Good morning Oxen Report readers. Yesterday, we had a great day in the market with a short on Soalrfun Power Holdings Inc. (SOLF). We were able to make a solid 3% on the day. We got into Solarfun at 5.90 and exited at 5.73. Like I supposed, as well, buying at 2:00 PM would have been a good idea for a Buy of the Day. At 2:00, the stock at 5.75 and ended at 5.83 for another 1.5% gain if you took the opportunity. Hope you were able to make some money with SOLF. I have two picks for today, let’s get into them.

Good morning Oxen Report readers. Yesterday, we had a great day in the market with a short on Soalrfun Power Holdings Inc. (SOLF). We were able to make a solid 3% on the day. We got into Solarfun at 5.90 and exited at 5.73. Like I supposed, as well, buying at 2:00 PM would have been a good idea for a Buy of the Day. At 2:00, the stock at 5.75 and ended at 5.83 for another 1.5% gain if you took the opportunity. Hope you were able to make some money with SOLF. I have two picks for today, let’s get into them.

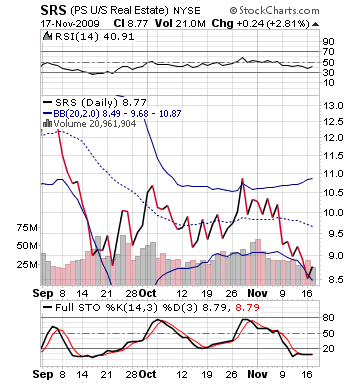

Buy Pick of the Day: Ultrashort Proshares Real Estate (SRS)

Today’s market is looking like it will be starting another day in the red. The market got some weak news out of the housing sector, as housing starts came in at 530,000 for the month of October, which was 60,000 below September and 70,000 below October estimates. This figure shows the troubling reality that we are not out of the woods, and we have so far still to go. Further, the market got a profit drop from BJ’s Wholesale for Q3. CPI Index came in slightly better than expected, but I don’t see it as being a major market mover. I feel pretty confident in a lower to extended low open with futures dropping around 35 points at 8:30 AM. They have recovered somewhat, but the market is still down and in reaction mode.

With the news of housing starts being bad, it gets worse with the fact that building permits were down 30,000 below estimates and 20,000 below September. In order to play the poor news, I think taking positions in SRS is a pretty strong idea. The ETF, however, is not getting much love in pre-market trading. It is up just 1% on the continued data we are getting that the housing industry continues to struggle.

estimates and 20,000 below September. In order to play the poor news, I think taking positions in SRS is a pretty strong idea. The ETF, however, is not getting much love in pre-market trading. It is up just 1% on the continued data we are getting that the housing industry continues to struggle.

In the past couple weeks, the stock has dropped around 15-16%. It is currently oversold, but it looks ready for a breakout near its lower bollinger band. The stock is well positioned to rally on the news if the market will help it somewhat. I think we have a similar set up to yesterday where we start down, move up, and then die off. One bit of worry I do have is that Pulte Homes did get a significant upgrade from Citi. Additionally, the crude inventories will play a role in how crude does, which at times can adjust the whole market.

Entry: We are looking for an entry of 8.75 – 8.85.

Exit: Looking to exit on a 2-3% gain.

Stop Loss: 3% on bottom of entry.

Short Sale of the Day: Direxion Daily Oil and Gas Bull/Bear ETF (ERX/ERY)

For the short sale of the day, I am going to short either ERX or ERY for my virtual portfolio, but it may be easier to think of this play as my standard oil buy pick I like to make on crude inventory days. The way it will work today is that I want to short based on how the inventories come out at 10:30 AM. If the inventories are good, then I want to short ERY. If the inventories are bad, short ERX (buy ERY). The number we are looking for is 1 million barrels. If the inventories come in above that then short ERX. If the inventories come in below that short ERY.

In my personal opinion, I think we are going to see a large increase in inventories, and I think the market will follow that. I am not going to position myself till 10:30 AM to harness my risk. Yet, I would recommend to you a buy in ERY this morning and feel confident about it. We saw crude supplies drop, according to the API, but the API number and EIA’s number rarely mix. Further, oil is approaching quickly that 80 mark. I think that is the top of the range. I would not mind picking up ERY around these levels for a little bit of a longer play.

In my personal opinion, I think we are going to see a large increase in inventories, and I think the market will follow that. I am not going to position myself till 10:30 AM to harness my risk. Yet, I would recommend to you a buy in ERY this morning and feel confident about it. We saw crude supplies drop, according to the API, but the API number and EIA’s number rarely mix. Further, oil is approaching quickly that 80 mark. I think that is the top of the range. I would not mind picking up ERY around these levels for a little bit of a longer play.

One of these reasons why we can do this trade is because ERX and ERY are both in pretty good shape to rally. Neither is too far down or too far up. ERX is a little more bought up and overvalued than ERY is, but they are in relatively good position to make that quick 2-3% we are looking for today. This trade would not work if we were in the middle of a two week oil rally or something similar.

To set this up, put the orders on your computer in two screens and await the data arrival. Check out marketwatch.com, cnbc.com, or theoxengroup.com/economiccalender for the quickest access, and press ORDER!

Entry: We will enter ERX/ERY for a short sale based on crude inventory data at 10:30 AM. Buy ERX, Short ERY if inventories were lost. Buy ERY, Short ERX if inventories are positive and gained.

Exit: 2-3% cover on buy in price.

Stop Buy: 3% on bottom.

Good Luck and Good Investing,

David Ristau

IN PROGRESS