We like going short on oil today.

We like going short on oil today.

We like going short on the Dow here, as close to 10,500 as we can until "they" prove they can hold it and not just spike us over the line. Copper is also a great short at $3.17 this morning as that is just ridiculous too. We can use 10,500 as a stop on Dow shorts and $80 as a stop for oil shorts and $3.18 as a stop for copper so it's not like we have to bet the house but, COME ON, this is just getting stupid! Oh, sorry – missed one, also short on the Euro at $1.4975 with a stop at $1.5025…

I know I am trying to be more bullish, we have plenty of bullish plays this week and just yesterday I was warning people to avoid the ultra-shorts, which can still get crushed but, I am sorry, THESE levels are ridiculous given the current environment. Oil may be up at $80 for now and we will get a draw in today's crude inventories but only because Tropical Storm Ida gave Gulf energy producers an excuse to shut down 43% of production last week and the port at Louisiana was closed for 3.5 days, stalling imports. Gasoline consumption will be up with the holiday last week so they couldn't have timed this better and, if you look at NYMEX trading yesterday, you'll see a quick spike from $79.36 to $80.06 at about 2pm, painting a top for the day they are now struggling to match in the futures.

Despite analysts official expectations of a 300,000 build in crude (which was never adjusted to take the above 2 major factors into account), the oil traders will be very disappointed with anything less than a 2.5Mb net draw so that's what we'll be looking for at 10:30. If we do get a good spike over $80, we'll be shorting into next week's report instead. Another report we're looking at is the latest from Cambridge Energy, which projects growth in oil production capacity through 2030 with "no peak evident," something I've been saying for years. As you can see from the chart – it's not peak oil they should be worried about, it's peak demand!

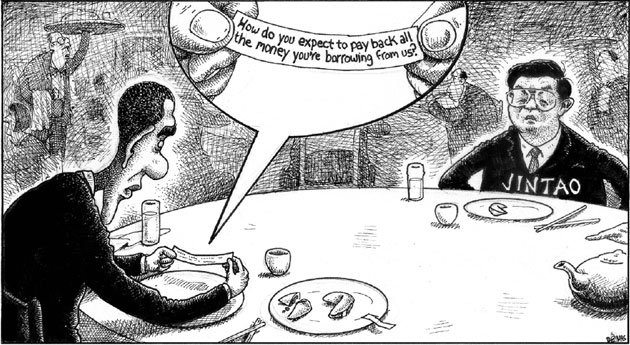

Keep in mind that we still think the dollar is about to wake up and rally off the 75 mark, although every possible effort is being made to push it lower. At this point, pretty much everyone is betting the dollar down but I flipped bullish this month (we mentioned our UUP bets) and George Soros has joined me in warning that betting the dollar lower may soon become hazardous to your financial health. Since it's the falling dollar, and not demand, that has been fueling the speculative bubbles in gold, oil and the dollar and since the energy and materials sector have led the markets up, a dollar rally is very likely to be short-term market poison but it's also the best way to put money back into people's hands ahead of the holidays as it's the quickest way to drive down food and fuel prices, which make up close to 1/3 of non-fixed household spending.

We are just barely a week away from what used to be called "Black Friday," the day after Thanksgiving when retailers typically begin making money for the year . Now most retailers will be lucky to be in the black on December 31st and that clock is tick, tick, ticking as the reality of the economy will soon hit the unreality of the stock valuations head on.

Mortgage applications fell 2.5% last week despite the 30-year fixed rate falling to 4.83%. As with last week, refinances held things up but even they fell 1.4% as bank lending requirements have tightened people out of qualifying and actual applications to buy homes fell 4.7%, after falling 11.7% last week – making 6 consecutive weeks of declines. This is now a 9-year low for mortgage applications. Not surprisingly, housing starts are dropping as well with builders cutting back 11% to just 529,000 homes or 882 homes per month, per state. “It’s going to be a long road back to recovery,” Scott Brown, chief economist at Raymond James & Associates Inc. in St. Petersburg, Florida, said before the report. “The labor market is a key factor. We really need to see job gains in order to become more optimistic about housing.”

No jobs and a weak dollar is not going to jump-start the housing market but that didn't stop "expert economists" from expecting 600,000 housing starts this month. Gee, if they can be 15% wrong about that, I wonder what other optimistic BS they've been telling us is going to fall apart. Permits also fell to 552,000 from 575,000 last month, possibly because 10.9% of the US housing supply, or 14.2M homes, are currently vacant and more and more families are evicted through foreclosure every day (averaging over 300,000 a month). When the number of people being thrown out of their homes exceeds the number of people moving into homes – generally there is a problem.

Once again this morning the Nikkei sold off (53 points to 9,676) and the Hang Seng pulled back (73 points to 22,840) and once again the Shanghai made a 1.5% gain. I don't want to by cynical but does it really matter what the news is in Asia? Skipping ahead to Europe, they have pulled back to near flat after a +0.5% open as they didn't like our housing data at all but we already got the dips we were looking for in the futures (9am) and are ready to wait and see now as we still expect a proper attempt at 10,500.

We're not going to go short again unless we get back to the pre-market levels mentioned above. Our upside 25% levels are still ow 10,500, S&P 1,162, Nas 2,100, NYSE 7,750 and Russell 637 but now we are getting a little more concerned with how our breakouts hold up and those are Dow 10,250, S&P 1,100, Nas 2,187, NYSE 7,000 and Russell 600 with the Russell and the Nasdaq having the greatest chance of failing. If those two break down, we will short the Dow, using that as a stop line. With just 3 days to expiration, the DIA $104 puts give you a lot of bang for your buck at .55 but hopefully we can get a good deal on the $105 puts on a silly pump.

Be careful out there, volume is still low enough for all sorts of shenanigans.