This was an annoying week for bulls and bears alike.

We had a very exciting day on Monday, topping out at 10,248 but I didn't like the way we got there (low-volume, commodity rally, as noted in David Fry's chart) and, when pressed for a prediction on TV that evening, I had to say that I felt that we were more likely to be down by Thanksgiving than up with a possible Santa Claus bounce into Christmas. What we did get for the remainder of the week was very choppy action on even lower volume.

I had mentioned in last week's "Wrong-Way Weekly Wrap-Up" that we were partying like it's 1999 as we broke through Dow 10,000 and S&P 1,080, despite rapidly deteriorating fundamentals. Stocks are being bought because they are going up in price (much like commodities), not because there is any actual demand for them and that is very clear from the rapidly declining index volume as we run back into resistance at S&P 1,100.

Since early September our upside targets for the indexes have been: Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623 and nothing has happened to change our fundamental outlook for the better so the closer we get to those levels, the LESS comfortable we are taking bullish positions. In fact, yesterday as we got our mid-day spike to 10,300, I told members that it was sorely tempting to just cash out all bullish positions and take 20% of the virtual portfolio 100% bearish with a 10% stop. Rather than mess around with a mix of positions, going fully bearish can allow for some spectacular gains if we crash and stopping out with a 50% loss would suck – but a breakout like that, well above Dow 11,000 and S&P 1,200 would certainly give us reason to be more bullish.

As I concluded last week: "We’re generally not happy until we see Russell 600 and the Dow Transports over 4,000 (now 3,852) and we took a 55% bearish stance into the weekend because we’ll feel a lot less silly being burned by a move up than we would if we weren’t bearish enough for a move down. It would be nice to be able to make more of a commitment but the bulls clearly have the bears cowering in fear so we’ll just patiently wait and see how far they can play things out." Not much has changed since then and we are still waiting to confirm a breakout on those indexes…

As I concluded last week: "We’re generally not happy until we see Russell 600 and the Dow Transports over 4,000 (now 3,852) and we took a 55% bearish stance into the weekend because we’ll feel a lot less silly being burned by a move up than we would if we weren’t bearish enough for a move down. It would be nice to be able to make more of a commitment but the bulls clearly have the bears cowering in fear so we’ll just patiently wait and see how far they can play things out." Not much has changed since then and we are still waiting to confirm a breakout on those indexes…

Monday Market Mark-Up – 50 Ways to Dump the Dollar

Probably my biggest overriding concern about the markets is that the weak dollar has given us the illusion of a rally as it has plunged 14 points from 89 (15.7%) since the March lows. Should the dollar be at 89 again? No, I wouldn't lend Bernanke any money, would you? But it also shouldn't be at 75 because there are plenty of countries just as screwed up as ours and all it will take is one small crisis to send investors flying back to the buck. This Friday, like last, there have been heavy bets placed on UUP into the weekend, indicating the expectation of a policy shift that boosts the dollar over some weekend. Last weekend the G20 disappointed us (the topic of Monday's post) and this weekend we have Obama in China and a shift in Chinese monetary policy could make a huge difference.

Probably my biggest overriding concern about the markets is that the weak dollar has given us the illusion of a rally as it has plunged 14 points from 89 (15.7%) since the March lows. Should the dollar be at 89 again? No, I wouldn't lend Bernanke any money, would you? But it also shouldn't be at 75 because there are plenty of countries just as screwed up as ours and all it will take is one small crisis to send investors flying back to the buck. This Friday, like last, there have been heavy bets placed on UUP into the weekend, indicating the expectation of a policy shift that boosts the dollar over some weekend. Last weekend the G20 disappointed us (the topic of Monday's post) and this weekend we have Obama in China and a shift in Chinese monetary policy could make a huge difference.

