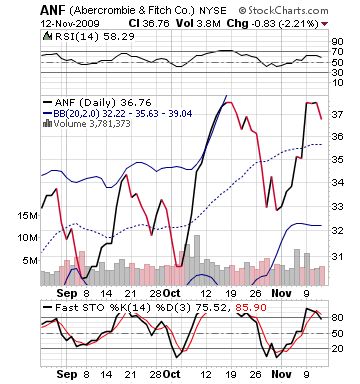

While I definitely notice that ANF had some very positive earnings this morning, I am skeptical that the stock will be able to hold onto its pre-market gains of over 7%. The company reported a solid profit of $38.8 million, 39% lower than one year ago. That equaled an EPS of 0.30 vs. the 0.20 that was expected. The company was able to beat the EPS, but across the board, things looked bad. The revenue dropped 15% from one year ago. Same-store sales were down 22% from one year ago. The company is closing its Ruehl line, a failed attempt for ANF to connect to the post-high school young adult. Yet, the eat an EPS has risen the stock to extremely high levels, after the stock already rose just under 10% in the past two weeks, going into earnings. The stock lost a bit the last couple days right before the earnings, which would tend to show investors were worried.

hold onto its pre-market gains of over 7%. The company reported a solid profit of $38.8 million, 39% lower than one year ago. That equaled an EPS of 0.30 vs. the 0.20 that was expected. The company was able to beat the EPS, but across the board, things looked bad. The revenue dropped 15% from one year ago. Same-store sales were down 22% from one year ago. The company is closing its Ruehl line, a failed attempt for ANF to connect to the post-high school young adult. Yet, the eat an EPS has risen the stock to extremely high levels, after the stock already rose just under 10% in the past two weeks, going into earnings. The stock lost a bit the last couple days right before the earnings, which would tend to show investors were worried.

Yet, the gains put the stock outside its upper bollinger band, really do not seem justified, and should come down. The stock’s upper bollinger band, as of yesterday’s close, appeared to be around 38.50. The stock is trading at 39.15 in pre-market. The stock is oversold, but it is declining on fast stochastics. I think we are going to see a lot of quick trading and short interest entering this one throughout the day, which will make it hard for those to see their profits slip away, further compounding a downward movement. The momentum will become too great.

If the market really rallies after the Michigan Consumer Sentiment Index and takes to these okay earnings, I may be wrong. I just cannot imagine, however, that one can expect much more to the upside. Quick profits on an already overvalued stock will occur.

Entry: We want to enter our short sale at 39.30 – 39.40.

Exit: We are looking for a cover of 2-3% on bottom.

Stop Buy: 3% on top of entry.

Good Luck and Good Investing,

David Ristau