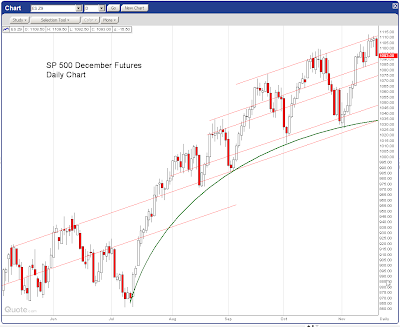

This chart says it all (thanks Jesse).

This chart says it all (thanks Jesse).

In last week's wrap-up I said: "Since early September our upside targets for the indexes have been: Dow 10,087, S&P 1,096, Nasdaq 2,173, NYSE 7,204 and Russell 623 and nothing has happened to change our fundamental outlook for the better so the closer we get to those levels, the LESS comfortable we are taking bullish positions." I mentioned how tempting it had been to cash out all our longs and go 100% bearish when we hit 10,300. Our downside levels told us to wait until the 16th, when Monday's move up was finally the last straw and we are out of the bull game (our last major Buy List was July 11th and most picks are up over 100%), probably for the rest of the year.

This chart shows you that the S&P is primed for a 5% correction back to 1,050. I don't know why Jesse didn't extend out the lower support line, which would take us right about to my pullback target of S&P 1,000/Dow 9,650. I stuck my neck out on TV two weeks ago, calling for a 10% correction to those levels but we've been playing both sides of the fence until this week, when I finally had to put my foot down on Monday, after having discussed cashing out for the holidays in Member Chat over the weekend. Our general plan this week was to cash out the winners and leave only longer-term, hedged bullish plays while adding more speculative downside plays for the short-term correction.

Why the change of heart? Well, something you don't see on this chart but is pretty clear on the Yahoo monthly view, is that virtually all of the gains (ALL of them if you include the spikes) in the Dow for the ENTIRE month of November have come on single days each week. This week it was Monday (139 points), last week Monday (206 points) and Nov 5th was Wednesday (198 points). Take those days out of the run from our Oct 30th close at 9,712 and we're up just 63 points to 9,975 despite there being only 1 losing day in the first week (11/3, down 16 points) of the month and one losing day in the second (Nov 12th, down 92 points). That is one super-flimsy way to build a "rally" don't you think?

Why the change of heart? Well, something you don't see on this chart but is pretty clear on the Yahoo monthly view, is that virtually all of the gains (ALL of them if you include the spikes) in the Dow for the ENTIRE month of November have come on single days each week. This week it was Monday (139 points), last week Monday (206 points) and Nov 5th was Wednesday (198 points). Take those days out of the run from our Oct 30th close at 9,712 and we're up just 63 points to 9,975 despite there being only 1 losing day in the first week (11/3, down 16 points) of the month and one losing day in the second (Nov 12th, down 92 points). That is one super-flimsy way to build a "rally" don't you think?

Getting 90% of our gains in on 3 days in 3 weeks indicates a certain lack of follow-through to these bullish market moves. I outlined the nature of the manipulation that takes place in yesterday's post so I won't get into it here but, in the words of our favorite economist, Elaine Benes, this rally looks FAKE, FAKE, FAKE, FAKE…

As George says in the video: "I know, I can tell – it's one my powers." Watch this Seinfeld video and imagine Jerry is the average investor, who is totally fooled and Elaine is Goldman Sachs who tells Jerry "You never knew because I was gooooood." The part of Alan Greenspan is played by Cramer who says "I know how to press those buttons, buddy." Sadly, no one in this game is your buddy. I told Members they should get the book "The Creature from Jekyll Island" and you can get a taste for what that book has to tell you about the Federal Reserve by watching this video with author Ed Griffin:

Two weeks ago (11/6), we noted unusual activity in the dollar options on UUP and we began playing the dollar for a bounce. On Wednedsday, the 11th, I called shenanigans on the global oil scam as they popped back to $80 for no reason at all so there should be no question about where we stand on this issue. On Friday I was on BNN with Marshall Auerback, who has a great take on the Dollar, asking "Should America Kowtow to China?" – an article I suggest everbody read. All that serves as the background for a very fun option expiration week, summarized as follows:

Just Another Manic Monday – Retail Edition

Just Another Manic Monday – Retail Edition

Japan is in a serious period of DEflation. Perhaps that's why the ACTUAL demand for physical gold is down 34% while the speculative price of gold – which is based on inflation that isn't happening anywhere on the planet – is up 73% off it's 2008 lows. Unlike speculators, real consumers vote with their pocketbooks and simply buy less of over-priced commodities. Unless, of course, those commodities are vital necessities like food and fuel – where speculators are able to extort quite a lot of cash out of consumers' pockets before the finally break. Ah capitalism… (and part 2, part 3, part 4 and part 5)

My major market concern is that Retail Sales will disappoint (and they did on Monday) and that the holiday shopping season will be a bust. That could lead to massive retail store closings, millions of lost jobs, the collapse of CRE and then another banking crisis. Since that stuff MIGHT happen over the next 45 days, I think it's prudent to take our 100% gains on 5-month old long positions off the table at this point and go cash into the new year. Does this make me a perma-bear?

The Bull position is, of course, that the economy is so bad that the Fed will leave interest rates at 0.25% and the government will keep spending money it doesn't have and continue tax breaks for corporations and the investor class and they will keep bailing out banks and investment banks while millions of more people have their wages and benefits cut to maintain profitable levels of productivity and, if all that fails, OF COURSE we will get another stimulus package that we can spin into another quarter or two of record profits for the Financials. These are all valid points (ethics aside) and make a great premise but excuse me while I take a break from the make-believe economy to enjoy the holidays.

If they can ramp the markets up another 10%, we'll make some short-term plays but the long-term bets are off at the moment until we get a real feel for a long-term recovery. If we make it through Jan earnings without a big pullback, I'll be happy to join in the fun, meanwhile, most of our plays are shorter-term with most of our bullish plays acting as long-term covers, just to make sure we don't miss out in case we're being too cautious. It's all about the levels and our key levels to get more bullish for the week were: Dow 10,300, S&P 1,100, Nasdaq 2,200, NYSE 7,200 and Russell 600 and I said on Monday: "Anything less than that is going to be a disappointing week for the bulls, who must prove we’re not topping out here ahead of the short holiday week next week."

If they can ramp the markets up another 10%, we'll make some short-term plays but the long-term bets are off at the moment until we get a real feel for a long-term recovery. If we make it through Jan earnings without a big pullback, I'll be happy to join in the fun, meanwhile, most of our plays are shorter-term with most of our bullish plays acting as long-term covers, just to make sure we don't miss out in case we're being too cautious. It's all about the levels and our key levels to get more bullish for the week were: Dow 10,300, S&P 1,100, Nasdaq 2,200, NYSE 7,200 and Russell 600 and I said on Monday: "Anything less than that is going to be a disappointing week for the bulls, who must prove we’re not topping out here ahead of the short holiday week next week."

- WFR Jan buy/write at $10.82/11.66 – on track at $12.08

- VLO Jan buy/write at $15.15/16.32 – on track at $16.47

- XLF Jan buy/write at $13.25/14.13 – on track at $14.60

- UYG Jan buy/write at $4.73/4.87 – on track at $5.63

- HOV Jan buy/write at $2.84/3.92 – on track at $4.06

- C 2011 Jan $5/7.50 bull call at .40, still .40 – even

- SRS $8 puts sold for .45, expired worthless – up 100%

- SRS at $8.57, now $8.91 – up 4%

- USD May $25/30 bull call at $2.50, now $2.10 – down 16%

- DIA $104 calls sold for .90, expired worthless – up 100%

- PARD June buy/write at $0/.85 – on target

- PARD 2011 $2.50/5 bull call at .10, now .39 – up 290%

- PARD June $5/10 bull call at .05, now .15 – up 200%

- FXP Dec $8 puts sold for $1.05, now ,.85, up 28%

- TBT artificial buy/write (too complicated to summarize) – on track

- EWJ Dec $9 calls at .75, now .45 – down 40%

- UUP $22 calls at .35, finished .44 – up 25%

- UTI Apr buy/write at $14.02/15.76 – on track

Wow, I didn't realize how busy we were on Monday! As you can see we mainly covered our long plays while takings some bearish pot-shots. PARD was great for us as we played it for the dip last week and swooped back in to buy it again but it's just playing with profits now, which is how we like to own our Biotechs. I noted the weak volume and level failures in my not to Members at 1:48 and the market turned down shortly after, mostly due to Meredith Whitney (who started this leg of the rally in July) coming out and saying: "I don’t know what’s going on in the market today. It doesn’t make any sense. There are no fundamentals to this." As I complained to Members in Chat at 3:36: "Oh great – Meredith Whitney says she doesn’t like the fundamentals and HER they listen to!!!"