On Monday morning I put up an index chart for the week and we targeted 2.5% moves up for the indexes to Dow 10,273 (finished the week at 10,270), S&P 1,095 (1,093), Nasdaq 2,164 (2,167), NYSE 7,131 (7,119) and Russell 594 (586) so not bad for targeting a week in advance! As we expected, the Nikkei put in the worst performance, finishing the week lower at 9,770 as that index has reached it's breaking point on the low dollar. Along with our many DIA cover adjustments in both directions, we had a fairly mixed week of picks overall. Monday's were:

- WFR Jan $12.50 puts sold for $1.05, now .90 – up 14%

- VLO Dec $17 puts sold for .85, now .83 – up 3%

- TIE Jan $10 buy/write net $7.31/$8.65, now $9.32 – on track

- FAS Dec $67/71 bull call spread at $2.20, now $2.25 – up 2%

- VIX Dec $22.50 puts at .65, now .75 – up 15%

- QQQQ Nov $43 calls at .85, now $1.18 – up 38%

- UWM Dec $25 calls at $2, now $1.60 – down 20%

- UWM Nov $26 calls sold at .60, now .30 – up 50%

- EDZ Dec $5 buy/write at $4.10/4.55 – on track

My attitude on the week is summed up in my 11:28 Alert to members, where I said: "As I said this morning, the entire Nasdaq run over 3,500 was a fakeout but it lasted 6 months and you could have made millions following the fake (buying YHOO at $150 and selling it for $300, for example). It doesn’t pay to insist on being bearish if we are breaking out here. We are better off being bi-directional and taking those hedged downside plays only until we break back down." That's why we continue to take hedged bullish entries, even though we are not true believers – if we do break over these levels, we could be truly heading off to La-La Land and there's no point in missing the party just because we know it will end badly.

My attitude on the week is summed up in my 11:28 Alert to members, where I said: "As I said this morning, the entire Nasdaq run over 3,500 was a fakeout but it lasted 6 months and you could have made millions following the fake (buying YHOO at $150 and selling it for $300, for example). It doesn’t pay to insist on being bearish if we are breaking out here. We are better off being bi-directional and taking those hedged downside plays only until we break back down." That's why we continue to take hedged bullish entries, even though we are not true believers – if we do break over these levels, we could be truly heading off to La-La Land and there's no point in missing the party just because we know it will end badly.

Toppy Tuesday Morning

We had a huge run-up into the futures that smacked of desperation. Cramer had been on TV the night before telling his sheeple that no news is good news and the market is in a "a positive and delicious void," which would allow a merit-less rise to continue. Jim is a veteran of 1999 trading and, to some extent, I think that colors his thinking as he loves riding the bubbles until they pop. Of course, that's why Jim's bestselling book for his viewers is now titled "Getting Back to Even." By pursuing a strategy that is based on collecting dividends and premiums from bullish and bearish plays – we're hoping to do a little better than even, no matter which way the market heads.

I was using my crystal ball to look ahead on the day and I decided that, despite the Fast Money and Cramer pumps the night before (I had been at the Nasdaq studios the night before with Fast Money taping one level below me) we would have trouble at our 25% levels (off the July consolidation) at Dow 10,206, S&P 1,086, Nas 2,152, NYSE 7,087 and Russell 588. As you can see from this chart, they all pretty much hit it on the nose. My comment that morning was: "I will be truly amazed if the "finest minds on Wall Street" called it right yesterday and we keep going higher with no pullback."

I was using my crystal ball to look ahead on the day and I decided that, despite the Fast Money and Cramer pumps the night before (I had been at the Nasdaq studios the night before with Fast Money taping one level below me) we would have trouble at our 25% levels (off the July consolidation) at Dow 10,206, S&P 1,086, Nas 2,152, NYSE 7,087 and Russell 588. As you can see from this chart, they all pretty much hit it on the nose. My comment that morning was: "I will be truly amazed if the "finest minds on Wall Street" called it right yesterday and we keep going higher with no pullback."

I pointed out how bad the copper situation is in China and that made FCX our first short of the day but, so far, runaway gold prices are sustaining them even as copper stalls out below $3. We were playing both sides of the fence on gold this week but cashed our our longs on Wednesday's rally and failed to cash out our shorts on Thursday's dip so we'll see what is real next week.

