What a nice day we had yesterday!

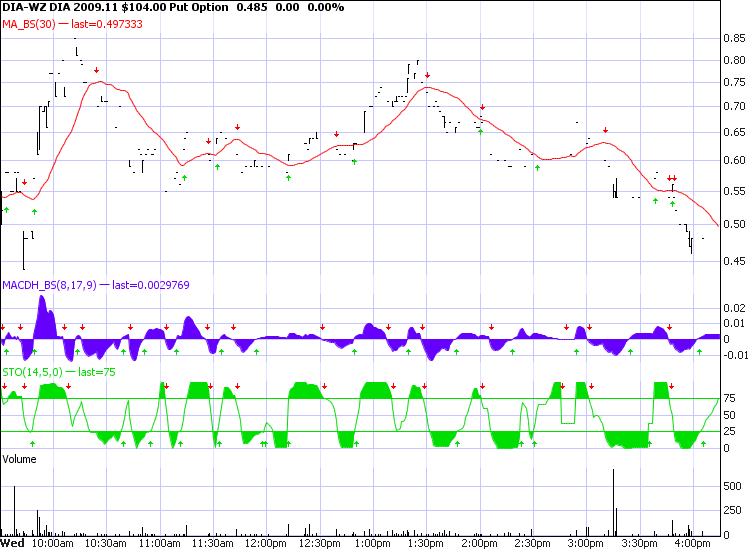

I led off my morning post saying it was time to short the Dow, Copper, Oil and the Euro and anyone playing those futures bets off my 8:27 post made out like a bandit. I even posted a nice little DIA play FOR FREE (for those of you who can't be bothered to subscribe yet), picking the DIA $104 puts at .55. It only took 45 minutes for those puts to shoot up to .85 and I warned our Members to take it off the table on the way up and, since it was my free trade of the week, I also posted it over at Stock Talk on Seeking Alpha. This is a great way to follow-up on some of our trades and is also the back-up for our member chat whenever we have server issues so do make sure you are signed up to follow me there (just click on my picture).

Yes, I know that so many newsletter writers give you free trade ideas that make 54% in 45 minutes that it's hard to keep track so only do it if you REALLY want to. The futures, of course, make TONS more than that as they are heavily leveraged, As I said in yesterday's post, we have been trying to get more bullish but sometimes we just have to put our bearish foot down. In Member Chat we also took bullish pokes at EDZ, SRS, DIA $103 puts and ERY early in the morning and then we were able to just sit back and watch the dip. I was a penny early calling a bottom on copper at $3.12 but .05 on the futures contracts is a huge win and we are very nervous bears, especially on low volume days, and we take our profits quickly.

At 1:40, I said to members: "DIA – Well mission accomplished on the $103 puts and now we see what Mr. Stick can accomplish for the day. Without the RUT over 600 I have no desire to cover the March puts" and we even decided to go with the DIA $104 CALLS at 3:20 to protect us against the anticipated stick save. Those went from .65 to to .80 into the close, another very quick 20%. We don't do this all the time, these plays are fun to make during expiration week as the premiums are low and there are huge short-term rewards for good market timing. Our longer-term short play for the Dow was the DIA Dec $101 puts at $1.20 as well as our "usual" March put covers.

Today should be fun as we have lots of data, including the thing we fear most – the dreaded CRE (Commercial Real Estate) Leading Indicators, which is the sector we feel is most likely to lead to a second market crash (hence our fixation with SRS). After peaking at 120.2 in Q2 '07, the CRE index has fallen to 101.5 in Q2 of this year and anyone who owns a building that is worth 80% of what it was in Q2 '07 can raise their hands and then all three of them (if that) can go tank up the Hummer for the weekend as we celebrate the return of $3 gas, just in time for the holidays.

Today should be fun as we have lots of data, including the thing we fear most – the dreaded CRE (Commercial Real Estate) Leading Indicators, which is the sector we feel is most likely to lead to a second market crash (hence our fixation with SRS). After peaking at 120.2 in Q2 '07, the CRE index has fallen to 101.5 in Q2 of this year and anyone who owns a building that is worth 80% of what it was in Q2 '07 can raise their hands and then all three of them (if that) can go tank up the Hummer for the weekend as we celebrate the return of $3 gas, just in time for the holidays.

Of course we will lose another 500,000 jobs today but I've learned to ignore that number as it doesn't seem to bother the people buying stocks one bit (I'm pretty sure it bothers the people who get fired though) so it has become a non-factor – just like the way people no longer care how many other people are blown up by terrorist bombs every day in the news – people can get used to anything I guess….

So 500,000 job deaths are a given for the week and $80 oil doesn't seem to worry anyone and $1,150 gold wasn't worrying anyone, even though that's higher than the worst currency panics in the history of the World. That's why it's so darned hard to be a bear but also why we find it so darn hard to run with the bulls at these levels – other than the juvenile premise that we should buy stocks and commodities solely because there will be massive inflation, cash is toxic and the economy is so bad the government will stimulate even more – we really can't find a good upside investing premise.

That's OK though, as we can play that premise with TBT without violating our overall view of the economy that it will soon be impossible for the US to borrow money cheaply. Since we had a nice pullback on TBT this week (we last played it in early October) I can make this my 2nd free trade idea of the week to play TBT higher by buying the March $42 calls for $5.45 and selling the March $46 calls for $3.25, which is net $2.20 for a $4 spread (81% potential upside) that is currently $4.03 in the money. A rising dollar makes this trade cheaper so hopefully it can be picked up under $2.

That's OK though, as we can play that premise with TBT without violating our overall view of the economy that it will soon be impossible for the US to borrow money cheaply. Since we had a nice pullback on TBT this week (we last played it in early October) I can make this my 2nd free trade idea of the week to play TBT higher by buying the March $42 calls for $5.45 and selling the March $46 calls for $3.25, which is net $2.20 for a $4 spread (81% potential upside) that is currently $4.03 in the money. A rising dollar makes this trade cheaper so hopefully it can be picked up under $2.

I have mentioned our FXP play several times and the Hang Seng had a proper 200-point dip this morning, bouncing off the 22,600 line that was it's break-up point last week (last Thursday's chart levels are still valid). The Nikkei fell yet another 127 points, now down every single day since I called a top on the markets 2 weeks ago (had I made that call on Japan TV, I'd be a national hero now!). As usual, none of this bothers the Shanghai Composite, which continues it's death march back up the cliff to 400. When they break the 2008 high of 423.50 and get past 450, THEN we'll give up but, until then, this seems like a very nice shorting opportunity to scale into.

This big international bullish news this morning is the OECD doubling their 2010 growth forecast to 1.9% and up to 2.5% for 2011 "as China powers a global recovery." This would be so much more impressive if the OECD had any credibility but this statement from them is no different than your local chamber of commerce dropping a flyer in your mailbox telling you that this will be downtown's "Best Christmas Ever" so come on down and start shopping. “We now have numbers that support a recovery in motion,” Jorgen Elmeskov, the OECD’s acting chief economist, said in an interview. “It’s still a slow recovery because of considerable headwinds from the need to adjust the balance sheets of households, enterprises and financial sectors.”

Europe was not all that impressed by the OECD's nice noises and the FTSE is off about half a point to 5,315 (and 5,250 is failure) while the DAX is right on the 5,750 line, also down half a point and the CAC is riding right along the 3,800 mark. We'll be watching the DAX very closely today as they and the FTSE are the global swing indexes at the moment.

My level watches from yesterday still stand and we'll see what holds today but the CRE results at 10 along with Leading Economic Indicators accompanied by the circus side-show of Geithner testifying in front of a committee should keep this a very exciting day.