Wow, I didn't realize how busy we were on Monday! As you can see we mainly covered our long plays while takings some bearish pot-shots. PARD was great for us as we played it for the dip last week and swooped back in to buy it again but it's just playing with profits now, which is how we like to own our Biotechs. I noted the weak volume and level failures in my not to Members at 1:48 and the market turned down shortly after, mostly due to Meredith Whitney (who started this leg of the rally in July) coming out and saying: "I don’t know what’s going on in the market today. It doesn’t make any sense. There are no fundamentals to this." As I complained to Members in Chat at 3:36: "Oh great – Meredith Whitney says she doesn’t like the fundamentals and HER they listen to!!!"

25% Off the Top Tuesday

I pointed out that we were stuck in a zone between 25% off the 2008 highs: Dow 10,500, S&P 1,162, Nas 2,100, NYSE 7,750 and Russell 637 and 25% above the July consolidation points (where we went long the week of July 11th) at: Dow 10,250, S&P 1,100, Nas 2,187, NYSE 7,000 and Russell 600. As I've been saying over and over again since we got to this level – We are AT our upside targets. In fact, we were pretty much done with this thing at the 20% line last month and this last 5% has been a bonus rally that we've reluctantly participated in but, with holidays coming up and light volume skewing results, the risk/reward profile of being a buy and hold investors has gotten a little too skewed to the risk side to bet on going 30% up and 20% off the top.

I pointed out the ridiculous disparity in valuations of the market and several stocks and commodities made no sense and that we would need to engage in realative valuations at these ridiculous levels in order to pick winners. Speaking of winners, we jumped on SPWRA as they came back to our buy price on accounting issues but it remains to be seen how severe the damage will be to the company long-term.

- SPWRA June $17.50/22.50 bull call at $3, now $2.50 – down 16%

- SPWRA Dec $21 puts sold at $1.15, still $1.15 – even

- SPWRA Dec $24 calls at $1.15, now .55 – (rolled to 2x $22.50s, net down 22%)

- RF Jan buy/write at $3.95/4.08 – on track

- XOM Dec $70 puts for .48, now .45 – down 6%

- XOM Dec $80 calls for .24, now .18 – down 25%

- DIS artificial buy/write (too complicated to summarize) – on track

- BSX Feb $8 puts sold for .60, still .60 – even

At 1:55 I was getting really fed up with the BS market movement and I said to Members: "Oil back to just under $80, Gold back to $1,140 and the miners are going nuts again. Energy sector also moving on up so I guess this is the big push for the day already. I don’t even thing they crack yesterday’s high (10,430) on this sad volume but you never know. I see FDX moving on up (because volume will be up 8% this year vs last year, when the world was ending and FDX was trading at $60). Madness!"

Will We Hold It Wednesday – 10,500 or Bust

I decided to put my foot down, not even waiting for 10,500 and called for shorts on the morning futures on the Dow at 10,420, copper at $3.17, oil at $80 and the Euro at $1.4975, all of which worked beyond fantastically. I pointed to this chart of Peak Oil (DEMAND) to illustrate how ridiculous $80 oil was from a fundamental standpoint. The entire frenzy to jack up the price of oil and overcharge you began when demand started trailing off back in early 2000.

My logic was easy to sum up in the morning post: "Keep in mind that we still think the dollar is about to wake up and rally off the 75 mark, although every possible effort is being made to push it lower. At this point, pretty much everyone is betting the dollar down but I flipped bullish this month (we mentioned our UUP bets) and George Soros has joined me in warning that betting the dollar lower may soon become hazardous to your financial health. Since it’s the falling dollar, and not demand, that has been fueling the speculative bubbles in gold, oil and the dollar and since the energy and materials sector have led the markets up, a dollar rally is very likely to be short-term market poison but it’s also the best way to put money back into people’s hands ahead of the holidays as it’s the quickest way to drive down food and fuel prices, which make up close to 1/3 of non-fixed household spending."