- FCX Dec $80 puts at $3.90, now $4 – up 2.5%

- SRS Dec $9 puts sold at .75, now .80 – down 7%

- RL Nov $80 calls sold at $4, now $2 – up 50%

- GLD Jan $111/108 bear put spread at $1.80, now $1.57 – down 13%

- ERY Dec $11 puts sold at $1.20, now .90, up 25%

- EDZ Dec $5 buy/write at net $4.15/4.48, now $5.48 – on track

- YRCW 2011 $2.50/5 bull call spread at .10, still .10 – even

- YRCW Apr $1/2 bull call spread at .20, now .15 – down 25%

- YRCW Apr $1 puts sold at .65, still .65 – even

- TM Dec $75 puts sold for $2.30, now $1.50 – up 35%

Will "THEY" Hold It Wednesday – Veteran Scammers on the Loose!

Will "THEY" Hold It Wednesday – Veteran Scammers on the Loose!

We expected Veteran's day to be to have some shenanigans but boy that 100-point pump to Dow 10,300 in the morning was a doozy! I had expected to be out for the day (but plans changed), so I made an extra-early post at 7:57 am but even that early – it seemed obvious that we were just pumping up into a big sell-off. I said at the conclusion of my post, a bit before 8am:

It’s probably a great day to buy cheap shorts at the open using those same lines but we have to be careful out there, Gates and Buffett have a TV special on Thursday and they are likely to be telling everyone to BUYBUYBUY so we’ll have to tread cautiously and be patient. If oil stays under $80, that’s still bearish. If XLF can’t get back over $15 – still bearish. If ANY of our indexes fails to hold their 5% level – still bearish. If, however, we are over the 25% lines and hold them, then the bears are the wrong team to be backing…

After publishing the post, I felt strongly enough about it to reiterate in a note to Members at 7:59: "Sorry I won’t be here, looks like an exciting day. Best to just let the levels guide us but I’m kind of glad I won’t even be able to look today as it may just be a blow-off top but one that is going to be very hard not to be suckered into." Luckily, my appointment got canceled and I was back by 10:03 and we were able to take advantage of some nice downside opportunities from the top. At 10:37 I noted: "10:30 volume is 42M so we are on track to be over 50M at 11, which is not all that low but that may indicate "THEY" already punched in the stick at the open and they are already spent." I said it was tough to call at the moment but 10 minutes later, we went short, but just 2 new plays:

- FCX Dec $85 puts at $5.55, now $6.60 – up 19%

- FXP Dec $8 calls for .50, still .50 – even

Jobless Thursday – Get Ready for the Next Million Layoffs

Jobless Thursday – Get Ready for the Next Million Layoffs

The state of the states caught my eye in the morning as they are coming in tens of billions of dollars short at the same time that the Federal government is going to have to go to Congress for permission to raise our own national debt ceiling above $12Tn, just $100Bn away by most counts.

