Rosenberg: U.S. GDP is overstated

Courtesy of Edward Harrison at Credit Writedowns

This morning, David Rosenberg of Gluskin Sheff had another wonderful piece. I am only going to take on one part of it here. I have linked to the full article below so that you can read his analysis in it’s entirety (registration free but required).

The part I want to focus in on has to do with GDP revisions. Basically, the GDP numbers the U.S. government releases are always revised when more complete data come in. Often the data come in years later via tax returns and other slower-to-report channels, so we can get huge disparities in what was reported at the time and what ends up being the final data series. Rosenberg thinks Q3 is going to see major, major downward revisions because of small businesses.

He says the following (highlighting added):

We noticed an interesting piece of research on U.S. GDP from Goldman Sachs’ Economics team that’s worth highlighting. The team questions whether the official government GDP statistics capture how poorly small businesses (ie, sole proprietorships) are doing. The weakness in small business sentiment is seemingly at odds with the recent 3.5% Q3 GDP reading but may explain why the unemployment rate has continued to steadily increase. Part of the reason for small business weakness is that most don’t have the same access to credit as larger firms and larger firms’ output tends to be better captured in the GDP data. While sole proprietorships tend to be small they collectively account for a nontrivial 17% of the U.S. economy.

The Goldman team uses a couple of different statistical approaches to test their thesis. They use timely data from the National Federation of Independent Business (NFIB) confidence survey, which shows that despite a recent improvement, confidence remains exceptionally weak (in fact two standard deviations below long-run trends). The first model suggests that the NFIB survey is consistent with overall GDP growth of 2.5% to 3.0% — not the 3.5% reported. As well, they find that current NFIB readings are more in line with below-50 readings on the ISM manufacturing index versus the actual reading of 55.7.

The second approach has to do with revisions to the GDP data and their relationship to the NFIB. U.S. GDP goes through many revisions as more, and better, information becomes available with lags — historically preliminary numbers are revised down by almost 0.5 percentage point. This second model suggests that Q3 GDP could be revised down by as much a 1-2 percentage points.

Translation: small businesses are suffering disproportionately because of a credit crunch. Their pain is not adequately reflected in the numbers because of big company bias in real-time data. GDP growth is probably much lower than we realize.

This view is consistent with the dichotomy in the BLS (Bureau of Labor Statistics) household survey used to calculate the unemployment rate and the establishment survey used to calculate non-farm payrolls.

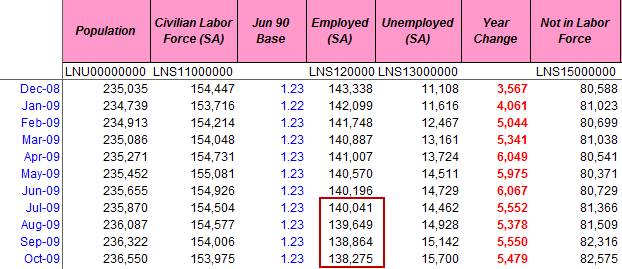

See the data below and pay attention to the area highlighted in red:

That shows employment levels dropping off a cliff over the last three months in the household survey. While I question the magnitude of the fall given the weekly jobless claims data, these numbers are much worse than the job losses seen in Non-farm payrolls. Directionally, this has to be right, meaning the 530,000 weekly claims was probably translating into something more like 300,000 job losses than the 200,000 reported. Again, underreporting of small business distress explains the difference.

My conclusion based on that we are still seeing about 500-510,000 jobless claims is that we are around a 200,000 job loss level at present.

As for third-quarter GDP growth, it is most certainly lower than 3.5%. How much lower? We won’t find out for years to come.

Toast with Dave (pdf)– David Rosenberg, Gluskin Sheff