- DIA $104 puts at .55, finished at .75 – up 36%

- UUP Dec $22 calls at .60, now .75 – up 25%

- BRCD Jan buy/write at $6.30/7.15 – on target

- SRS Dec $9 puts sold for .90, now .72 – up 20%

- SRS Dec $8 calls at net $1.02 (roll), now $1.20 – up 17%

- EDZ Apr $3/5 bull call at $1.10, still $1.10 – even

- ERY Dec $11 puts sold for 1.10, now .70 – up 36%

After watching and waiting for the bulls to show us something real, I sent out an Alert to Members at 1:07 saying: "I think this is toppy and there is no reason to risk bullish positions that are unhedged as a catastrophic fall is more likely than a catastrophic rise."

Thrill Ride Thursday – CRE Crash?

Actually, the CRE data wasn't all that bad, but also not all that good so it didn't change our opinions. As you can see above, we had built up enough short-term bearish positions earlier in the week that we already had scored a victory early Thursday morning so we were able to take quick profits on the table and we ended up riding into the weekend just 55% bearish after making that big score as the Dow fell from Wednesday's close at 10,425 all the way down to 10,260.

- TBT March $42/26 bull call at $2.20, still $2.20 – even

- VLO artificial buy/write (too complicated to summarize) – on track

- GLL at $9.60 (assigned through sold puts), now $9.56 – down 1%

That may seem like a slow day but we were also in an out of DIA puts and calls over and over again, as we like to do on expiration weeks, when the premiums are low. Otherwise, we were just riding our bearish positions downhill. We even sold the DIA $103 puts for .50 (they expired worthless, up 100%) as we got more bullish in the afternoon as I had called a turn in my 11:56 comment to Members.

Friday: Dell Misses, I Goldman Sachs Stupid or Evil?

Friday: Dell Misses, I Goldman Sachs Stupid or Evil?

GS had pumped up the markets on Monday morning with an upgrade to DELL and you would think they must know something to paint such a glowing report just days before earnings but, as it turns out, they don't know a damn thing. I wonder if their trades will reflect the fact that they were dead wrong on tech this week and, if they don't, I wonder if there will be an investigation as to how they can say one thing about the markets publicly, yet then spend the entire week betting the opposite of that call, making Billions of dollars off the poor investors that they steer into positions they are dumping? It will be interesting to see…

- DXD $30s at .40, stopped at .60 – up 50%

- EDZ at $5.58, now $5.60 – even

- EDZ Apr $2/5 bull call spread at $2, still $2 – even

- VLO Dec $17 puts sold for $1, still $1 – even

- HOV Jan buy/write at net $.85/2.92 – on track

- UYG Jan buy/write at net $4.55/4.78 – on track

- EDZ artificial buy/write (too complicated to summarize) – on track

- DIA $103 puts at .20, stopped at .30 – up 50%

- PCLN Dec $185 puts at $1.90, still $1.90 – even

- RIMM 2011 $40 puts sold for $4, still $4 – even

- RIMM 2011 $55/65 bull call at $4.40, still $4.40 – even

- UGL Apr $53/54 bull call at .25, now .35 – up 40%

- GLL Apr $9 puts sold at .90, now .95 – down 5%

- EDZ Jan buy/write at net $3.82/4.41 – on track

So Friday was another busy day and we snapped up a lot of EDZ as we feel a rising dollar or a falling Asia can both punch down the emerging markets. We already have our upside play on Japan in case the global markets rally as well as TBT covering a fall in the dollar and we got our bargain-hunting in on VLO, HOV, UYG and RIMM with two-way bets on gold using GLL and UGL. All in all, a pretty even spread of bets. Also, you'll notice the pattern to the betting as we go short, long, short , long, short – this reflects how close we are to the middle in our betting at this point.

As I said, it was still 55% bearish into the close as we simply think that a sudden crash is more likely than a sudden break-out over the weekend. Next week we'll be watching to see if we can get more bullish above our 25% lines at: Dow 10,250, S&P 1,100, Nasdaq 2,187, NYSE 7,000 and Russell 600. If we fail to hold those lines (and it’s doubtful they will be taken back) we are going to be looking at our long-expected retrace levels of: Dow 9,840, S&P 1,056, Nas 2,100, NYSE 6,720 and Russell 576. Each one of those levels that falls make the next one more likely.

Nonetheless, we bravely begin a new $100K Virtual Portfolio Next week, as planned, on Wall Street Survivor which people will be able to follow along using their new spy function to track all of our entries and exits. Members check your mailboxes for aspecial alert waiving the sign-up fees!