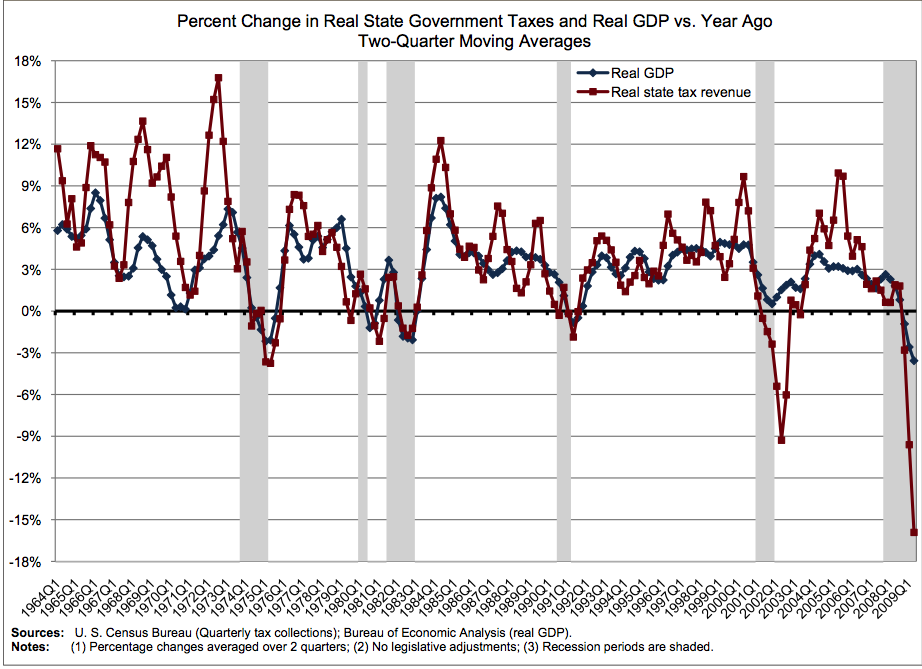

Without a shower of manna from Federal Heaven, it seems virtually impossible for the 10 states we looked at to avoid having to lay off an additional Million employees in 2010. State tax receipts (see chart) are plummeting and most most of the states are losing another 2% of their taxable property base to foreclosure each year in addition to the rampant unemployment that is chewing away at income and sales tax revenues. $12,000,000,000,000 is a lot of money and, unless Congress doesn't act quickly AND quietly to expand our debt limit, this is just the sort of conversation that can eat into consumer confidence just in time to ruin Christmas.

Nonetheless, as we were brushing right up against our breakout levels on Thursday morning, I reminded Members it was time to switch off those annoying brains and go with the flow, saying: "When I need to switch my brain off, I go to the charts. In Monday morning’s post, we expected to test our 25% lines (up from July consolidation) of: Dow 10,250, S&P 1,100, Nasdaq 2,187, NYSE 7,000 and Russell 600…" We shifted our attention overseas to watch the FTSE, which must hold 5,250 (now 5,296) and the DAX, which needs to break over 5,750 (now 5,685) in order to give the global economies another leg up. With Asia looking top-heavy, it would be a very bad time for Europe to falter too.

- DIA Nov $101 puts at .55, out at .82 – up 49%

That was our only new play of the day (other than adjusting our other DIA positions) but we did finally capitulate on our short AMZN position that wrecked our $100K Virtual Portfolio and turned it into the Amazon virtual portfolio, with that position down 80%. We finalized our other small positions there and turned the AMZN short puts into a short strangle with higher strikes so now we have to play the long game and hope AMZN hits our target prices, wipes out our obligation and lets us keep the cash from the calls and puts we sold. We will begin a new $100K Virtual Portfolio next Monday after expirations, concentrating on our buy/write strategies (much like the Q2 $100KP) – which have been the best performers this year and I'll set up a new Buy List for Members next weekend, hopefully at the tail end of a sell-off!

That was our only new play of the day (other than adjusting our other DIA positions) but we did finally capitulate on our short AMZN position that wrecked our $100K Virtual Portfolio and turned it into the Amazon virtual portfolio, with that position down 80%. We finalized our other small positions there and turned the AMZN short puts into a short strangle with higher strikes so now we have to play the long game and hope AMZN hits our target prices, wipes out our obligation and lets us keep the cash from the calls and puts we sold. We will begin a new $100K Virtual Portfolio next Monday after expirations, concentrating on our buy/write strategies (much like the Q2 $100KP) – which have been the best performers this year and I'll set up a new Buy List for Members next weekend, hopefully at the tail end of a sell-off!

Friday – Well We Finish the Week Over Our Target Levels?

If you haven't seen the videos I posted in the morning about the empty Utopia shopping mall in China and the empty Chinese CITY of Ordos, please do. This goes to the heart of why I am skeptical about the "resurgence" of global GDP. It is very easy for governments do create statistics to tell you anything they want but when I go to the shopping mall on a Saturday morning and get a space near the door and I don't have to watch my kids too closely because we're the only people in the store – that's just not good!

