Happy Monday! Hope you all had a stupendous weekend. We are ready to get this weekend started on a good note with some solid investing today, following up a strong Friday. I will get back to Friday’s pick after we get to today’s important stock selections.

Buy Pick of the Day: Pacific Sunwear of California Inc. (PSUN)

This morning, the market is looking to start off on a good foot after a number of market moving news was released that was pretty positive. On the plus side, General Motors commented that they have a $1.2 billion loss since they came out of bankruptcy through September 30, the company’s Q3. It was one of the best quarters in a long time for the struggling auto giant and a definite positive for the future.

This morning, the market is looking to start off on a good foot after a number of market moving news was released that was pretty positive. On the plus side, General Motors commented that they have a $1.2 billion loss since they came out of bankruptcy through September 30, the company’s Q3. It was one of the best quarters in a long time for the struggling auto giant and a definite positive for the future.

"We have significantly more work to do, but today’s results provide evidence of the solid foundation we are building for the new GM," CEO Fritz Henderson said in a statement.

The market was reacting fairly well to the news along with the news we got out of the retail sector. Retail sales were up 1.40% in the month of October, which was much better than the 2.30% decline seen in September, and the 1.4 number beat estimates at 1.00%. On the earnings front, as well, Lowe’s reported earnings that met estimates and gave good forecasts for the future. Further, investors are always excited when Bernanke is speaking, which will occur this afternoon. So, all in all, there appears to be a lot of positives moving into the day. As of 8:15 AM, futures were up 63 points for the Dow. Those numbers have come down to around 45 after Core Retail Sales were weak at 8:30, but the green is still there.

I like Pacific Sunwear (PSUN) for today in this market that looks ready to rally. Teen retailer Abercrombie and Fitch led the way for teen retail with some very positive earnings at the end of last week, smashing estimates and gaining lots of ground on the previous four quarters. A very similar company to PSUN is Urban Outfitters, who are in that niche teen retail sector. URBN also beat earnings last week by 0.01. PSUN reports earnings in after hours today, and the stock is actually down in pre-market trading. I would not expect a huge rally, but with the market looking positive and a stock that should get some attention for its earnings, PSUN looks like it could make a solid 2-3% jump.

way for teen retail with some very positive earnings at the end of last week, smashing estimates and gaining lots of ground on the previous four quarters. A very similar company to PSUN is Urban Outfitters, who are in that niche teen retail sector. URBN also beat earnings last week by 0.01. PSUN reports earnings in after hours today, and the stock is actually down in pre-market trading. I would not expect a huge rally, but with the market looking positive and a stock that should get some attention for its earnings, PSUN looks like it could make a solid 2-3% jump.

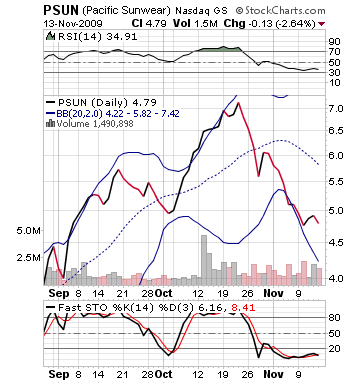

The stock has been beaten down going into the earnings as retail struggled last week. With ANF’s positive earnings, however, I think that trend may be reversed. The stock is way oversold, riding its lower bollinger band, and undervalued – meaning its in a perfect place to pop! Further, PSUN has beat analyst estimates for the last four quarters, and its estimates are relatively weak. It is only estimated to gain 0.03 on its EPS this quarter, whereas ANF gained almost 0.30 and URBN gained 0.07. I think analysts are really underestimating this one, and investors should see that today.

Let’s get in early into this one and ride a wave up throughout the day. Don’t worry if you don’t see a lot of movement. I am expecting this one to really get going after lunch.

Entry: We are looking for an entry of 4.62 – 4.72.

Exit: We are looking for a 2-3% gain from entry.

Stop Loss: 3% on bottom of entry price.

Short Sale of the Day: Sprint Nextel Corp. (S)

Sprint Nextel received a pretty significant upgrade today from Credit Suisse from "neutral" to "outperform," which included a 50% increase in the expected share price from $4 to $6. The company upgraded S on the prediction that the company will stop losing subscribers, which has been a major issue for Sprint over the past couple years.

Credit Suisse is only one of two companies now out of 10 major investment firms that have a buy rating on Sprint. It is basically an anomaly of market maker sentiment, and that is why I worry about the 8%+ gains we are seeing this morning. Anytime a company jumps over 5-6% in the morning, there is going to be profit taking that occurs. There will be a short squeeze for sure, but there is no point in selling a short at a 9% loss when you could wait for a 4-5% one. The gains, however, start to dwindle away and that sell button looks sexier and sexier. This is the reason we always see significant gap ups dwindle away.

Credit Suisse is only one of two companies now out of 10 major investment firms that have a buy rating on Sprint. It is basically an anomaly of market maker sentiment, and that is why I worry about the 8%+ gains we are seeing this morning. Anytime a company jumps over 5-6% in the morning, there is going to be profit taking that occurs. There will be a short squeeze for sure, but there is no point in selling a short at a 9% loss when you could wait for a 4-5% one. The gains, however, start to dwindle away and that sell button looks sexier and sexier. This is the reason we always see significant gap ups dwindle away.

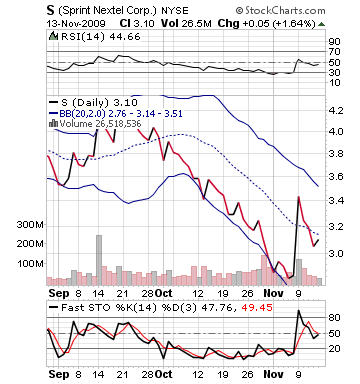

With Sprint, not only are the fundamentals not truly there, but this one has the technicals to back up a short sale. The stock has gained over 10% in the last week, and it is trying to add another 8% today. Technically, it has become overbought but is already losing ground. The RSI basically bounced when it got to even and is trending back down. The stock is below $5, which means there are a lot of traders on it who want to be in and out. Today, they want to get out. The stock has an upper band range at 3.50, and it is trading in the 3.30s in pre-market. Not much room to grow for Sprint.

I think it will get a slight rally out of the start, but we can definitely expect it to start moving downwards soon into the day.

Entry: We want to get into our short sale at 3.40 – 3.50.

Exit: We are looking to cover on 2-4% gains.

Stop Buy: 3% on top of entry price.

Good Luck and Good Investing,

David Ristau