As I've pointed out in the past, much of the global optimism we've been seeing is based on every nation pointing to every other nation's recovery as having the potential to save them. The US and Europe look at China's $585Bn-stimulated GDP (12% of GDP), which keeps the economy at 8% growth and we call that a sign that things are turning around. This is much like having a leaky swimming pool that is losing 4,000 gallons of water and you pour in 12,000 gallons of water and declare the leak fixed because the water level went up 8,000 gallons.

As I've pointed out in the past, much of the global optimism we've been seeing is based on every nation pointing to every other nation's recovery as having the potential to save them. The US and Europe look at China's $585Bn-stimulated GDP (12% of GDP), which keeps the economy at 8% growth and we call that a sign that things are turning around. This is much like having a leaky swimming pool that is losing 4,000 gallons of water and you pour in 12,000 gallons of water and declare the leak fixed because the water level went up 8,000 gallons.

While 8% growth does sound exciting, it's only $650Bn of growth (China's GDP last year was just under $8Tn) and if it cost the government almost $1Tn to get $650Bn in growth, that's not really sustainable is it? So the global $68Tn economy is pinning it's hopes on $8Tn China and $3Tn India growing to offset the declines in $17.5Tn Europe/UK and $14Tn America and $4.5Tn Japan. This is some plan, isn't it? All China and India have to do is grow 20% ($2Tn) to offset a 3% decline ($1Tn) in their trading partners and that would give us a total of $1Tn in net growth against $45Tn in combined GDP (2.2%). Isn't this great?

Overall, about $3Tn (about 4% of global GDP) has been spent on global stimulus programs in addition to 5 times that amount going to bank rescue programs and that is ignoring the incredible increase in the global money supply, estimated to be as much as 10% this year – all just to keep the World economy from showing a big negative in 2009. From our short-term investing standpoint, none of this matters and we can go with the flow as the market is determined to party like it's 1999 but, as long-term investors – it's VERY hard to get enthusiastic looking at these numbers. This is why I often joke that we have to disconnect our brains in order to go long sometimes, it's a scary world out there. Not making our levels kept us a bit bearish in our betting on Friday:

- DIA Nov $103 puts, sold for $1.50, out at $1 – up 50%

- DIA Nov $102/100 bear puts spread at net .40, now .45 – up 12%

- SRS Dec $9 puts sold for .75, now .81 – down 8%

- SRS Nov $9 calls at .35 (avg), now .32 – down 9%

- UUP Jan $23 calls at .30 (avg), now .25 – down 16%

- SRS $8/9 bull call spread at .65, still .65

- SRS $9 puts sold for .35, still .35

We ended up going into the weekend 55% bearish as planned. From a level perspective, we still haven't made 3 of 5 of our upside breakouts and the XLF is below $15, while the Financial Index was above $15 for most of September, until they gave us an early signal of the market breakdown at the month's end.

We'll be very much in chart-watching mode next week but it was fundamental concerns more than levels that determined our weekend stance as it seems more likely that the market opens down 200 on Monday than up 200. It was my 1:58 comment to Members on Friday when I said I was tempted to cash out all bullish positions and go 100% bearish with about 20% of the portflio, it is only the fact that some of our levels are holding up that prevents me from going with my gut on this one. As I said to Members: "There are so many stocks that are not at all justified in their valuations and there are only 40 shopping days until Christmas and I have yet to see a positive consumer report."

Retail sales lead off the week's data at 8:30 on Monday morning so we placed our bet ahead of the call. The Nov number was -1.5% and the consensus is for +0.7% this month as we have some very easy comps. We also get Business Inventories and the Empire Manufacturing Index for November, which is likely to fall off October's surpring 34.57. Japan's GDP will be released at about 7pm on Sunday as well so all that data will hit us before the open. I applaud the bulls who are not worried about any of this – you are braver men than I am!